E-commerce Growth

The rise of e-commerce is significantly influencing the France commercial printing market. As online retail continues to expand, businesses require various printed materials, including packaging, promotional materials, and labels. In 2025, the e-commerce sector in France was projected to reach a value of over 100 billion euros, driving demand for printed products. This growth presents opportunities for printing companies to diversify their offerings and cater to the specific needs of e-commerce businesses. Additionally, the need for high-quality packaging and branding materials is becoming increasingly important in a competitive online marketplace. Consequently, the France commercial printing market is likely to see a surge in demand for innovative and visually appealing printed products.

Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the France commercial printing market. The French government has implemented various regulations aimed at promoting environmental sustainability and reducing waste in the printing sector. For instance, the introduction of the Extended Producer Responsibility (EPR) scheme mandates that printing companies manage the lifecycle of their products, including recycling and waste management. Compliance with these regulations not only ensures legal adherence but also enhances a company's reputation among environmentally conscious consumers. As businesses strive to meet these regulatory requirements, the France commercial printing market is likely to witness an increase in demand for eco-friendly printing solutions and sustainable practices.

Sustainability Trends

Sustainability trends are profoundly impacting the France commercial printing market. With increasing awareness of environmental issues, consumers and businesses alike are prioritizing eco-friendly practices. The demand for sustainable printing solutions, such as recycled paper and vegetable-based inks, is on the rise. In 2025, it was estimated that around 40 percent of consumers in France preferred products from companies that demonstrated a commitment to sustainability. This shift is prompting printing companies to adopt greener practices and invest in sustainable technologies. As a result, the France commercial printing market is likely to see a transformation towards more environmentally responsible production methods, aligning with broader societal trends.

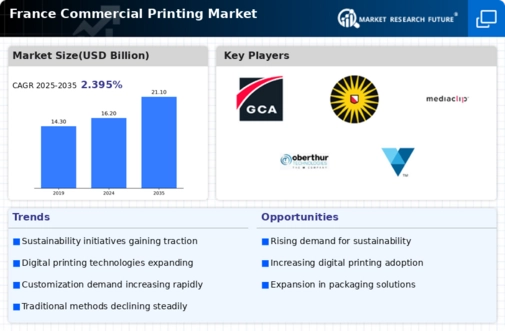

Technological Advancements

The France commercial printing market is experiencing a notable transformation due to rapid technological advancements. Innovations such as digital printing, 3D printing, and automation are reshaping production processes. Digital printing, in particular, has gained traction, accounting for approximately 30 percent of the total printing market in France. This shift allows for shorter print runs and faster turnaround times, catering to the growing demand for customized products. Furthermore, advancements in printing technology enhance print quality and reduce waste, aligning with sustainability goals. As companies adopt these technologies, they are likely to improve operational efficiency and reduce costs, thereby strengthening their competitive position in the France commercial printing market.

Consumer Demand for Personalization

Consumer demand for personalization is a driving force in the France commercial printing market. As customers increasingly seek unique and tailored products, printing companies are adapting their services to meet these expectations. Personalized marketing materials, such as brochures and direct mail, are becoming more prevalent as businesses recognize the effectiveness of targeted communication. In fact, studies indicate that personalized marketing can lead to a 20 percent increase in engagement rates. This trend encourages printing companies to invest in technologies that facilitate customization, thereby enhancing customer satisfaction and loyalty. As a result, the France commercial printing market is likely to evolve to accommodate this growing demand for personalized products.