E-commerce Growth

The rise of e-commerce in Japan is significantly influencing the commercial printing market. As online retail continues to expand, businesses require various printed materials, including packaging, promotional materials, and labels, to enhance their branding and customer engagement. In 2025, the e-commerce market in Japan was projected to reach 20 trillion yen, driving demand for printed products that support online sales. This trend suggests that companies in the Japan commercial printing market must adapt their offerings to cater to the specific needs of e-commerce businesses. Additionally, the demand for personalized and targeted marketing materials is increasing, prompting printers to invest in digital printing technologies that enable customization and quick turnaround times.

Regulatory Compliance

Regulatory compliance is a critical factor influencing the Japan commercial printing market. The government has implemented various regulations aimed at ensuring quality and safety in printed materials, particularly in sectors such as food packaging and pharmaceuticals. Compliance with these regulations is essential for businesses to maintain their market position and avoid penalties. In 2025, the Japanese government introduced stricter guidelines regarding the use of certain chemicals in printing processes, prompting companies to invest in safer alternatives. This regulatory landscape necessitates that firms in the Japan commercial printing market stay informed and adapt their practices accordingly. Consequently, those that proactively address compliance issues may enhance their reputation and foster trust among clients.

Sustainability Trends

Sustainability is becoming a pivotal driver in the Japan commercial printing market. With growing awareness of environmental issues, businesses are increasingly seeking eco-friendly printing solutions. The adoption of sustainable practices, such as using recycled materials and environmentally friendly inks, is gaining traction among printing companies. In 2025, approximately 30% of businesses in Japan reported prioritizing sustainability in their procurement processes, indicating a shift towards greener practices. This trend not only aligns with consumer preferences but also helps companies in the Japan commercial printing market reduce their carbon footprint. As a result, printers that embrace sustainability are likely to gain a competitive edge and attract environmentally conscious clients.

Technological Advancements

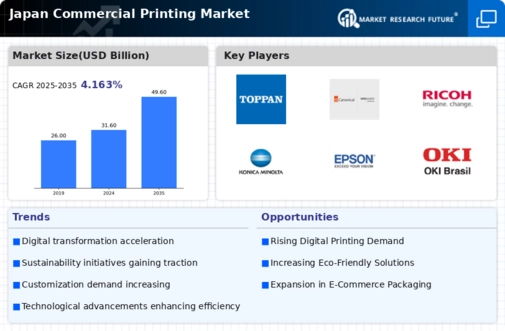

The Japan commercial printing market is experiencing a notable transformation due to rapid technological advancements. Innovations in printing technology, such as high-speed inkjet and digital printing, are enhancing production efficiency and quality. In 2025, the market for digital printing in Japan was valued at approximately 1.2 trillion yen, indicating a robust growth trajectory. These advancements allow for shorter print runs and customization, catering to the evolving demands of consumers and businesses alike. Furthermore, the integration of automation and artificial intelligence in printing processes is streamlining operations, reducing costs, and improving turnaround times. As a result, companies in the Japan commercial printing market are increasingly adopting these technologies to remain competitive and meet the diverse needs of their clientele.

Customization and Personalization

Customization and personalization are increasingly becoming vital drivers in the Japan commercial printing market. As consumers seek unique and tailored products, businesses are responding by offering personalized printed materials. This trend is particularly evident in sectors such as marketing and packaging, where customized designs can significantly enhance brand identity. In 2025, the demand for personalized printing solutions in Japan was estimated to grow by 15%, reflecting a shift towards individualized consumer experiences. Companies in the Japan commercial printing market are leveraging digital printing technologies to meet this demand, enabling shorter print runs and rapid adjustments to designs. This capability not only satisfies consumer preferences but also allows businesses to differentiate themselves in a competitive marketplace.