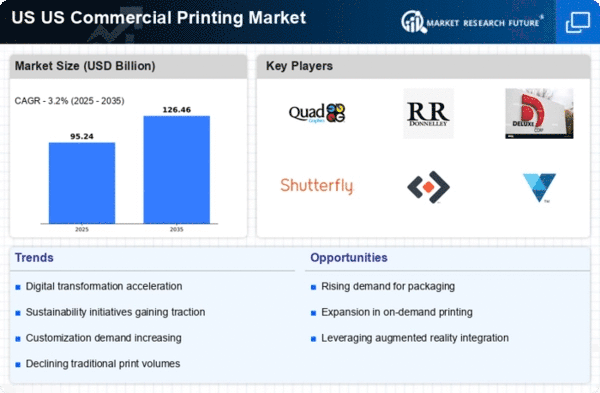

E-commerce Growth

The rise of e-commerce is reshaping the landscape of the US Commercial Printing Market. As online retail continues to expand, businesses are increasingly relying on printed materials for marketing and branding purposes. Packaging, labels, and promotional materials are essential for e-commerce companies to establish their identity and connect with consumers. Data indicates that the demand for printed packaging is expected to grow at a compound annual growth rate (CAGR) of approximately 4% through 2026. This trend suggests that the US Commercial Printing Market will benefit from the increasing need for high-quality printed products that enhance the customer experience. Consequently, printing companies that adapt to the evolving needs of e-commerce will likely find new opportunities for growth.

Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the US Commercial Printing Market. Various federal and state regulations govern the printing sector, particularly concerning environmental standards and safety protocols. Compliance with these regulations is essential for companies to maintain their operational licenses and avoid penalties. For instance, the Environmental Protection Agency (EPA) has established guidelines that impact the use of certain inks and solvents in printing processes. As businesses strive to meet these standards, they may invest in eco-friendly materials and processes, which could lead to increased operational costs. However, adherence to regulations can also enhance a company's reputation and appeal to environmentally conscious consumers, thereby potentially driving growth within the US Commercial Printing Market.

Sustainability Trends

Sustainability trends are increasingly influencing the US Commercial Printing Market. As environmental concerns gain prominence, businesses are prioritizing sustainable practices in their operations. This includes the use of recycled materials, eco-friendly inks, and energy-efficient printing processes. According to industry reports, a significant portion of consumers now prefers to engage with brands that demonstrate a commitment to sustainability. Consequently, printing companies that adopt green practices may enhance their market position and attract environmentally conscious clients. The US Commercial Printing Market is likely to see a shift towards sustainable printing solutions, which could lead to new product offerings and innovative business models. This trend not only addresses consumer preferences but also aligns with broader societal goals of reducing environmental impact.

Technological Advancements

The US Commercial Printing Market is experiencing a notable transformation driven by rapid technological advancements. Innovations in digital printing technologies, such as inkjet and laser printing, are enhancing production efficiency and quality. These technologies allow for shorter print runs and faster turnaround times, catering to the growing demand for customized printing solutions. According to recent data, the digital printing segment is projected to grow significantly, potentially reaching a market share of over 30% by 2026. This shift towards digital solutions not only meets consumer preferences for personalization but also reduces waste, aligning with sustainability goals. As companies invest in state-of-the-art equipment, the US Commercial Printing Market is likely to witness increased competitiveness and profitability.

Consumer Demand for Customization

Consumer demand for customization is a significant driver in the US Commercial Printing Market. As individuals and businesses seek unique and personalized products, the need for customized printing solutions has surged. This trend is particularly evident in sectors such as marketing, where tailored materials can significantly impact consumer engagement. The market for personalized printed products, including business cards, brochures, and promotional items, is projected to grow steadily. Companies that offer innovative customization options, such as variable data printing, are likely to capture a larger share of the market. This shift towards personalization not only enhances customer satisfaction but also fosters brand loyalty, indicating a promising future for the US Commercial Printing Market.