Increasing Global Trade Volumes

The Global Trade Finance Market Industry is experiencing a notable surge in trade volumes, driven by the expansion of international trade agreements and the globalization of supply chains. In 2024, the market is valued at approximately 235.94 USD Billion, reflecting the growing interdependence of economies. As countries engage in more cross-border transactions, the demand for trade finance solutions rises, facilitating smoother operations. This trend is likely to continue as emerging markets integrate into the global economy, potentially leading to a market valuation of 541.32 USD Billion by 2035, with a projected CAGR of 7.84% from 2025 to 2035.

Regulatory Support and Compliance

The Global Trade Finance Market Industry benefits from increasing regulatory support aimed at facilitating international trade. Governments worldwide are implementing policies that promote trade finance accessibility, particularly for small and medium-sized enterprises. Initiatives such as trade facilitation agreements and export credit guarantees enhance the confidence of financial institutions in providing trade finance solutions. This supportive regulatory environment is crucial for fostering growth in the market, as it encourages investment and participation from various stakeholders. As a result, the market is poised for substantial growth, potentially reaching 541.32 USD Billion by 2035.

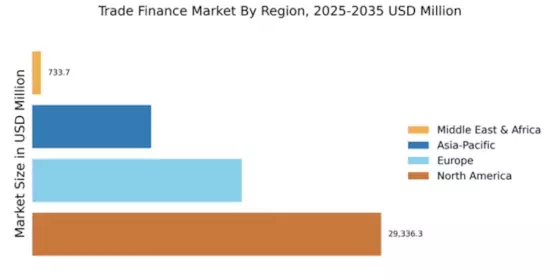

Chart Representation of Market Growth

The Global Trade Finance Market Industry is characterized by a robust growth trajectory, as illustrated in the accompanying charts. The market is projected to expand from 235.94 USD Billion in 2024 to an estimated 541.32 USD Billion by 2035, reflecting a compound annual growth rate of 7.84% from 2025 to 2035. These charts depict the increasing trade volumes, technological advancements, and regulatory support that are driving this growth, providing a visual representation of the market's potential and the factors influencing its expansion.

Rising Demand for Supply Chain Financing

The Global Trade Finance Market Industry is witnessing a growing demand for supply chain financing solutions. Companies are increasingly recognizing the importance of optimizing their supply chains to enhance liquidity and reduce costs. Supply chain financing allows businesses to access funds based on their receivables, improving cash flow and operational efficiency. This trend is particularly pronounced in sectors such as manufacturing and retail, where timely financing is critical. As organizations seek to strengthen their supply chains, the market is expected to grow significantly, with projections indicating a valuation of 541.32 USD Billion by 2035.

Technological Advancements in Trade Finance

Technological innovations are reshaping the Global Trade Finance Market Industry, enhancing efficiency and transparency. The adoption of blockchain technology, artificial intelligence, and digital platforms streamlines processes, reduces fraud, and accelerates transaction times. For instance, blockchain enables secure and immutable records of trade transactions, which can significantly lower operational risks. As these technologies gain traction, they are expected to attract more participants into the trade finance ecosystem, thereby expanding the market. This shift towards digitalization is likely to play a crucial role in achieving the projected growth of the market to 541.32 USD Billion by 2035.