Technological Advancements

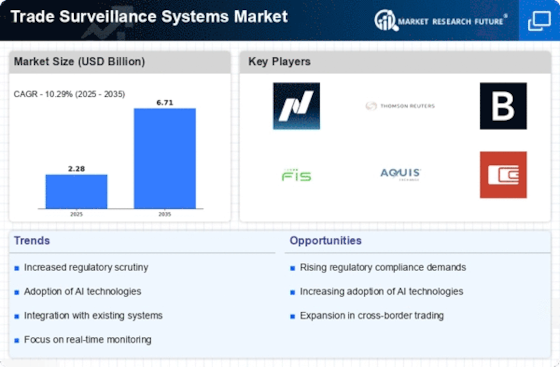

Technological advancements in data analytics and machine learning are significantly influencing the Trade Surveillance Systems Market. The integration of these technologies enables firms to analyze vast amounts of trading data in real-time, enhancing their ability to detect anomalies and suspicious activities. As organizations increasingly recognize the value of predictive analytics, the demand for trade surveillance systems that leverage these technologies is expected to surge. Reports suggest that the market for trade surveillance solutions could reach USD 2 billion by 2026, driven by the need for more efficient and effective monitoring tools. This trend underscores the importance of innovation in the Trade Surveillance Systems Market.

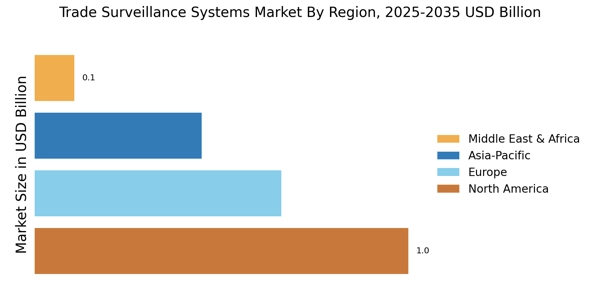

Expansion of Trading Venues

The expansion of trading venues, including alternative trading systems and dark pools, is influencing the Trade Surveillance Systems Market. As new platforms emerge, the complexity of monitoring trading activities increases, necessitating the implementation of advanced surveillance solutions. Financial institutions must adapt to this evolving landscape by investing in systems that can effectively track and analyze trades across multiple venues. This trend is expected to drive the demand for trade surveillance systems, as firms seek to ensure compliance and mitigate risks associated with these new trading environments. The market is likely to see significant growth as organizations prioritize comprehensive surveillance capabilities.

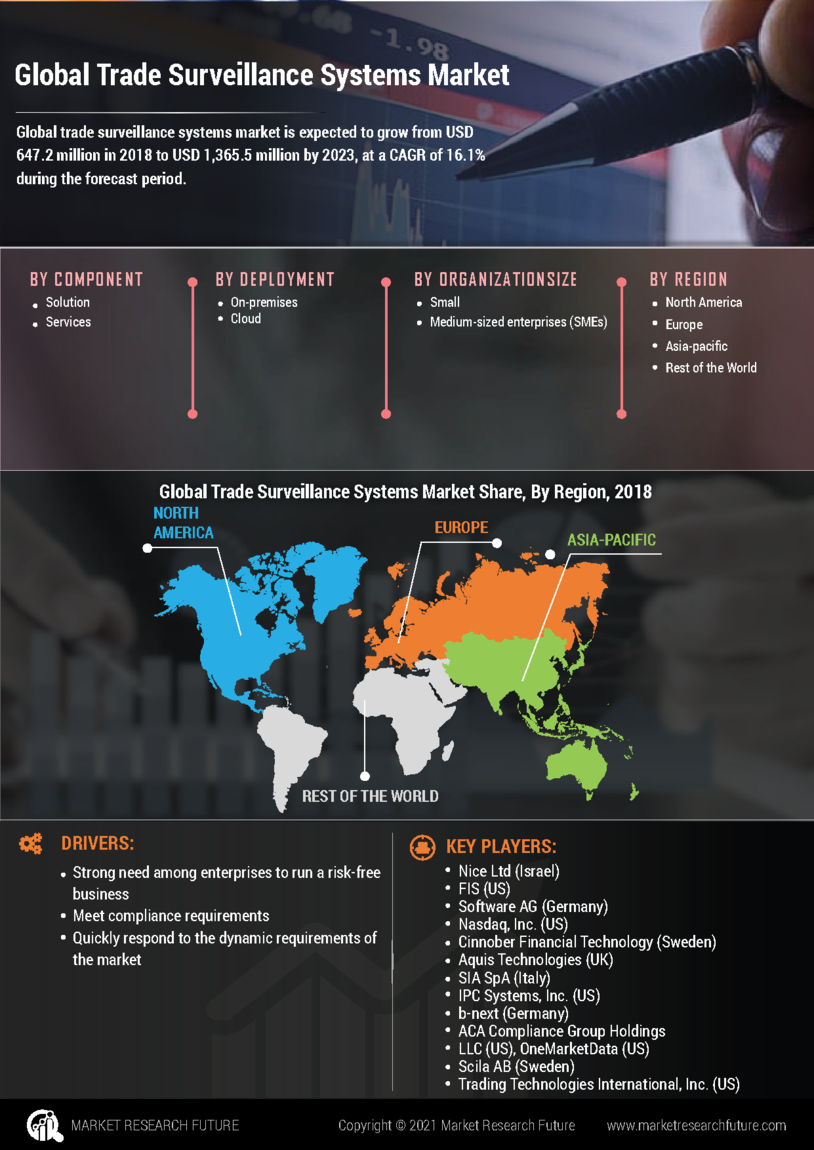

Regulatory Compliance Requirements

The increasing complexity of regulatory frameworks across various jurisdictions appears to drive the Trade Surveillance Systems Market. Financial institutions are compelled to adopt advanced surveillance systems to ensure compliance with regulations such as MiFID II, Dodd-Frank, and others. These regulations necessitate robust monitoring of trading activities to detect potential market abuse and insider trading. As a result, the demand for sophisticated trade surveillance solutions is likely to rise, with the market projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is indicative of the critical role that compliance plays in shaping the Trade Surveillance Systems Market.

Increased Focus on Market Integrity

An increased focus on market integrity and transparency is shaping the Trade Surveillance Systems Market. Stakeholders, including regulators and investors, are demanding higher standards of accountability from financial institutions. This shift is prompting firms to adopt comprehensive surveillance systems that not only monitor trading activities but also ensure compliance with ethical standards. The emphasis on maintaining a fair trading environment is likely to drive investments in trade surveillance technologies. As a result, the market is projected to experience steady growth, with firms recognizing the long-term benefits of fostering trust and integrity in their operations.

Rising Incidences of Financial Fraud

The rising incidences of financial fraud and market manipulation are likely to propel the Trade Surveillance Systems Market. As financial markets become more complex, the potential for fraudulent activities increases, prompting firms to invest in advanced surveillance systems. The need to protect investors and maintain market integrity is paramount, leading to a heightened focus on implementing effective monitoring solutions. According to recent studies, financial fraud costs the industry billions annually, which further emphasizes the necessity for robust trade surveillance mechanisms. Consequently, the market for these systems is expected to expand as organizations seek to mitigate risks associated with fraudulent activities.