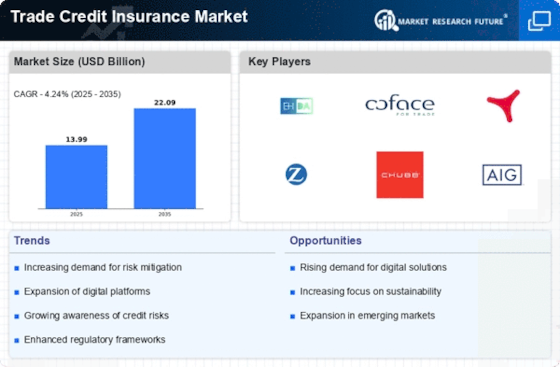

The market remains moderately fragmented, with leading trade credit insurers leveraging digital tools, partnerships, and regional expansion strategies. Localization and collaboration are becoming essential for differentiation within the credit insurance market. Key players such as Euler Hermes (DE), Coface (FR), and Atradius (NL) are actively shaping the market through strategic initiatives aimed at enhancing their service offerings and expanding their geographical reach. Euler Hermes (DE) has positioned itself as a leader in digital transformation, focusing on integrating advanced analytics into its risk assessment processes. Meanwhile, Coface (FR) emphasizes regional expansion, particularly in emerging markets, to capture new business opportunities. Atradius (NL) is leveraging partnerships with fintech companies to innovate its product offerings, thereby enhancing customer experience and operational efficiency. Collectively, these strategies contribute to a moderately fragmented market structure, where competition is increasingly defined by technological advancements and customer-centric solutions.

In terms of business tactics, companies are localizing their operations to better serve regional markets and optimize their supply chains. This localization strategy not only enhances responsiveness to local market conditions but also fosters stronger relationships with clients. The competitive structure of the Trade Credit Insurance Market appears to be moderately fragmented, with several key players exerting influence through differentiated service offerings and localized strategies. The collective actions of these companies indicate a trend towards a more integrated approach to risk management, where collaboration and innovation are paramount.

In August Euler Hermes (DE) announced a strategic partnership with a leading data analytics firm to enhance its predictive modeling capabilities. This move is significant as it allows Euler Hermes to refine its risk assessment processes, potentially leading to more accurate underwriting decisions and improved client satisfaction. The integration of advanced analytics is likely to position the company favorably against competitors who may not yet fully embrace such technologies.

In September Coface (FR) launched a new suite of digital tools aimed at streamlining the claims process for its clients. This initiative reflects a growing trend towards digitalization within the industry, as companies seek to improve operational efficiency and customer engagement. By simplifying the claims process, Coface not only enhances its service delivery but also strengthens its competitive edge in a market that increasingly values speed and efficiency.

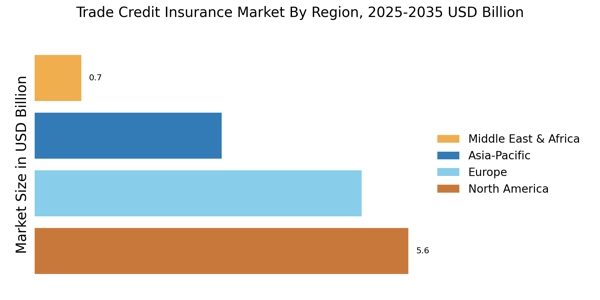

In October Atradius (NL) expanded its presence in the Asia-Pacific region by opening a new office in Singapore. This strategic move underscores Atradius's commitment to tapping into high-growth markets and diversifying its portfolio. The establishment of a local office is expected to facilitate better client relationships and provide tailored solutions that meet the specific needs of businesses in the region.

As of October the Trade Credit Insurance Market is witnessing a shift towards digitalization, sustainability, and the integration of artificial intelligence in risk assessment processes. Strategic alliances are becoming increasingly important, as companies recognize the value of collaboration in enhancing their service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and

supply chain reliability. This shift suggests that companies that prioritize technological advancements and customer-centric solutions will be better positioned to thrive in an increasingly competitive landscape.