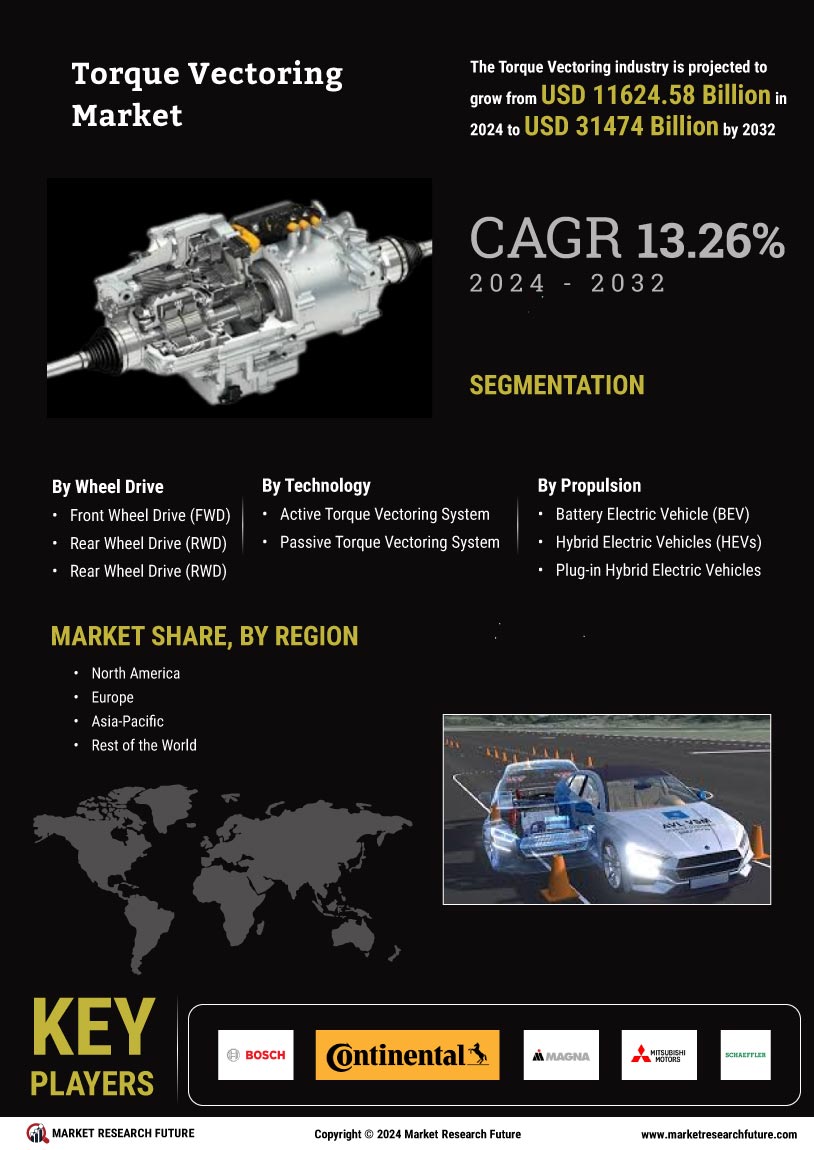

Market Growth Projections

The Global Torque Vectoring Market Industry is projected to experience substantial growth over the next decade. With a market value of 4.17 USD Billion in 2024, it is anticipated to reach 9.41 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 7.68% from 2025 to 2035, driven by various factors including technological advancements, increasing vehicle electrification, and heightened consumer demand for performance. The market's expansion indicates a robust future for torque vectoring technologies, positioning them as a critical component in the evolution of modern automotive engineering.

Regulatory Support for Emission Reduction

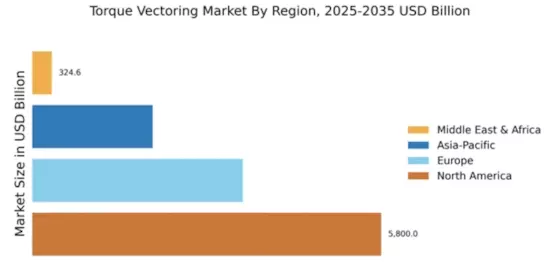

Regulatory support for emission reduction is influencing the Global Torque Vectoring Market Industry, as governments worldwide implement stricter emissions standards. Torque vectoring systems contribute to improved fuel efficiency and reduced emissions by optimizing power delivery to the wheels. This is particularly relevant in regions with stringent environmental regulations, where automakers are compelled to adopt technologies that enhance vehicle efficiency. As a result, the market is likely to benefit from increased investments in torque vectoring technologies, aligning with global sustainability goals and further driving market growth.

Rising Adoption of Electric and Hybrid Vehicles

The Global Torque Vectoring Market Industry is witnessing a notable increase in the adoption of electric and hybrid vehicles, which often utilize torque vectoring systems to optimize performance and efficiency. Electric drivetrains can independently control torque delivery to each wheel, enhancing traction and stability. This capability is particularly advantageous in electric SUVs and performance cars, where agility and responsiveness are paramount. The shift towards electrification is expected to contribute significantly to market growth, with projections indicating a market value of 9.41 USD Billion by 2035, as manufacturers increasingly incorporate torque vectoring in their electric vehicle designs.

Increasing Demand for Enhanced Vehicle Performance

The Global Torque Vectoring Market Industry experiences a surge in demand for enhanced vehicle performance, driven by consumer preferences for superior handling and stability. Torque vectoring technology allows for the distribution of torque to individual wheels, improving traction and cornering capabilities. This trend is particularly evident in high-performance vehicles, where manufacturers are integrating advanced torque vectoring systems to differentiate their offerings. As a result, the market is projected to reach 4.17 USD Billion in 2024, reflecting a growing recognition of the benefits of torque vectoring in enhancing driving dynamics.

Growing Interest in Autonomous Driving Technologies

The Global Torque Vectoring Market Industry is also being shaped by the growing interest in autonomous driving technologies. Torque vectoring plays a crucial role in enhancing the stability and control of autonomous vehicles, allowing for smoother navigation and improved safety. As manufacturers invest in developing self-driving capabilities, the integration of torque vectoring systems becomes increasingly vital. This trend is expected to drive demand for advanced torque vectoring solutions, as they are essential for achieving the high levels of performance and safety required in autonomous driving applications.

Technological Advancements in Automotive Engineering

Technological advancements in automotive engineering are propelling the Global Torque Vectoring Market Industry forward. Innovations in sensors, control algorithms, and electronic systems enable more precise torque distribution, enhancing vehicle dynamics. For instance, the integration of advanced driver-assistance systems (ADAS) with torque vectoring allows for real-time adjustments based on driving conditions. This synergy not only improves safety but also elevates the overall driving experience. As these technologies continue to evolve, the market is expected to grow at a CAGR of 7.68% from 2025 to 2035, indicating a robust future for torque vectoring solutions.