Market Growth Projections

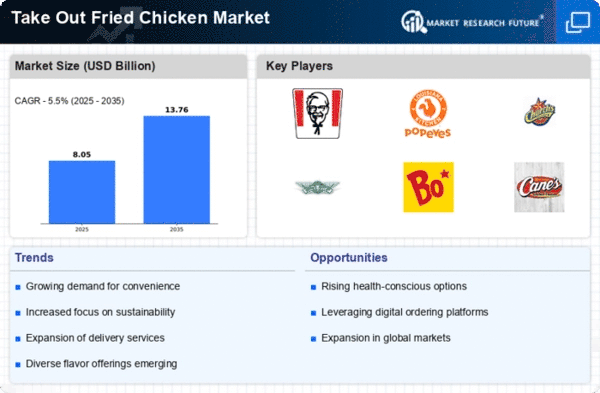

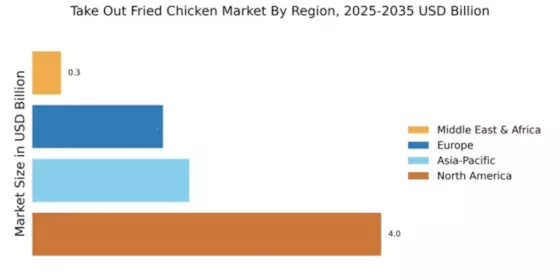

The Global Take-Out Fried Chicken Industry is projected to experience substantial growth, with estimates indicating a rise from 7.63 USD Billion in 2024 to 13.8 USD Billion by 2035. This growth trajectory suggests a robust demand for fried chicken take-out options, driven by evolving consumer preferences and market dynamics. The anticipated CAGR of 5.51% from 2025 to 2035 further underscores the industry's potential for expansion. As consumer lifestyles continue to evolve, the market is likely to adapt, offering innovative products and services that cater to the changing needs of a diverse customer base.

Health-Conscious Innovations

The Global Take-Out Fried Chicken Industry is witnessing a shift towards health-conscious innovations, as consumers become increasingly aware of nutritional content. Many establishments are adapting their menus to include healthier options, such as grilled or baked chicken alternatives, organic ingredients, and lower-calorie offerings. This trend reflects a broader movement within the food industry, where health and wellness considerations play a crucial role in consumer choices. By catering to this demand, fried chicken outlets can attract a diverse customer base, thereby enhancing their market position. This adaptation may also contribute to the industry's projected CAGR of 5.51% from 2025 to 2035.

Expansion of Delivery Services

The Global Take-Out Fried Chicken Industry benefits significantly from the expansion of delivery services. With the proliferation of food delivery platforms, consumers gain unprecedented access to a variety of fried chicken options from local and national chains. This development not only enhances consumer convenience but also broadens the market reach for fried chicken establishments. As delivery services continue to evolve, the industry is poised for growth, potentially contributing to the market's projected increase to 13.8 USD Billion by 2035. The integration of technology in food delivery is likely to further streamline operations, making take-out fried chicken more accessible.

Rising Demand for Convenience Foods

The Global Take-Out Fried Chicken Industry experiences a notable surge in demand for convenience foods, driven by busy lifestyles and changing consumer preferences. As individuals increasingly seek quick meal solutions, take-out fried chicken emerges as a favored option. This trend is particularly pronounced in urban areas, where time constraints limit cooking at home. The industry is projected to reach 7.63 USD Billion in 2024, reflecting the growing inclination towards ready-to-eat meals. Additionally, the convenience factor is likely to propel the market further, as consumers prioritize ease of access and speed in meal preparation.

Cultural Influence and Globalization

The Global Take-Out Fried Chicken Industry is significantly influenced by cultural factors and globalization. Fried chicken, with its diverse preparation styles and flavors, appeals to a wide range of palates across different regions. As culinary traditions blend due to globalization, consumers are exposed to various fried chicken recipes and styles, enhancing their dining experiences. This cultural exchange fosters innovation within the industry, encouraging establishments to experiment with unique flavors and offerings. Consequently, the market is likely to benefit from increased consumer interest and engagement, further solidifying its position in the global food landscape.

Technological Advancements in Food Preparation

The Global Take-Out Fried Chicken Industry is experiencing transformative changes due to technological advancements in food preparation. Innovations such as air frying and advanced cooking equipment enhance the quality and efficiency of fried chicken production. These technologies not only improve the taste and texture of the product but also reduce cooking times, aligning with consumer demands for quick service. As establishments adopt these technologies, they can optimize their operations and potentially increase profit margins. This trend may contribute to the market's growth trajectory, as consumers increasingly seek high-quality, quickly prepared fried chicken options.