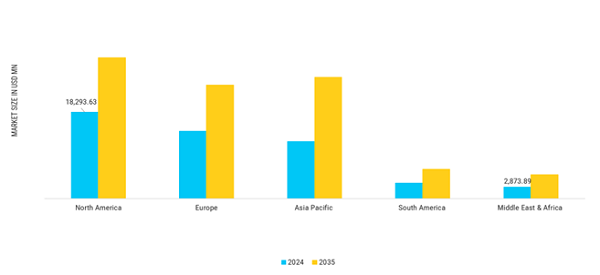

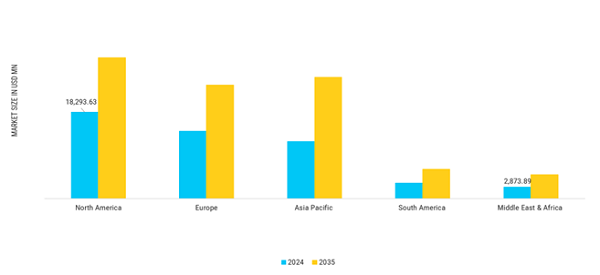

Asia Pacific: Global Sportswear Manufacturing Powerhouse

Asia Pacific represents the largest and most influential region in the global sportswear manufacturing market, serving as the primary production hub for global brands. The region benefits from a strong textile ecosystem, availability of skilled labor, cost-efficient manufacturing, and well-established export infrastructure. Countries such as China, Vietnam, Bangladesh, Indonesia, and India play a critical role in OEM and ODM sportswear production, supplying performance apparel, athleisure, and technical garments worldwide.

Government-backed initiatives supporting textile manufacturing, export incentives, and industrial parks further strengthen the region’s dominance. Additionally, rising domestic consumption driven by urbanization, fitness awareness, and growing middle-class populations is boosting local demand. Although growth is comparatively moderate due to market maturity, Asia Pacific remains indispensable to global sportswear supply chains.

North America: Innovation-Driven and High-Value Manufacturing Market

North America is a key innovation-led region in the sportswear manufacturing market, characterized by strong demand for premium, high-performance, and technologically advanced apparel. The region places high emphasis on product innovation, sustainability, and smart textiles rather than large-scale volume manufacturing. Advanced manufacturing practices, automation, and nearshoring trends are increasingly shaping production strategies.

Rising participation in fitness activities, athleisure adoption, and strong brand influence drive steady growth across the U.S. and Canada. Government focus on domestic manufacturing resilience and sustainable production further supports the market. North America demonstrates healthy growth, supported by demand for customized, performance-oriented, and eco-conscious sportswear.

Europe: Sustainability-Focused and Regulation-Driven Market

Europe represents a mature but steadily growing sportswear manufacturing market, strongly influenced by sustainability regulations and circular economy policies. The region emphasizes ethical sourcing, environmentally responsible production, and compliance with strict labor and environmental standards. European manufacturers are increasingly investing in recycled materials, low-impact dyeing, and energy-efficient production processes.

Consumer demand is driven by premium athleisure, outdoor sportswear, and fashion-performance hybrids. Countries such as Germany, Italy, and France remain important hubs for design, innovation, and high-quality manufacturing. Growth is moderate but stable, supported by strong institutional backing for sustainable textiles.

South America: Emerging Manufacturing and Consumption Market

South America is an emerging region in the global sportswear manufacturing landscape, with increasing importance driven by growing sports participation, fitness awareness, and urban lifestyles. The region is gradually strengthening its domestic manufacturing capabilities to reduce reliance on imports while supporting local brands and regional exports.

Brazil leads the regional market due to its large population, active sports culture, and expanding textile manufacturing base. Growth is supported by rising middle-class incomes and increasing demand for affordable sportswear. While still developing in scale, South America shows consistent growth potential over the forecast period.

Middle East & Africa: Niche but High-Potential Market

The Middle East & Africa region represents a smaller but steadily expanding segment of the global sportswear manufacturing market. Growth is fueled by increasing sports participation, government-led fitness initiatives, and rising awareness of health and wellness, particularly in GCC countries. Investments in sports infrastructure, international sporting events, and lifestyle transformation programs are supporting demand for performance and athleisure apparel.

Manufacturing activity remains limited compared to Asia, but regional governments are encouraging local production through industrial diversification strategies. While growth is relatively slower, the region holds long-term potential, especially in premium sportswear and private-label manufacturing.