E-commerce Expansion

The rapid expansion of e-commerce platforms is significantly influencing The Global athleisure Industry. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase athleisure products. Recent data indicates that online sales of athleisure wear have surged, accounting for nearly 30% of total sales in the sector. This trend is likely to continue as brands enhance their online presence and invest in digital marketing strategies. The ability to reach a broader audience through e-commerce not only facilitates consumer access to a diverse range of products but also allows for personalized shopping experiences. Consequently, the growth of e-commerce is expected to be a major catalyst for the expansion of the athleisure market, as it aligns with the preferences of tech-savvy consumers.

Influence of Social Media

The influence of social media on consumer purchasing decisions is a notable driver for The Global Athleisure Industry. Platforms such as Instagram and TikTok have become vital for brands to engage with their target audience, showcasing athleisure products through influencer partnerships and user-generated content. This trend has led to a significant increase in brand visibility and consumer interest, with studies suggesting that social media marketing can boost sales by up to 20%. As consumers increasingly rely on social media for fashion inspiration, brands that effectively leverage these platforms are likely to see enhanced brand loyalty and customer engagement. The dynamic nature of social media also allows for real-time feedback, enabling brands to adapt quickly to consumer preferences, thereby driving growth in the athleisure market.

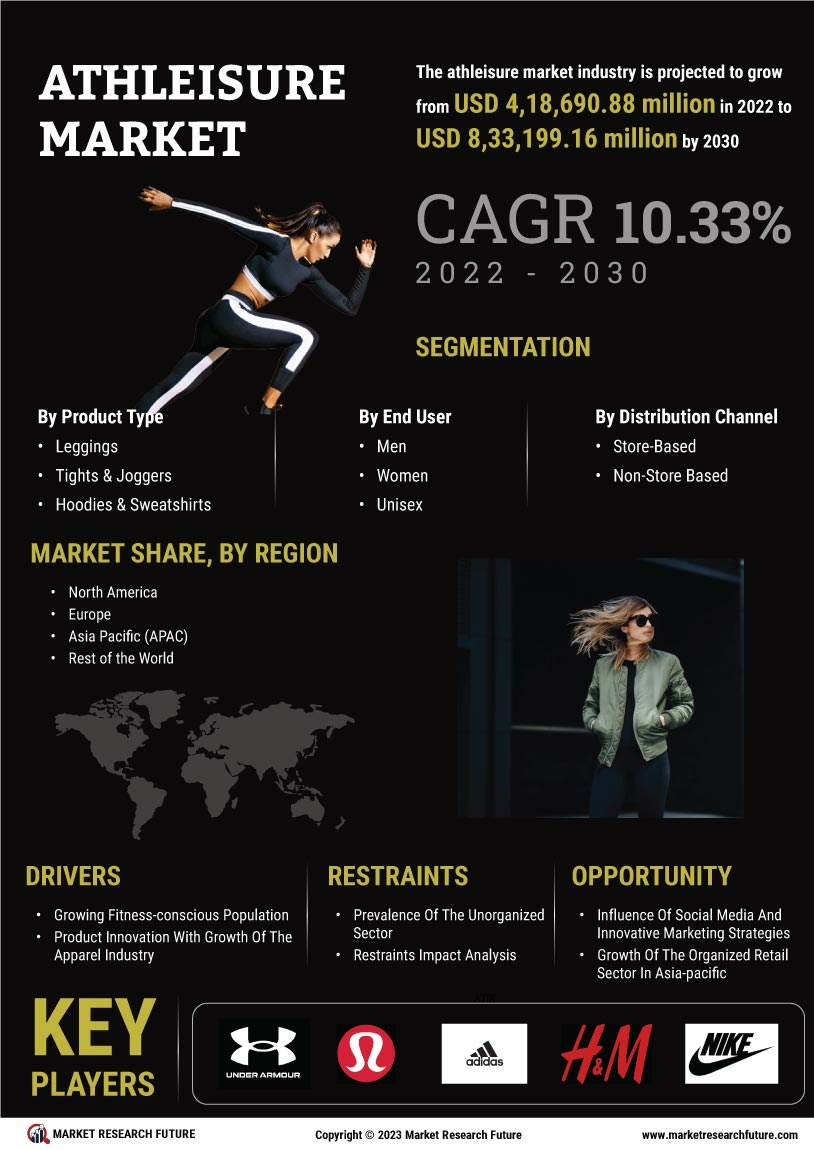

Health and Wellness Trends

The increasing emphasis on health and wellness is a pivotal driver for The Global Athleisure Industry. Consumers are becoming more health-conscious, leading to a surge in demand for activewear that is not only functional but also stylish. This trend is reflected in the market data, which indicates that the athleisure segment is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. As individuals seek to incorporate fitness into their daily routines, the appeal of athleisure clothing, which seamlessly transitions from workout to casual wear, becomes more pronounced. This shift in consumer behavior suggests that brands focusing on health-oriented marketing strategies may capture a larger share of the market, thereby driving growth in the industry.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly crucial in shaping The Global Athleisure Industry. As consumers grow more environmentally conscious, there is a rising demand for athleisure products made from sustainable materials and ethical manufacturing practices. Market data suggests that brands adopting sustainable practices can experience a competitive advantage, as approximately 60% of consumers express a preference for eco-friendly products. This shift towards sustainability not only aligns with consumer values but also encourages brands to innovate in their product offerings. Companies that prioritize sustainability are likely to attract a loyal customer base, thereby contributing to the overall growth of the athleisure market. The integration of sustainable practices into business models is expected to be a key factor in the industry's evolution.

Diverse Consumer Demographics

The emergence of diverse consumer demographics is a significant driver for The Global Athleisure Industry. As athleisure wear becomes increasingly popular across various age groups, genders, and lifestyles, brands are recognizing the need to cater to a broader audience. Recent market analysis indicates that the demand for inclusive sizing and gender-neutral designs is on the rise, reflecting a shift in consumer expectations. This diversification presents an opportunity for brands to expand their product lines and reach untapped markets. By embracing inclusivity, companies can foster brand loyalty and enhance their market presence. The ability to appeal to a wide range of consumers is likely to be a crucial factor in driving growth within the athleisure market, as it aligns with contemporary societal values.