Pharmaceutical Contract Manufacturing Market Summary

As per Market Research Future analysis, the Pharmaceutical Contract Manufacturing Market was estimated at 200.92 USD Billion in 2024. The Pharmaceutical Contract Manufacturing industry is projected to grow from 209.36 USD Billion in 2025 to 315.91 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Pharmaceutical Contract Manufacturing Market is experiencing robust growth driven by technological advancements and increasing demand for biologics.

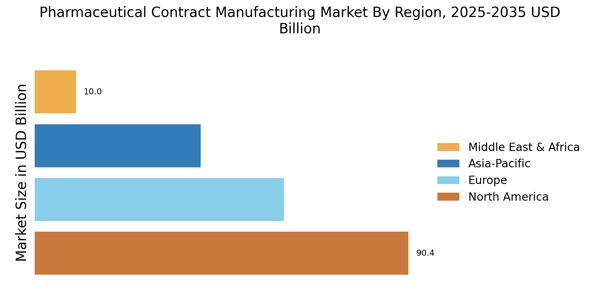

- The market is witnessing a rising demand for biologics, particularly in North America, which remains the largest market.

- Technological advancements in manufacturing processes are enhancing efficiency and quality across the sector.

- The Asia-Pacific region is emerging as the fastest-growing area, driven by increasing investments in pharmaceutical R&D activities.

- Key market drivers include the increasing demand for personalized medicine and the need for cost efficiency and resource optimization.

Market Size & Forecast

| 2024 Market Size | 200.92 (USD Billion) |

| 2035 Market Size | 315.91 (USD Billion) |

| CAGR (2025 - 2035) | 4.2% |

Major Players

Lonza (CH), Catalent (US), Samsung Biologics (KR), Boehringer Ingelheim (DE), Fujifilm Diosynth Biotechnologies (JP), Recipharm (SE), WuXi AppTec (CN), Patheon (US), Aenova (DE)