The South Korean government has been playing an active role in supporting the development of the chemical industry, including the ethylene market. Recent policies aimed at advancing the chemical industry's technological capabilities and sustainability have provided a conducive environment for growth. The government announced plans to invest heavily in green chemistry and sustainable practices, with a projected investment of over USD 10 billion by 2025 to bolster the sector.This initiative not only underscores the government's commitment to eco-friendly practices but also positions the South Korea Ethylene Market Industry to benefit from modernized facilities and technology.

Initiatives from organizations such as the Korea Petrochemical Industry Association further contribute to this favorable environment, enhancing the market's growth prospects.

Emergence of New Applications for Ethylene Derivatives

New applications for ethylene derivatives are propelling growth in the South Korea Ethylene Market Industry. The electronics sector in South Korea, which is a global leader, is increasingly utilizing materials derived from ethylene, such as polyethylene and ethylene vinyl acetate, for manufacturing components in smartphones and other devices. Reports estimate that the electronics sector is expected to grow approximately 4% annually, translating into increased demand for ethylene-based materials.Major corporations like Samsung Electronics are heavily investing in high-quality materials, further driving the need for ethylene.

This trend highlights the ongoing innovation in applications related to ethylene derivatives, which is essential for the growth of the South Korea Ethylene Market.

Rising Population and Urbanization Trends

The continuous growth in population and urbanization in South Korea is significantly impacting the South Korea Ethylene Market Industry. The country's population has been increasing steadily and is expected to reach around 52 million by 2030. This urbanization trend contributes to a higher demand for consumer goods, packaging, and transportation materials, all of which utilize ethylene-based compounds.

According to Statistics Korea, urban areas will host over 90% of the population by the end of the decade, emphasizing the need for efficient packaging and consumer products.The result is a reinforced demand for ethylene across multiple applications, thereby driving growth in this market segment.

South Korea Ethylene Market Segment Insights

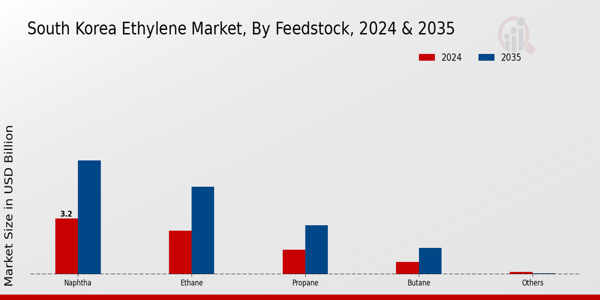

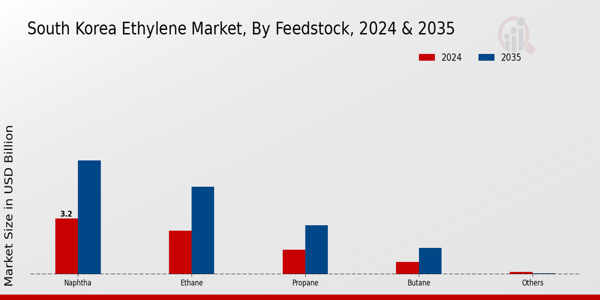

Ethylene Market Feedstock Insights

The Feedstock segment of the South Korea Ethylene Market plays a crucial role in the overall development and expansion of the industry, particularly as this region is a significant player in the global petrochemical landscape. South Korea, known for its advanced industrial capabilities and robust infrastructure, relies heavily on various sources of feedstock to produce ethylene, which is an essential building block for numerous chemical products. Among these, Naphtha typically holds substantial importance, as it serves as a primary feedstock for ethylene production in many countries due to its wide availability and cost-effectiveness.

This segment has shown dominance in the region due to South Korea's advanced refining capabilities and its access to global supply chains, enabling manufacturers to optimize production efficiencies. Moreover, Ethane, another noteworthy feedstock, has gained traction over the years, primarily due to the availability of natural gas in the region, offering a cleaner, low-cost alternative to more traditional feedstock options.

Propane and Butane also serve as valuable feedstock for ethylene production, particularly in niche applications where specific properties of these hydrocarbons can be effectively utilized for specialized chemicals.The versatility of these feedstocks presents significant opportunities for manufacturers to expand their product offerings and cater to diverse market needs. Overall, the Feedstock segment is vital for driving the growth and innovation seen in the South Korea Ethylene Market, supporting numerous downstream industries and contributing to the region's economic development.

As trends shift toward sustainable practices in the chemical industry, the evaluation of feedstock sources remains critical, with a key focus on optimizing processes and improving efficiency while addressing environmental concerns.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Ethylene Market Application Insights

The South Korea Ethylene Market showcases a diverse range of applications significantly impacting its overall landscape. Within this segment, Polyethylene, consisting of HDPE, LDPE, and LLDPE, plays a crucial role due to its versatility in packaging, construction, and automotive industries, driving robust demand. Ethylene Oxide is vital for producing antifreeze and detergents, while Ethylbenzene serves as a key component in Styrene production, essential for making plastics and resins. Ethylene Dichloride's relevance in PVC manufacturing also positions it as a significant player, ensuring its ongoing consumption in construction materials.

Vinyl Acetate supports the adhesive and paint industries, reflecting its importance in enhancing product performance. The South Korea Ethylene Market is benefiting from increased industrial activities and heightened consumer demand for packaging materials, which are fostering growth across these applications. However, challenges such as fluctuating raw material prices and regulatory pressures on environmental impact present hurdles. Opportunities lie in innovation and sustainability, motivating manufacturers to explore bio-based alternatives and efficient production methodologies, enabling a balanced growth trajectory within the South Korean landscape.

Ethylene Market Use Industry Insights

The South Korea Ethylene Market is significantly influenced by its End Use Industry, which encompasses a diverse array of applications. Key sectors include Packaging, Automotive, Building Construction, Agrochemical, Textile, Chemicals, Rubber Plastics, and soap etergents. The Packaging sector represents a substantial share of the market, driven by the increasing demand for efficient and sustainable solutions in food and consumer goods. The Automotive industry also plays a crucial role, as ethylene-based materials are vital for enhancing vehicle durability and reducing weight. Building Construction leverage ethylene products for their strong properties in insulation and safety.

Additionally, the Agrochemical segment benefits from ethylene derivatives that improve crop production. Textiles utilize ethylene for enhanced fabric quality and durability, while Chemicals Rubber Plastics industries rely heavily on ethylene as a key feedstock. Soaps Detergents enhance their formulations with ethylene derivatives, reflecting the market's adaptability. Overall, the diversity within the End Use Industries illustrates the South Korea Ethylene Market's robust capacity for growth and innovation, making it a dynamic and essential component of the country's economy.

South Korea Ethylene Market Key Players and Competitive Insights

The South Korea Ethylene Market is characterized by a competitive landscape driven by the growing demand for ethylene in various industrial applications, including the production of plastics and chemicals. This market has seen significant evolution with advancements in technology, regulatory changes, and shifting consumer preferences. The players in this market are focused on innovation, capacity expansion, and strategic partnerships to enhance market share and improve operational efficiency.

As South Korea continues to be a crucial hub for petrochemical production in the region, the competitive dynamics are influenced not only by the domestic players but also by multinational entities vying for a stake in the lucrative market. The focus on sustainability and eco-friendly production methods has also become a critical factor in shaping the competitive strategy among market participants.OCI Company has established itself as a significant player in the South Korea Ethylene Market, focusing on producing high-quality ethylene and other derivatives.

The company benefits from its advanced manufacturing capabilities and a strong commitment to research and development, allowing it to innovate and meet the evolving needs of customers effectively. OCI Company has a robust distribution network that enhances its market presence, enabling the efficient transportation of products throughout the region. The company's strengths include its operational efficiency, the ability to leverage technology, and strong customer relationships that contribute to high customer loyalty and satisfaction.

The focus on sustainable practices and reducing emissions further enhances OCI Company's competitive edge in the South Korean market, aligning with global trends towards sustainability in the chemical industry.Hyundai Chemical is another key participant in the South Korea Ethylene Market, known for its superior product offerings, including ethylene and its derivatives. The company has carved out a significant market presence through investments in advanced production facilities and innovative technology to enhance productivity and product quality. Hyundai Chemical focuses on maintaining strong quality control processes, allowing it to deliver consistent and reliable products to its clients.

With a strategic emphasis on mergers and acquisitions, Hyundai Chemical has expanded its operational capabilities and market reach, further solidifying its position within the industry. The company's strengths lie in its strong brand reputation, diversified product portfolio, and ongoing commitment to sustainability, which resonates with the growing regulatory focus on environmental concerns in South Korea. As they continue to enhance their operational strategies and develop new products, Hyundai Chemical remains well-positioned to adapt to the changing dynamics of the South Korean Ethylene Market.

Key Companies in the South Korea Ethylene Market Include

- Samsung Total Petrochemicals

South Korea Ethylene Market Industry Developments

The South Korea Ethylene Market has observed several significant developments recently. In October 2023, LG Chem announced plans to enhance its ethylene production capacity at its Daesan plant, investing approximately USD 300 million to meet the growing domestic and international demand. Additionally, in September 2023, KPX Chemical revealed the integration of a new advanced ethylene cracking unit, expected to improve operational efficiency and production output. Hyundai Chemical is also exploring collaborations to expand its ethylene capabilities, aiming to keep pace with competitors like SK Global Chemical and Lotte Chemical.

On the merger and acquisition front, no major transactions have been publicly disclosed September to October 2023 that would significantly alter market dynamics. However, the landscape remains competitive, with ongoing investments across companies such as GS Caltex and Daelim Industrial. The South Korean ethylene market is reflecting a promising growth trajectory, driven by rising industrial demand and increasing global market participation from local players. Changes in regulatory frameworks and environmental policies continue to shape operational strategies, underscoring the evolving nature of the market in the face of both domestic and international challenges.