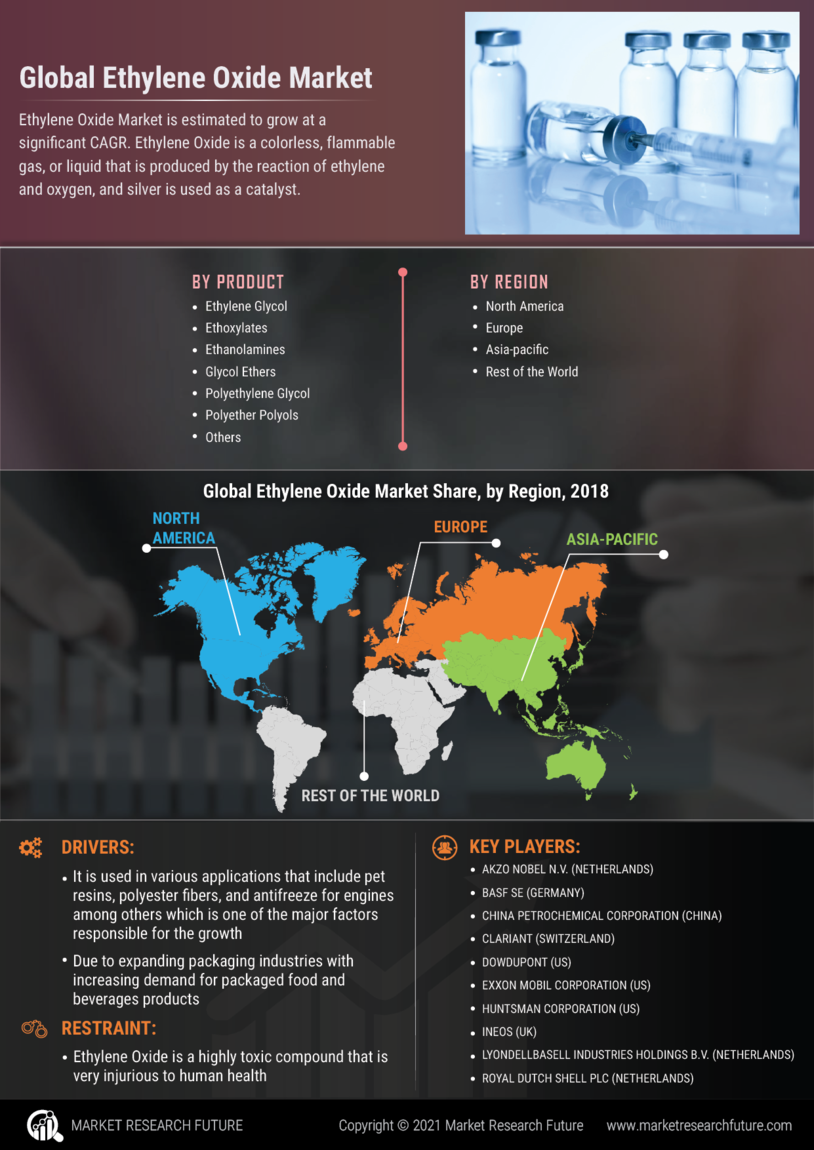

Growth in the Packaging Sector

The Global Ethylene Oxide Market Industry benefits from the expanding packaging sector, particularly in food and beverage applications. Ethylene oxide is pivotal in producing polyethylene terephthalate (PET), a widely used plastic in packaging. The increasing consumer preference for packaged goods, coupled with the rise of e-commerce, is expected to bolster this sector. As the market approaches 46.9 USD Billion by 2035, the packaging industry's growth is anticipated to contribute significantly to the overall demand for ethylene oxide, thereby enhancing the market's trajectory.

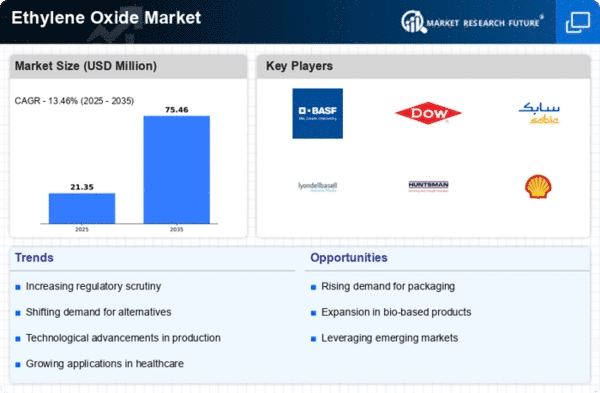

Market Trends and Growth Projections

The Global Ethylene Oxide Market Industry is poised for growth, with projections indicating a market value of 30.4 USD Billion in 2024 and an anticipated increase to 46.9 USD Billion by 2035. The compound annual growth rate of 4.03% from 2025 to 2035 reflects a steady demand trajectory, influenced by various factors such as technological advancements and regulatory support. The market's expansion is likely to be driven by increasing applications of ethylene oxide in diverse sectors, suggesting a dynamic and evolving landscape for stakeholders.

Advancements in Production Technologies

Technological advancements in the production of ethylene oxide are reshaping the Global Ethylene Oxide Market Industry. Innovations such as improved catalytic processes and energy-efficient methods are enhancing production efficiency and reducing costs. These advancements not only streamline operations but also minimize environmental impact, aligning with global sustainability goals. As companies adopt these technologies, the market is likely to witness an increase in output, further driving growth. The potential for enhanced production capabilities suggests a favorable outlook for the Global Ethylene Oxide Market Industry in the coming years.

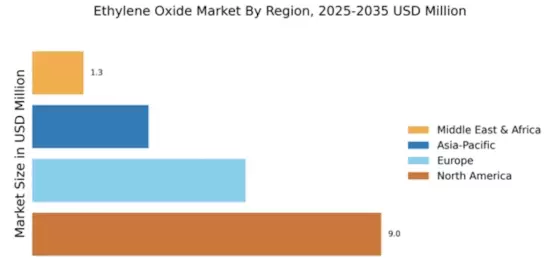

Emerging Markets and Economic Development

Emerging markets are becoming increasingly vital to the Global Ethylene Oxide Market Industry. Rapid economic development in regions such as Asia-Pacific and Latin America is driving demand for ethylene oxide and its derivatives. As these economies industrialize, the need for chemicals in various applications, including automotive, textiles, and packaging, is expected to surge. The projected compound annual growth rate of 4.03% from 2025 to 2035 underscores the potential for growth in these markets. This trend suggests that the Global Ethylene Oxide Market Industry will likely expand its footprint in response to evolving economic landscapes.

Rising Demand for Ethylene Oxide Derivatives

The Global Ethylene Oxide Market Industry experiences a robust demand for derivatives such as ethylene glycol, which is extensively utilized in the production of antifreeze and polyester fibers. This demand is driven by the automotive and textile industries, which are projected to grow significantly in the coming years. In 2024, the market is valued at approximately 30.4 USD Billion, indicating a strong consumer base. As industries evolve, the need for high-performance materials continues to rise, suggesting that the Global Ethylene Oxide Market Industry will likely see sustained growth fueled by these derivative applications.

Regulatory Support for Chemical Manufacturing

Regulatory frameworks supporting the chemical manufacturing sector play a crucial role in the Global Ethylene Oxide Market Industry. Governments worldwide are implementing policies that encourage sustainable practices and innovation in chemical production. This regulatory support fosters an environment conducive to investment and growth, enabling companies to expand their operations. As the market evolves, such frameworks are likely to enhance the industry's resilience and adaptability. The anticipated growth trajectory of the market indicates that regulatory measures will continue to influence the Global Ethylene Oxide Market Industry positively.