Research Methodology on Mono Ethylene Glycol Market

Abstract

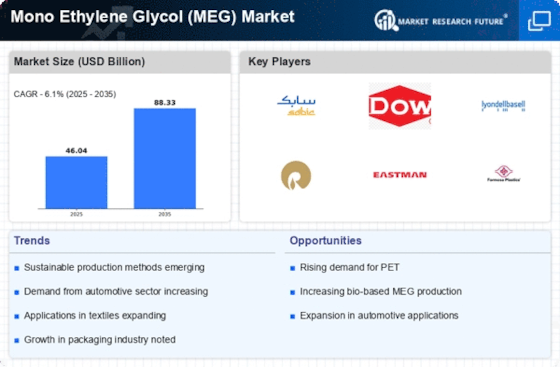

This research report aims to explore the various market drivers and restraints that have an impact on the Mono Ethylene Glycol (MEG) Market. The paper analyzes the current market trends, opportunities, and challenges that the MEG industry faces. It also looks at the historical and forecasted market growth of the MEG market, as well as the market segments of the various end-use industries and regions. The report also identifies the major players in the MEG market and evaluates their competitive strategies. Finally, the research methodology applied to this research paper is discussed in detail.

Introduction

Mono-Ethylene Glycol (MEG) is an odourless clear colourless liquid with a sweet taste which is used as a solvent, for resins, and as an intermediate in the manufacture of several chemicals. It is mainly used as a raw material for polyester fibres and resins in the textile industry, manufacturing of automotive coolants and antifreeze, and other consumer products. Demand for MEG continues to increase due to its use in various industries like automotive, packaging, paints, coating, food, and pharmaceuticals.

The global MEG capacity is estimated to expand at a healthy rate, driven by the ever-increasing demand for MEG from the textile, packaging, and construction industries. The performance of the MEG industry is also dependent on a number of factors like raw material availability, pricing, and government regulations. In addition, the demand for MEG is also driven by the increasing popularity of bio-based MEG and rising consumption of polyester.

Research Methodology

The primary purpose of this research report is to explore the dynamics and trends of the global MEG market. The research methodology applied to this research report utilizes both qualitative and quantitative strategies.

The first step in the research methodology is the identification of the research objective. This objective was to gain an understanding of the drivers and restraints of the MEG market and analyze the current market trends and opportunities in the MEG industry.

After the research objective was established, the second step was the market analysis phase. The market analysis phase primarily involved gathering secondary data from online databases. To ensure credibility and accuracy, only reliable sources such as market reports, industry reports, white papers, and journal and magazine articles were consulted. In addition, interviews with key industry experts were conducted. The interviews were conducted via phone and video conferencing.

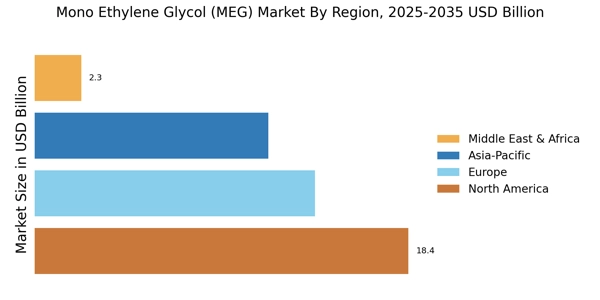

The next step was the data analysis phase. This included examining all the primary and secondary sources of information to identify the key insights and draw meaningful conclusions. In addition, the data was analyzed to identify the major market segments, opportunities, and challenges in the MEG market. This step also included a statistical analysis of the different market segments, in order to identify the most promising markets and regions.

The next step was the market forecast phase. This included the evaluation of the historical trends in the MEG industry, including the market size, market share, and market segments. The data was then extrapolated to provide a forecast of the future performance of the MEG market for 2023 to 2030.

Following this, the competitive analysis phase was used to identify the major players in the MEG industry. The companies were identified through a combination of primary and secondary sources, such as company reports and websites, and interviews with industry experts. The competitive analysis also included an evaluation of the competitive strategies adopted by the major players, such as branding, marketing, product innovation, and pricing.

Finally, the research methodology was concluded with the validation of the data. This included a thorough review of all the gathered data to ensure accuracy and reliability.

Conclusion

This research report presented an overview of the various market drivers and restraints that impact the Mono Ethylene Glycol (MEG) Market. The report analyzed the current market trends, opportunities, and challenges that the MEG industry faces. The research methodology applied to the research report includes the identification of research objectives, market analysis, data analysis, market forecasting, competitive analysis, and data validation. Through the application of this research methodology, this research report was able to provide a comprehensive overview of the MEG market.