Growth in Construction Activities

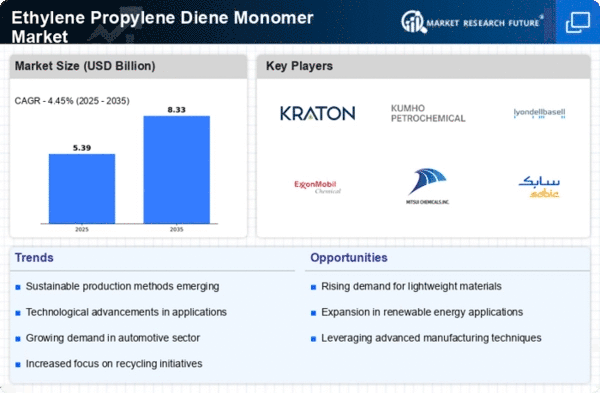

The Global Ethylene Propylene Diene Monomer Market Industry is significantly influenced by the expansion of construction activities worldwide. EPDM is widely used in roofing membranes, waterproofing, and insulation applications due to its superior resistance to UV radiation and extreme weather conditions. As urbanization accelerates and infrastructure projects increase, the demand for durable and reliable materials like EPDM is likely to rise. This growth is reflected in the projected market value of 5.3 USD Billion by 2035, indicating a robust trajectory. The construction sector's emphasis on sustainable building practices further enhances the appeal of EPDM, as it contributes to energy efficiency and longevity in building materials.

Rising Demand from Automotive Sector

The Global Ethylene Propylene Diene Monomer Market Industry experiences a notable surge in demand driven by the automotive sector. EPDM is increasingly utilized in vehicle manufacturing due to its excellent weather resistance, flexibility, and durability. As automotive manufacturers focus on enhancing vehicle performance and longevity, the use of EPDM in seals, gaskets, and hoses becomes more prevalent. In 2024, the market is projected to reach 3.42 USD Billion, reflecting the automotive industry's growing reliance on high-performance materials. This trend is expected to continue, with the market anticipated to expand further as electric vehicles gain traction, necessitating advanced materials for improved efficiency and sustainability.

Increasing Adoption in Consumer Goods

The Global Ethylene Propylene Diene Monomer Market Industry is witnessing an increasing adoption of EPDM in consumer goods. The material's excellent resistance to heat, ozone, and aging makes it suitable for various applications, including household appliances, toys, and sporting goods. As consumer preferences shift towards durable and high-quality products, manufacturers are incorporating EPDM to enhance product performance and longevity. This trend is likely to drive market growth, as the demand for reliable consumer goods continues to rise. The versatility of EPDM allows it to cater to diverse applications, further solidifying its position in the consumer goods sector.

Technological Advancements in Production

Technological advancements in the production of Ethylene Propylene Diene Monomer Market are reshaping the Global Ethylene Propylene Diene Monomer Market Industry. Innovations in polymerization processes and catalysts enhance the efficiency and quality of EPDM production, leading to lower costs and improved material properties. These advancements enable manufacturers to meet the evolving demands of various industries, including automotive and construction. As a result, the market is poised for growth, with a projected CAGR of 4.06% from 2025 to 2035. Enhanced production techniques not only optimize resource utilization but also align with sustainability goals, making EPDM a more attractive option for environmentally conscious consumers.

Environmental Regulations and Sustainability Initiatives

The Global Ethylene Propylene Diene Monomer Market Industry is increasingly shaped by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing carbon footprints and promoting the use of eco-friendly materials. EPDM, known for its recyclability and low environmental impact, aligns well with these initiatives. As industries strive to comply with regulations and enhance their sustainability profiles, the demand for EPDM is likely to increase. This shift not only supports market growth but also encourages innovation in developing greener production methods, ensuring that EPDM remains a viable option for environmentally conscious applications.