Collaboration Between Industries

Collaboration between various industries is emerging as a vital driver for the biomaterial market in South America. Partnerships between agricultural, chemical, and manufacturing sectors are fostering the development of new biomaterials that meet specific market demands. For instance, collaborations aimed at utilizing agricultural waste for biomaterial production are gaining traction, potentially reducing costs and environmental impact. This synergy is likely to enhance the efficiency of the biomaterial market, leading to increased adoption and innovation.

Regulatory Support for Biomaterials

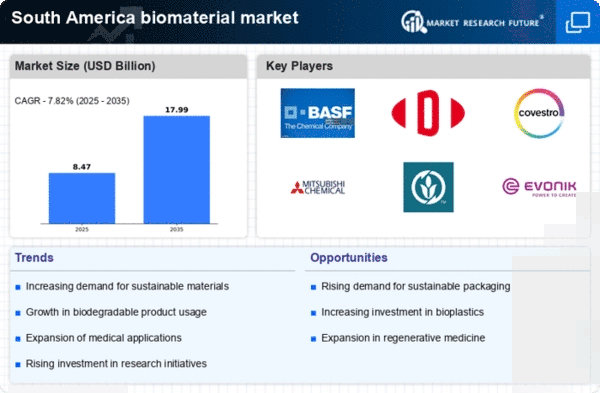

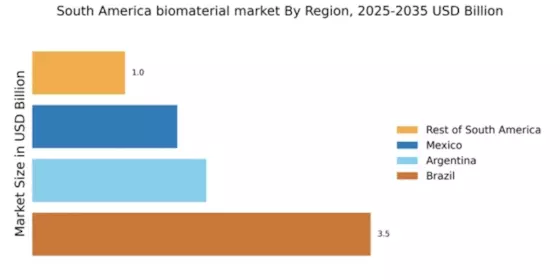

The regulatory landscape in South America is increasingly supportive of the biomaterial market. Governments are implementing policies that encourage the use of sustainable materials in various industries, including packaging, construction, and healthcare. For instance, Brazil has introduced regulations that promote biodegradable materials, which could potentially lead to a market growth of approximately 15% annually. This regulatory support not only fosters innovation but also attracts investments in research and development, thereby enhancing the overall competitiveness of the biomaterial market in the region.

Growing Awareness of Health and Safety

The growing awareness of health and safety issues is influencing the biomaterial market in South America. As consumers become more conscious of the materials used in products, there is a rising demand for biomaterials that are non-toxic and safe for human use. This trend is particularly evident in the healthcare sector, where the demand for biocompatible materials is increasing. The biomaterial market is expected to benefit from this shift, as manufacturers prioritize the development of safe and sustainable materials.

Investment in Research and Development

Investment in research and development is a crucial driver for the biomaterial market in South America. With increasing funding from both public and private sectors, innovative biomaterials are being developed to meet diverse industrial needs. For example, the Brazilian government has allocated approximately $50 million to support research initiatives focused on biopolymers and bio-composites. This influx of capital not only accelerates technological advancements but also enhances the region's capacity to produce high-quality biomaterials, thereby expanding the market.

Rising Demand for Eco-Friendly Products

Consumer preferences in South America are shifting towards eco-friendly products, significantly impacting the biomaterial market. As awareness of environmental issues grows, consumers are increasingly seeking products made from renewable resources. This trend is reflected in the packaging sector, where the demand for biodegradable and compostable materials is expected to rise by 20% over the next five years. Companies that adapt to these changing preferences are likely to gain a competitive edge, thereby driving growth in the biomaterial market.