Orthopedic Biomaterial Market Summary

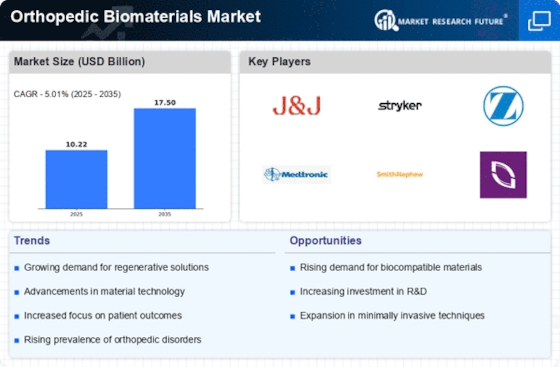

As per Market Research Future analysis, the Orthopedic Biomaterials Market Size was estimated at 10.22 USD Billion in 2024. The Orthopedic Biomaterials industry is projected to grow from 10.73 USD Billion in 2025 to 17.5 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.01% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Orthopedic Biomaterials Market is experiencing dynamic growth driven by technological advancements and increasing demand for innovative solutions.

- The market is witnessing a rise in biodegradable materials, reflecting a shift towards sustainable practices.

- Advancements in 3D printing technology are revolutionizing the production of customized orthopedic implants.

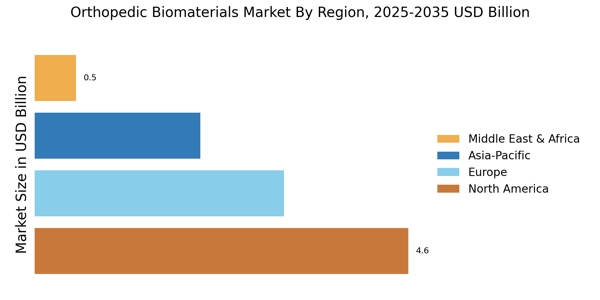

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for orthopedic biomaterials.

- Key drivers include the growing aging population and rising incidence of sports injuries, which are fueling demand for effective biomaterial solutions.

Market Size & Forecast

| 2024 Market Size | 10.22 (USD Billion) |

| 2035 Market Size | 17.5 (USD Billion) |

| CAGR (2025 - 2035) | 5.01% |

Major Players

DePuy Synthes (US), Stryker (US), Zimmer Biomet (US), Medtronic (US), Smith & Nephew (GB), NuVasive (US), Aesculap (DE), Orthofix (US), B. Braun (DE)