Increasing Healthcare Expenditure

The orthopedic biomaterial market is benefiting from the increasing healthcare expenditure in South Korea. The government has been actively investing in healthcare infrastructure and services, which has led to enhanced access to orthopedic care. Recent statistics indicate that healthcare spending has risen to approximately 8% of the country's GDP, reflecting a commitment to improving health outcomes. This increase in expenditure is likely to drive demand for advanced orthopedic biomaterials, as healthcare providers seek to offer high-quality treatments. Furthermore, the expansion of health insurance coverage for orthopedic procedures is expected to further stimulate market growth, as more patients gain access to necessary surgical interventions.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the orthopedic biomaterial market in South Korea. The government and private sector are increasingly allocating funds to develop novel biomaterials that offer improved biocompatibility and mechanical properties. This focus on innovation is evident in the establishment of specialized research institutions and partnerships between universities and industry players. Recent reports indicate that R&D spending in the medical device sector has reached over $500 million annually, with a substantial portion directed towards orthopedic applications. Such investments are likely to yield advanced materials that can address the specific needs of orthopedic surgeries, thereby enhancing the overall market landscape.

Technological Integration in Healthcare

Technological integration in healthcare is emerging as a pivotal driver for the orthopedic biomaterial market in South Korea. The adoption of digital health technologies, including telemedicine and electronic health records, is transforming the way orthopedic care is delivered. This integration facilitates better patient management and enhances the efficiency of surgical procedures. Moreover, the use of advanced imaging techniques and 3D printing in the development of custom orthopedic implants is gaining traction. As these technologies become more prevalent, the demand for innovative biomaterials that can be tailored to individual patient needs is likely to increase, thereby propelling the growth of the orthopedic biomaterial market.

Rising Demand for Joint Replacement Surgeries

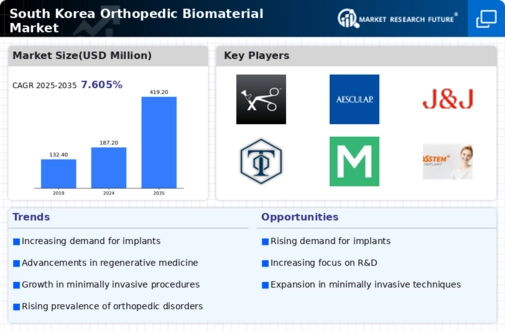

The orthopedic biomaterial market in South Korea is experiencing a notable surge in demand for joint replacement surgeries. This trend is primarily driven by an increasing prevalence of orthopedic conditions such as osteoarthritis and rheumatoid arthritis among the population. According to recent data, the number of joint replacement procedures has escalated, with estimates suggesting that over 100,000 surgeries are performed annually. This growing demand necessitates the use of advanced biomaterials that enhance surgical outcomes and improve patient recovery times. As healthcare providers seek to adopt innovative solutions, the orthopedic biomaterial market is poised for significant growth, with projections indicating a compound annual growth rate (CAGR) of approximately 8% over the next five years.

Growing Awareness of Minimally Invasive Procedures

There is a growing awareness and preference for minimally invasive surgical techniques among both healthcare professionals and patients in South Korea. This shift is significantly impacting the orthopedic biomaterial market, as these procedures often require specialized biomaterials that facilitate quicker recovery and reduced postoperative complications. The trend towards minimally invasive surgeries is supported by advancements in surgical technologies and techniques, which have been widely adopted in orthopedic practices. As a result, the demand for biomaterials that are compatible with these procedures is expected to rise, potentially leading to a market growth rate of around 7% in the coming years.