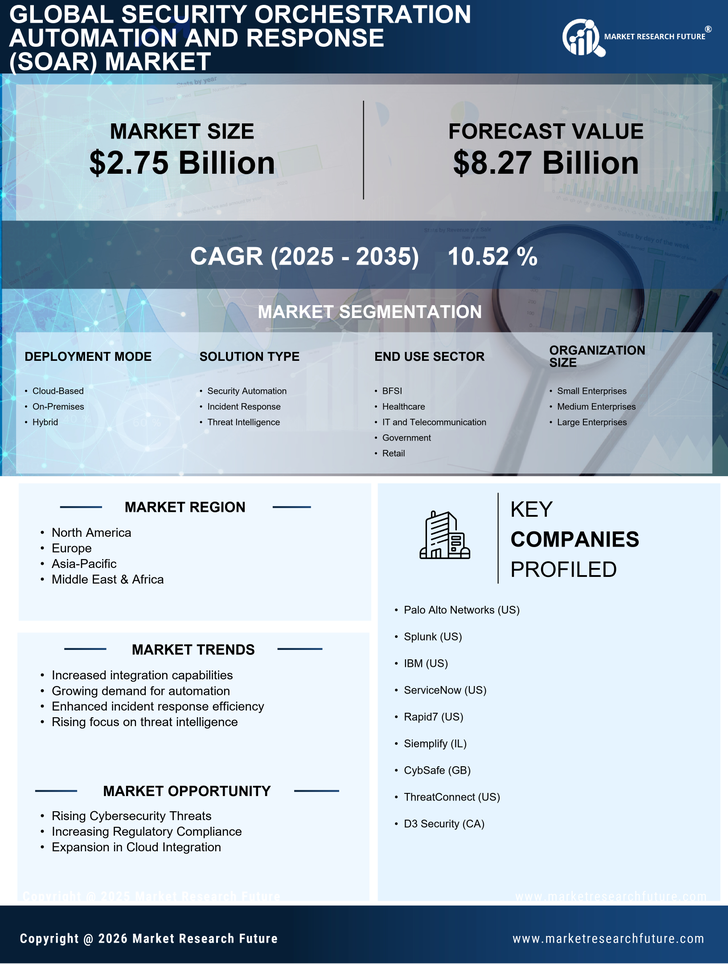

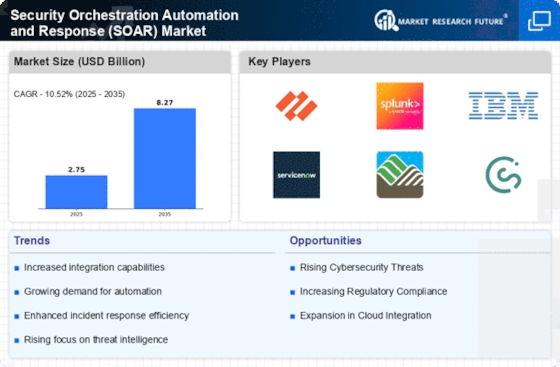

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the Security Orchestration Automation and Response Market (SOAR) Market. Organizations are facing a myriad of attacks, including ransomware, phishing, and advanced persistent threats. As a result, the demand for automated response solutions is surging. According to recent data, the cybersecurity market is projected to reach USD 345 billion by 2026, indicating a robust growth trajectory. This escalation in threats necessitates the implementation of SOAR solutions to enhance incident response capabilities and reduce the time to mitigate attacks. Consequently, organizations are investing heavily in SOAR technologies to bolster their defenses and streamline their security operations.

Integration with Cloud Services

The rapid adoption of cloud services is significantly influencing the Security Orchestration Automation and Response Market (SOAR) Market. As organizations migrate to cloud environments, the complexity of managing security across multiple platforms increases. SOAR solutions provide the necessary tools to integrate security operations across on-premises and cloud infrastructures seamlessly. This integration is essential for maintaining visibility and control over security incidents. Market data indicates that the cloud security market is expected to grow to USD 12 billion by 2025, underscoring the importance of SOAR in managing cloud security challenges. Consequently, the demand for SOAR solutions that can effectively address these challenges is likely to rise.

Need for Operational Efficiency

Operational efficiency remains a critical driver for the Security Orchestration Automation and Response Market (SOAR) Market. Organizations are increasingly recognizing the need to optimize their security operations to manage resources effectively. SOAR solutions facilitate the automation of repetitive tasks, allowing security teams to focus on more strategic initiatives. This shift not only enhances productivity but also reduces operational costs. Data suggests that organizations utilizing SOAR can decrease incident response times by up to 90%, thereby improving overall security posture. As businesses strive to achieve greater efficiency in their security operations, the adoption of SOAR technologies is likely to accelerate, further propelling market growth.

Regulatory Compliance Pressures

Regulatory compliance is a significant driver for the Security Orchestration Automation and Response Market (SOAR) Market. Organizations are increasingly subject to stringent regulations regarding data protection and privacy, such as GDPR and HIPAA. Non-compliance can result in severe penalties and reputational damage. SOAR solutions assist organizations in automating compliance processes, ensuring that security measures align with regulatory requirements. This capability is particularly crucial as the regulatory landscape continues to evolve. Data indicates that compliance-related costs can account for up to 5% of an organization's revenue, highlighting the financial implications of non-compliance. As such, the demand for SOAR technologies that facilitate compliance is expected to grow.

Growing Demand for Threat Intelligence

The escalating need for threat intelligence is a pivotal driver for the Security Orchestration Automation and Response Market (SOAR) Market. Organizations are increasingly seeking to enhance their threat detection and response capabilities through actionable intelligence. SOAR solutions integrate threat intelligence feeds, enabling security teams to respond proactively to emerging threats. This integration is vital for maintaining a robust security posture in an ever-evolving threat landscape. Market analysis suggests that the threat intelligence market is projected to reach USD 12 billion by 2025, indicating a strong demand for solutions that can leverage this intelligence effectively. As organizations prioritize threat intelligence, the adoption of SOAR technologies is likely to increase.