Health and Wellness Trends

The Salad Dressings Mayonnaise Market is significantly influenced by the prevailing health and wellness trends among consumers. There is a growing awareness regarding dietary choices, leading to an increased demand for healthier salad dressings. This shift is evidenced by market data showing that sales of low-fat and organic mayonnaise options have risen by approximately 15% in the past year. Consumers are increasingly scrutinizing ingredient labels, seeking products with natural ingredients and fewer preservatives. This trend has prompted manufacturers to reformulate their offerings, introducing mayonnaise variants that align with health-conscious preferences. As a result, the industry is witnessing a diversification of product lines, catering to various dietary needs, including gluten-free and vegan options, thereby expanding the consumer base.

Innovative Flavor Profiles

The Salad Dressings Mayonnaise Market is witnessing a transformation driven by innovative flavor profiles. As consumers become more adventurous in their culinary choices, there is a growing appetite for unique and exotic flavors in salad dressings. Market data suggests that specialty mayonnaise flavors, such as sriracha, garlic, and truffle, have gained popularity, with sales increasing by over 20% in the last year. This trend is encouraging manufacturers to experiment with new ingredients and flavor combinations, thereby enhancing the overall consumer experience. The introduction of gourmet mayonnaise products not only caters to the evolving tastes of consumers but also positions brands as premium offerings in a competitive market. Consequently, this innovation in flavor profiles is likely to play a pivotal role in driving growth within the Salad Dressings Mayonnaise Market.

Expansion of Distribution Channels

The Salad Dressings Mayonnaise Market is benefiting from the expansion of distribution channels, which enhances product accessibility for consumers. The proliferation of e-commerce platforms and online grocery shopping has transformed the way consumers purchase salad dressings, including mayonnaise. Market data reveals that online sales of salad dressings have surged by approximately 30% in the past year, indicating a shift in consumer purchasing behavior. Retailers are also diversifying their offerings by including mayonnaise in various formats, such as single-serve packets and bulk containers, catering to different consumer needs. This expansion not only increases market reach but also allows brands to tap into new consumer segments. As a result, the Salad Dressings Mayonnaise Market is poised for continued growth as distribution channels evolve to meet changing consumer preferences.

Increased Demand for Convenience Foods

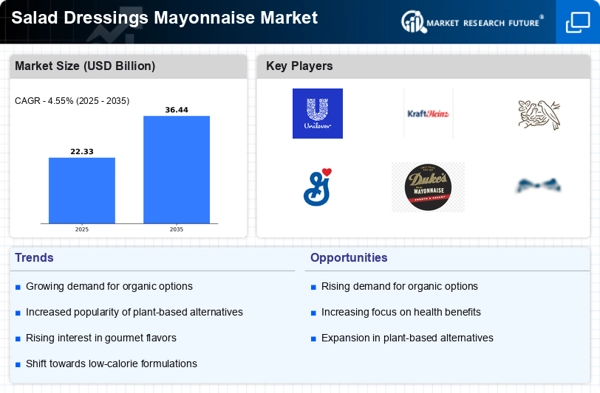

The Salad Dressings Mayonnaise Market is experiencing a notable surge in demand for convenience foods. As consumers lead increasingly busy lifestyles, the preference for ready-to-use salad dressings, including mayonnaise, has escalated. This trend is reflected in market data, indicating that the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. The ease of use and time-saving attributes of mayonnaise-based dressings appeal to consumers seeking quick meal solutions. Furthermore, the rise in meal kit deliveries and pre-packaged salads has further fueled this demand, as these products often include mayonnaise as a key ingredient. Consequently, manufacturers are focusing on innovative packaging and product formulations to cater to this growing consumer preference.

Sustainability and Eco-Friendly Packaging

The Salad Dressings Mayonnaise Market is increasingly aligning with sustainability initiatives, reflecting a broader consumer demand for eco-friendly products. As environmental concerns gain prominence, consumers are gravitating towards brands that prioritize sustainable practices. Market data indicates that products with eco-friendly packaging have seen a sales increase of approximately 10% in the past year. This trend has prompted manufacturers to adopt biodegradable and recyclable packaging solutions, thereby reducing their environmental footprint. Additionally, the use of organic and sustainably sourced ingredients in mayonnaise formulations is becoming more prevalent. This commitment to sustainability not only appeals to environmentally conscious consumers but also enhances brand loyalty, as consumers are more likely to support companies that demonstrate a genuine commitment to ecological responsibility.