Increase in Surgical Procedures

The rise in surgical procedures globally is contributing to the growth of the Wound Dressings Devices Market. Surgical interventions often result in postoperative wounds that require effective management to prevent complications such as infections. As the number of surgeries continues to rise, so does the demand for high-quality wound dressings that can facilitate healing and minimize the risk of infection. The market is projected to benefit from this trend, with estimates suggesting an increase in demand for wound dressings by approximately 8% annually, driven by the growing surgical volume across various medical specialties. This trend underscores the critical role of advanced wound care solutions in enhancing patient recovery.

Supportive Government Initiatives

Government initiatives aimed at improving healthcare infrastructure and access to advanced medical technologies are playing a crucial role in the Wound Dressings Devices Market. Many countries are implementing policies that promote the adoption of innovative wound care solutions, including subsidies and funding for research and development. These initiatives are designed to enhance patient care and reduce healthcare costs associated with wound management. As a result, manufacturers are encouraged to invest in the development of new wound dressing technologies. The market is likely to experience accelerated growth due to these supportive measures, with projections indicating a potential market expansion of 6% over the next few years.

Rising Incidence of Chronic Wounds

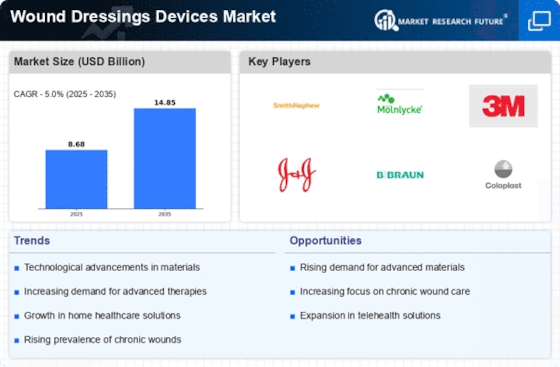

The increasing prevalence of chronic wounds, such as diabetic ulcers and pressure sores, is a primary driver of the Wound Dressings Devices Market. According to recent estimates, chronic wounds affect millions of individuals worldwide, leading to a heightened demand for effective wound care solutions. This trend is particularly pronounced in aging populations, where the incidence of chronic conditions is on the rise. As healthcare providers seek to improve patient outcomes, the focus on advanced wound dressings that promote healing and reduce infection risk becomes paramount. The market is projected to grow significantly, with a compound annual growth rate (CAGR) of over 5% anticipated in the coming years, reflecting the urgent need for innovative wound care products.

Technological Innovations in Wound Care

Technological advancements in wound dressing materials and designs are transforming the Wound Dressings Devices Market. Innovations such as hydrocolloid, foam, and antimicrobial dressings are enhancing healing processes and patient comfort. The introduction of smart dressings, which can monitor wound conditions and deliver medication, is particularly noteworthy. These advancements not only improve clinical outcomes but also reduce healthcare costs associated with wound management. The market is witnessing a surge in research and development activities, with companies investing heavily in creating next-generation wound care products. This focus on innovation is expected to drive market growth, with a projected increase in market size by approximately 7% over the next five years.

Growing Awareness of Advanced Wound Care

There is a notable increase in awareness regarding advanced wound care solutions among healthcare professionals and patients, which is positively impacting the Wound Dressings Devices Market. Educational initiatives and training programs are being implemented to inform stakeholders about the benefits of modern wound dressings. This heightened awareness is leading to a shift from traditional wound care methods to more effective, evidence-based practices. As a result, healthcare providers are more inclined to adopt advanced wound dressings that offer superior healing properties. The market is expected to expand as more practitioners recognize the importance of utilizing advanced wound care technologies, potentially increasing market penetration by 10% in the next few years.