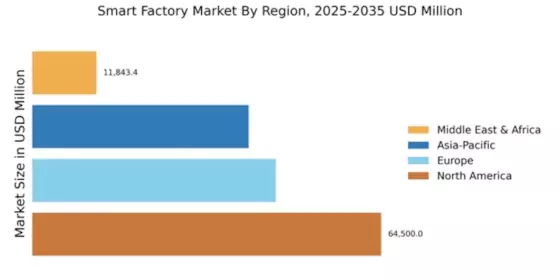

Market Growth Projections

The Global Smart Factory Market Industry is characterized by robust growth projections, with the market expected to reach 161.3 USD Billion in 2024 and 785.2 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 15.47% from 2025 to 2035, reflecting the increasing adoption of smart technologies across various sectors. The expansion of the market is driven by factors such as automation, customization, sustainability, and technological advancements. As industries continue to embrace smart factory solutions, the market is likely to witness significant transformations, positioning smart factories as integral components of the future manufacturing landscape.

Sustainability Initiatives

Sustainability initiatives are becoming a cornerstone of the Global Smart Factory Market Industry, as manufacturers strive to reduce their environmental footprint. The integration of smart technologies facilitates energy-efficient processes and waste reduction, aligning with global sustainability goals. Governments worldwide are increasingly implementing regulations that encourage sustainable practices, further driving the adoption of smart factory solutions. This trend not only enhances corporate responsibility but also appeals to environmentally conscious consumers. As sustainability becomes a competitive differentiator, the market is expected to grow substantially, with projections indicating a CAGR of 15.47% from 2025 to 2035, underscoring the importance of sustainable manufacturing practices.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Smart Factory Market Industry, as innovations in IoT, AI, and big data analytics transform manufacturing processes. These technologies enable real-time monitoring, predictive maintenance, and data-driven decision-making, enhancing operational efficiency and reducing downtime. As manufacturers increasingly leverage these advancements, the market is poised for significant growth. The integration of smart technologies is expected to drive the market to an estimated value of 161.3 USD Billion in 2024, highlighting the transformative impact of technology on manufacturing. The continuous evolution of these technologies suggests a promising future for smart factories, fostering innovation and competitiveness.

Increased Automation Adoption

The Global Smart Factory Market Industry experiences a notable surge in automation adoption, driven by the need for enhanced operational efficiency. As industries seek to minimize human error and optimize production processes, automation technologies such as robotics and AI are increasingly integrated into manufacturing systems. In 2024, the market is projected to reach 161.3 USD Billion, reflecting a growing recognition of automation's potential to streamline operations. This trend is expected to continue, with the market expanding significantly as companies invest in smart technologies to remain competitive. The shift towards automation is likely to redefine traditional manufacturing paradigms, fostering innovation and productivity.

Rising Demand for Customization

The Global Smart Factory Market Industry is witnessing a rising demand for product customization, compelling manufacturers to adopt flexible production systems. Consumers increasingly seek personalized products, prompting factories to implement smart technologies that enable rapid adjustments in production lines. This shift not only enhances customer satisfaction but also drives revenue growth. As the market evolves, it is projected to reach 785.2 USD Billion by 2035, indicating a robust growth trajectory. The ability to swiftly adapt to changing consumer preferences positions smart factories as pivotal players in meeting market demands, thereby reinforcing their significance in the global manufacturing landscape.

Global Supply Chain Optimization

Global supply chain optimization is a key driver in the Global Smart Factory Market Industry, as manufacturers seek to enhance their responsiveness and efficiency. The integration of smart technologies allows for better visibility and control over supply chain processes, enabling companies to respond swiftly to market fluctuations. This optimization not only reduces operational costs but also improves customer satisfaction through timely deliveries. As the market evolves, it is projected to expand significantly, with estimates suggesting a value of 785.2 USD Billion by 2035. The emphasis on supply chain efficiency underscores the critical role of smart factories in navigating the complexities of global manufacturing.