Research Methodology on Robotics Market

For the purpose of this research, Market Research Future (MRFR) employs an extensive and methodical primary and secondary research process. Primary research takes in research industry representative, news sources, press release and industry dealers to exhaustively comprehend the market. Extensive secondary research is carried out through high-quality databases.

The primary research focus is to understand industry perceptions on their experiences and opinions with their ongoing operations, along with individual preferences of their market players. The approach involves interviews and surveys with key opinion leaders, market players, in-depth interviews with sources, public sources and data sources.

MRFR’s primary research team conducted interviews with the key industry players and representatives from the Robotics market, comprising of

- The Robotics Industry Association

- Robotics Companies

- Robo Project Managers

- Robotics Researchers

- Robotics Analysts

- Robotics Specialists

- Technology Companies

The interviews undertaken for the primary research provides in-depth and qualitative insights about the market, giving an opportunity to analyze information and draw conclusions about the future market outlook.

Secondary Research

MRFR also conducts an extensive secondary research to gather the necessary market data and insights form the market. The secondary research comprises of reports from various published websites, white papers from companies and reviews from the expert industry sources. Secondary data enables us to gain an insight into the current marketing and promotional trends, market trends, industry advancements, market size, opportunities and threats, market players and more related to the Robotics market.

Market Forecasting

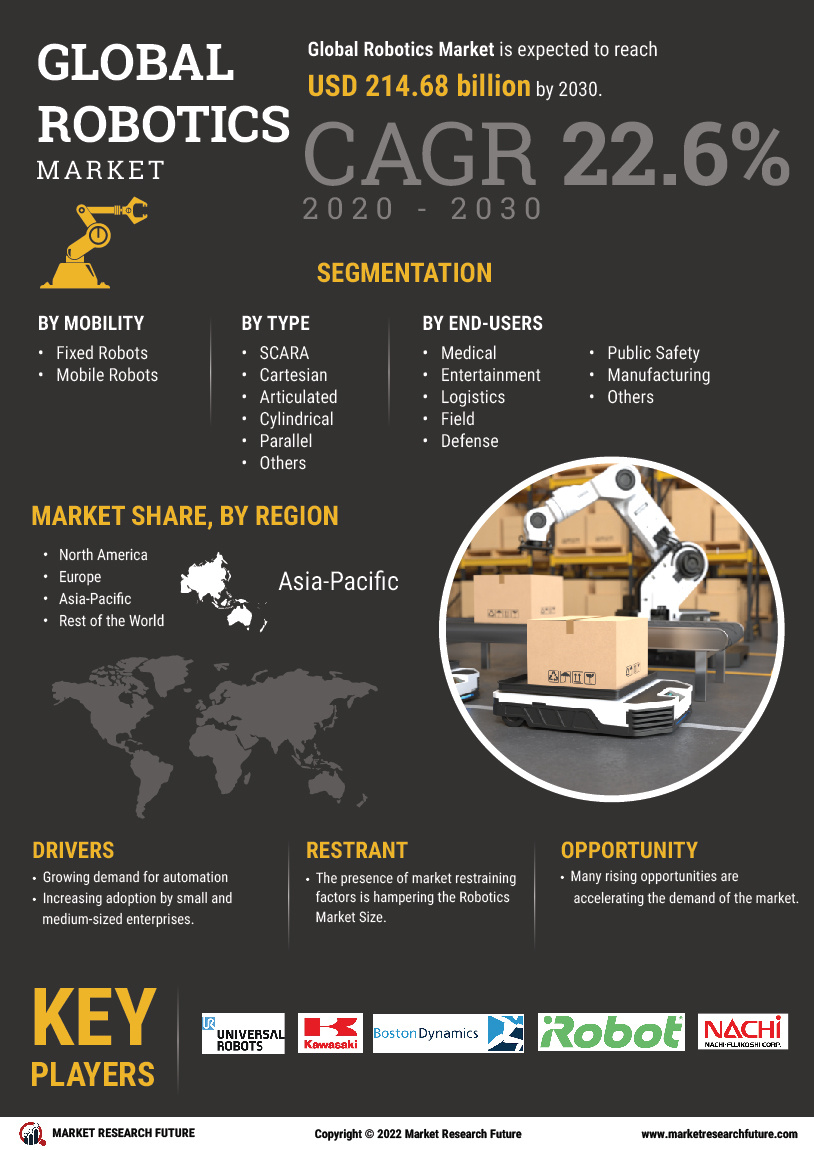

The report estimations include analysis of the growth rate, market future trends to 2030. Market forecasting is employed to identify and estimate the size of the global robotics market for 2023-2030. Furthermore, the report includes an estimation of the market size and emergence of new markets which includes detailed profiles of key players and comprehensive industry returns.

Market Segmentation

The market is segmented on the basis of technology (artificial intelligence, machine learning, computer vision and natural language processing) application (military and defence, medical, automotive and aerospace, logistics, domestic and consumer applications and others).

Data Collection Triangulation

MRFR employs triangulation methodology to arrive at the forecast and estimations by conducting intensive primary and secondary research. During the triangulation process, data is collected from both, primary and secondary sources, thereby developing a holostic view of the data collected. To analyse, interpret and evaluate the available data and information, MRFR deploys tools such as SWOT, Porter’s five forces, Ansoff Matrix and others.

The market values are assessed and validated using both, top-down and bottom-up approaches. The top-down approach is developed depending upon the assumptions such as basic parameters, the market segments and their distribution, economic environment, strategic and political environment, etc. A bottom-up approach is used to breakdown the market values from the forecast of various sub-segments which driven the market size of the entire portfolio.

Finally, to arrive at the detailed market insights and trends, MRFR implemented its own proprietary market intelligence system emphasizing on a data repository such as Aerospace & Defence Database, Government of China Aerospace Strategy Database and Aerospace & Defence Supply Chain Database. The data and analysis forms out the critical insights and trends by data mining, analysis of the impact of data variables on the market, and primary & secondary research.