Research Methodology on Smart Factory Market

1. Introduction

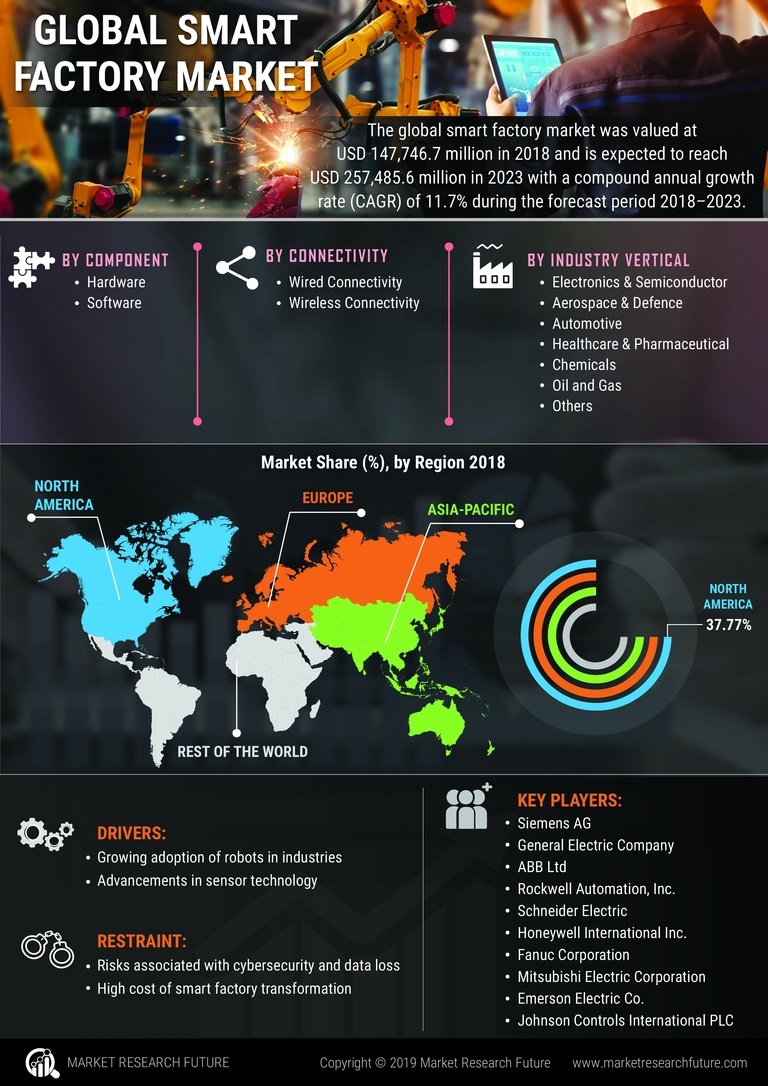

The concept of a smart factory has gained considerable importance in the industry over the past decade. Smart factories are automated factories where machines, processes, and workers interact in a technologically advanced way, to ensure optimized and efficient production. A smart factory stands apart from traditional industrial manufacturing factories because of its unique characteristics such as computer-aided automation, integrated workflow control, safety, energy optimization, and speed of operations. The use of the smart factory can have several advantages such as production speed, improved efficiency, and reduced operational costs.

The research aims to analyze the drivers, limitations, opportunities, and challenges associated with the smart factory market, concerning its segments. The research project has been designed to focus on providing comprehensive information related to the market and its stakeholders.

2. Research Objectives

The primary objective of the research project is to analyze the drivers, limitations, opportunities and challenges associated with the smart factory market, by segments.

Specific objectives are to:

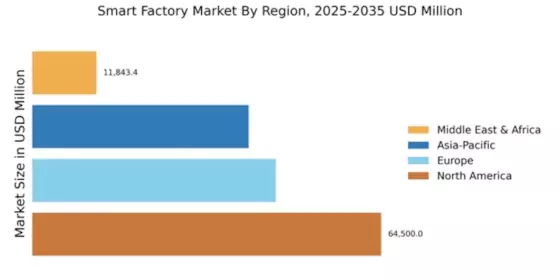

- Analyze the global smart factory market, by type, end user, and key geographic regions.

- Analyze the competitive landscape related to the major players operating in the market.

- Analyze the technology related to the development of the smart factory market.

- Determine the various strategies and possible future opportunities associated with the smart factory market.

- Formulate a detailed, accurate and reliable forecast of the market size in terms of value and volume.

3. Research Design

This research study is a combined survey and analytical research project which will be conducted through a primary and secondary research approach.

3.1 Primary Research

Primary research is an important phase of the study since it provides the study with direct, firsthand information about the smart factory market in-depth. In order to accurately assess and collect pertinent data related to the smart factory market, the research focuses on both desk research as well as primary research based on interviews.

3.2 Desk Research

Desk research is conducted through several sources including industry publications, trade journals, white papers, and market reports. This will enable the study to gain valuable information about the smart factory market, in terms of market size, growth trends, and competitive dynamics.

3.3 Primary Research

Primary research will predominantly be based on semi-structured interviews with key industry stakeholders, business consultants, and technology analysts, to gain an in-depth insight into the market. This enables the study to incorporate stakeholders’ perspectives on the market in its findings.

4. Sampling Design

A stratified sampling technique is adopted for the study, wherein the different geographic regions, segments and various stakeholders such as suppliers, intermediaries and manufacturers, are taken into account. This sampling technique is aimed at ensuring the accuracy and reliability of the study findings since it provides the study with the capability to incorporate several perspectives into the analysis.

5. Data Analysis

Data analysis is conducted primarily through quantitative approaches, in order to generate reliable findings from diverse datasets. Regular market research reports will be analyzed to understand the growth trends and industry-specific information. Furthermore, market forecasting techniques will be employed to simulate the accurate market size, in terms of value and volume.

6. Report Commentary

The report findings are analysed through an in-depth market assessment in order to systematically interpret the data and information collected through primary and secondary research. The report portrays the Industry insights, driven by various regions and countries, through production and sales outlook, technology advancement outlook and key market players.

7. Conclusion

The research project will provide an in-depth insight into the opportunities and challenges associated with the smart factory market, by segments. The research methodology adopted for the study would enable the project to focus on providing a detailed, accurate and reliable forecast of the market size in terms of value and volume. The report will serve as a valuable guide to businesses seeking to gain a better understanding of the smart factory market.