Top Industry Leaders in the Pumps Market

*Disclaimer: List of key companies in no particular order

The landscape of the pumps industry is a dynamic amalgamation of established global giants, regional champions, and innovative niche players, all engaged in a fierce competition for market share and sustained growth. Successfully navigating this intricate market requires a comprehensive understanding of the key strategies employed by industry leaders, the emergence of trends shaping its trajectory, and the pivotal factors that determine success.

Key Player Strategies:

Global Giants: Recognizable names such as Grundfos, Sulzer, and Flowserve dominate the global stage, leveraging extensive product portfolios, robust brand recognition, and expansive global reach to maintain significant market shares. These industry giants prioritize continuous innovation, invest heavily in research and development, and strategically acquire companies to enhance their offerings and stay ahead of the curve.

Regional Champions: Companies like KSB (Europe), Andritz (Austria), and Xylem (US) excel in catering to specific geographic markets. Their success is attributed to focused product lines and service networks tailored to local regulations and customer needs, fostering strong regional relationships.

Niche Players: Smaller, specialized players carve out their space by concentrating on specific pump types or unique applications. Their agility, customization capabilities, and technological expertise allow them to meet specialized needs, particularly in sectors like water treatment or chemical processing.

Factors Influencing Market Share Analysis:

Product Mix and Expertise: The breadth and depth of a company's product portfolio, along with their proficiency across various pump types, significantly influence market share.

Geographic Presence: Global reach and robust regional networks are pivotal, especially in meeting diverse project requirements and optimizing supply chains.

Technology and Innovation: Companies committed to research and development, energy efficiency, and smart pump technologies gain a competitive edge by meeting evolving customer needs and complying with environmental regulations.

Sustainability Focus: The growing emphasis on sustainability and energy efficiency has increased the demand for eco-friendly pumps, offering companies that provide such solutions a distinct advantage.

After-Sales Service and Network: A robust after-sales service and a well-established network of service centers are critical for ensuring customer satisfaction, especially in applications involving critical infrastructure.

New and Emerging Trends:

Digitalization and Smart Pumps: The integration of advanced sensors, data analytics, and remote monitoring into pumps is gaining traction, enabling predictive maintenance, optimizing performance, and reducing operational costs.

Energy Efficiency and Sustainability: With tightening environmental regulations and rising energy costs, there is a growing demand for energy-efficient pump designs and eco-friendly materials.

Decentralization and Modular Solutions: Compact, modular pump solutions catering to distributed applications like wastewater treatment or building automation are gaining momentum.

Focus on Niche Applications: Increasing specialization in niche applications, such as high-pressure pumping, biopharmaceutical pumps, and solar-powered pumps, presents growth opportunities for companies with expertise in these areas.

Overall Competitive Scenario:

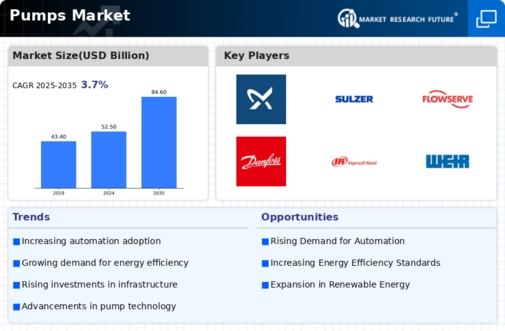

The pumps market is poised for steady growth, driven by factors like rising urbanization, infrastructure development, and increased investments in water treatment and industrial automation. However, competition is expected to intensify further, with players differentiating themselves through product innovation and strategic partnerships. Those adept at navigating these trends, embracing cutting-edge technologies, and prioritizing customer needs are well-positioned for success in this dynamic market.

Industry Developments and Latest Updates:

Grundfos (Denmark): In a partnership announced on December 15, 2023, with Microsoft, Grundfos aims to develop AI-powered water management solutions, focusing on optimizing water usage and reducing energy consumption in buildings and industrial facilities.

Sulzer (Switzerland): Sulzer secured a €20 million contract on December 21, 2023, to supply pumps for a desalination plant in the Middle East, strengthening its position in the growing desalination market.

Flowserve (US): In its Q4 2023 financial report on December 28, 2023, Flowserve reported revenue of $1.2 billion, surpassing analyst expectations. The positive outlook for 2024 is driven by strong demand in the energy and chemical sectors.

ITT Corporation (US): On December 19, 2023, ITT Corporation announced the acquisition of an industrial pump manufacturer for $150 million, expanding its portfolio in the water and wastewater treatment markets.

Danfoss (Denmark): In a blog post on December 27, 2023, Danfoss unveiled a new generation of high-efficiency circulator pumps, reducing energy consumption by up to 30% compared to previous models.

Top Companies in the Pumps Industry:

- Grundfos (Denmark)

- Sulzer (Switzerland)

- Flowserve (US)

- ITT Corporation (US)

- Danfoss (Denmark)

- Ingersoll-Rand (Ireland)

- The Weir Group (UK)

- Ebara Corp (Japan)

- KSB (Germany)

- Schlumberger (US)

- Nikkiso Co Ltd (Japan)

- Wilo AG (Germany)

- Roper Industries (US), and others.