High Pressure Pumps Market Summary

The Global High-Pressure Pumps Market is projected to grow from 3290.30 USD Billion in 2024 to 4662.82 USD Billion by 2035, reflecting a robust growth trajectory.

Key Market Trends & Highlights

High-Pressure Pumps Key Trends and Highlights

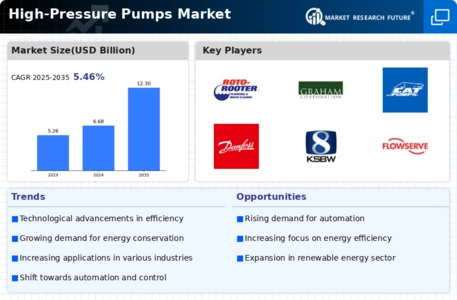

- The market is expected to experience a compound annual growth rate (CAGR) of 5.72% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 12.3 USD Billion, indicating substantial growth opportunities.

- in 2024, the market is valued at 3290.30 USD Billion, laying a strong foundation for future expansion.

- Growing adoption of high-pressure pumping technologies due to increasing industrial automation is a major market driver.

Market Size & Forecast

| 2024 Market Size | 3290.30 (USD Billion) |

| 2035 Market Size | 4662.82 (USD Billion) |

| CAGR (2025-2035) | 3.22% |

Major Players

RotoRooter, Graham Corporation, Cat Pumps, Danfoss, KSB, Wilden, Flowserve, Wilo, Grundfos, Hidrostal, Torishima Pump, Parker Hannifin, HermeticPumpen, Liberty Pumps