Regulatory Support and Standards

Regulatory support and the establishment of stringent standards are vital drivers for the Infusion Pump Market. Regulatory bodies are increasingly focusing on ensuring the safety and efficacy of medical devices, including infusion pumps. This heightened scrutiny has led to the development of comprehensive guidelines that manufacturers must adhere to, fostering innovation while ensuring patient safety. The infusion pump market is likely to benefit from these regulations, as they encourage the adoption of advanced technologies and improve product quality. Furthermore, compliance with these standards can enhance market competitiveness, as healthcare providers prefer devices that meet regulatory requirements, thereby driving market growth.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a primary driver of the Infusion Pump Market. As these conditions require long-term management and treatment, the demand for infusion pumps is likely to rise. According to recent estimates, chronic diseases account for approximately 70% of all deaths worldwide, necessitating effective treatment solutions. Infusion pumps play a crucial role in delivering medications and fluids accurately, thereby enhancing patient outcomes. The growing patient population requiring infusion therapy is expected to propel the infusion pump market further, as healthcare providers seek reliable and efficient devices to manage complex treatment regimens.

Technological Innovations in Infusion Pumps

Technological advancements in infusion pump design and functionality are significantly influencing the Infusion Pump Market. Innovations such as smart infusion pumps, which integrate advanced software for dose calculation and error prevention, are becoming increasingly prevalent. These devices not only enhance patient safety but also improve workflow efficiency in healthcare settings. The infusion pump market is projected to witness a compound annual growth rate of around 7% over the next few years, driven by these technological enhancements. Furthermore, the integration of wireless connectivity and data analytics into infusion pumps allows for real-time monitoring and better management of infusion therapies, thereby meeting the evolving needs of healthcare providers.

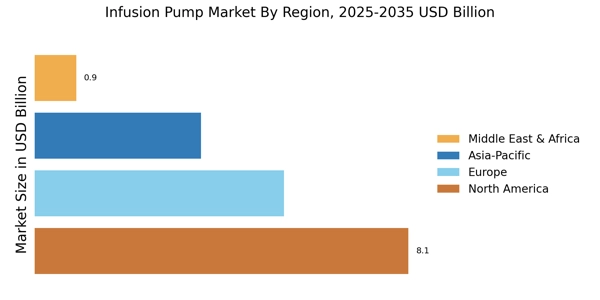

Rising Investment in Healthcare Infrastructure

The increasing investment in healthcare infrastructure is a significant driver of the Infusion Pump Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in emerging economies. This investment is aimed at improving patient care and expanding access to advanced medical technologies, including infusion pumps. As healthcare facilities upgrade their equipment and expand their services, the demand for reliable and efficient infusion pumps is expected to rise. Market forecasts indicate that the infusion pump market could experience a growth rate of approximately 6% annually, driven by these infrastructural developments and the need for modern medical devices.

Increasing Demand for Home Healthcare Solutions

The shift towards home healthcare solutions is reshaping the Infusion Pump Market. As patients increasingly prefer receiving care in the comfort of their homes, the demand for portable and user-friendly infusion pumps is on the rise. This trend is supported by the growing aging population and the need for chronic disease management outside traditional healthcare facilities. Market analysts suggest that the home healthcare segment could account for a substantial share of the infusion pump market, with projections indicating a potential increase in demand by over 20% in the coming years. This shift not only enhances patient satisfaction but also reduces healthcare costs, making it a pivotal driver for the infusion pump market.