North America : Innovation and Sustainability Focus

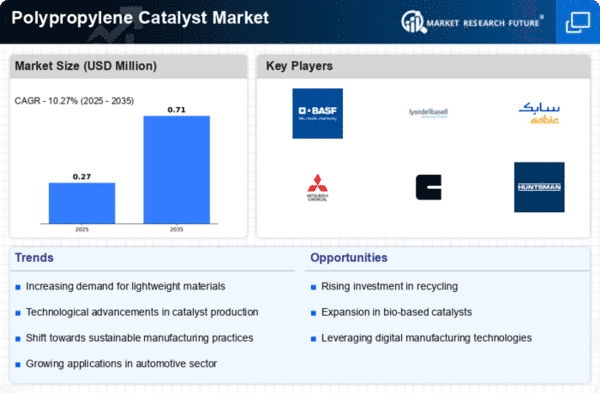

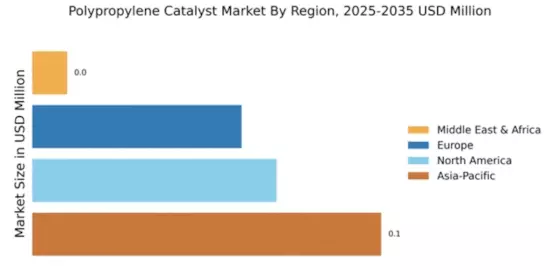

The North American polypropylene catalyst market is projected to grow, driven by increasing demand for lightweight and durable materials in automotive and packaging sectors. With a market size of $0.07 billion, the region is focusing on sustainable practices and innovative technologies to enhance production efficiency. Regulatory support for eco-friendly materials is also a significant driver, encouraging manufacturers to adopt advanced catalyst technologies. Leading countries like the US and Canada are home to major players such as LyondellBasell and Huntsman, which are investing in R&D to improve catalyst performance. The competitive landscape is characterized by collaborations and partnerships among key players, aiming to capture a larger market share. The presence of established companies ensures a robust supply chain, further bolstering market growth.

Europe : Regulatory Support and Innovation

Europe's polypropylene catalyst market is witnessing growth, supported by stringent regulations promoting sustainable practices and innovation. With a market size of €0.06 billion, the region is focusing on reducing carbon emissions and enhancing recycling processes. Regulatory frameworks are encouraging the adoption of advanced catalysts, which are essential for producing high-quality polypropylene with lower environmental impact. Countries like Germany, France, and the UK are leading the market, with key players such as BASF and Clariant driving innovation. The competitive landscape is marked by significant investments in R&D and collaborations among industry leaders. This dynamic environment fosters the development of next-generation catalysts, positioning Europe as a hub for technological advancements in the polypropylene sector.

Asia-Pacific : Dominant Market Leader

Asia-Pacific is the largest market for polypropylene catalysts, with a market size of $0.1 billion, driven by rapid industrialization and increasing demand for polypropylene in various applications. The region's growth is fueled by rising consumer demand for packaging and automotive products, alongside supportive government policies promoting manufacturing. The presence of major chemical manufacturers enhances the region's market dynamics, making it a focal point for catalyst innovation. China, Japan, and India are the leading countries in this market, with key players like Mitsubishi Chemical and SABIC actively investing in new technologies. The competitive landscape is characterized by a mix of local and international companies, fostering a robust supply chain. This environment encourages continuous improvement in catalyst performance, ensuring that Asia-Pacific remains at the forefront of the polypropylene catalyst market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is emerging as a potential market for polypropylene catalysts, with a market size of $0.01 billion. The growth is driven by increasing investments in the petrochemical sector and the rising demand for polypropylene in various industries. Government initiatives aimed at diversifying economies and enhancing manufacturing capabilities are also contributing to market expansion. The region's rich natural resources provide a solid foundation for developing a robust chemical industry. Countries like Saudi Arabia and the UAE are leading the charge, with significant investments from companies such as SABIC. The competitive landscape is evolving, with both local and international players vying for market share. As the region continues to develop its industrial base, the demand for advanced catalysts is expected to rise, presenting numerous opportunities for growth in the polypropylene sector.