Sustainability Initiatives

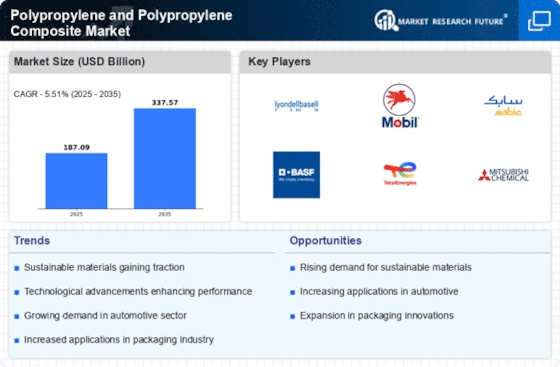

The increasing emphasis on sustainability is a pivotal driver for the Polypropylene and Polypropylene Composite Market. As industries strive to reduce their carbon footprints, the demand for recyclable and eco-friendly materials has surged. Polypropylene, known for its recyclability, aligns well with these sustainability goals. In 2025, the market for recycled polypropylene is projected to grow significantly, driven by regulatory pressures and consumer preferences for sustainable products. This shift not only enhances the appeal of polypropylene but also encourages innovations in composite materials that incorporate recycled content. Consequently, manufacturers are investing in sustainable practices, which is likely to bolster the overall growth of the Polypropylene and Polypropylene Composite Market.

Technological Advancements

Technological advancements play a crucial role in shaping the Polypropylene and Polypropylene Composite Market. Innovations in processing techniques, such as injection molding and extrusion, have enhanced the performance characteristics of polypropylene composites. These advancements enable the production of lighter, stronger, and more durable materials, which are increasingly sought after in various applications, including packaging and construction. In 2025, the market is expected to witness a rise in the adoption of advanced manufacturing technologies, which could lead to improved efficiency and reduced production costs. This trend not only supports the growth of the Polypropylene and Polypropylene Composite Market but also fosters competition among manufacturers to develop superior products.

Expanding Applications in Packaging

The expanding applications of polypropylene in the packaging industry serve as a vital driver for the Polypropylene and Polypropylene Composite Market. Polypropylene's versatility, coupled with its excellent barrier properties, makes it an ideal choice for various packaging solutions, including food and consumer goods. In 2025, the packaging sector is anticipated to witness a notable increase in the use of polypropylene materials, driven by the rising demand for lightweight and durable packaging options. This trend is further fueled by consumer preferences for convenience and sustainability, prompting manufacturers to explore innovative packaging designs. As a result, the Polypropylene and Polypropylene Composite Market is expected to experience robust growth, with new applications emerging in response to market needs.

Growing Demand in Automotive Sector

The automotive sector's growing demand for lightweight materials is a significant driver for the Polypropylene and Polypropylene Composite Market. As manufacturers seek to enhance fuel efficiency and reduce emissions, polypropylene composites are increasingly utilized in vehicle components. In 2025, the automotive industry is projected to account for a substantial share of the polypropylene market, driven by the need for materials that offer both strength and weight reduction. This trend is further supported by the ongoing shift towards electric vehicles, where lightweight materials are essential for optimizing battery performance. Consequently, the Polypropylene and Polypropylene Composite Market is likely to benefit from this burgeoning demand, leading to increased production and innovation.

Regulatory Support for Advanced Materials

Regulatory support for advanced materials is emerging as a key driver for the Polypropylene and Polypropylene Composite Market. Governments worldwide are increasingly implementing regulations that promote the use of high-performance materials in various sectors, including construction and automotive. These regulations often favor materials that enhance energy efficiency and reduce environmental impact. In 2025, the Polypropylene and Polypropylene Composite Market is likely to benefit from such regulatory frameworks, which encourage the adoption of polypropylene composites in infrastructure projects and energy-efficient applications. This supportive environment not only stimulates demand but also incentivizes research and development efforts aimed at improving the properties of polypropylene materials, thereby fostering innovation within the industry.