Surge in Consumer Electronics Production

The proliferation of consumer electronics, such as smartphones, laptops, and tablets, has significantly influenced the Polyolefin Battery Separator Films Market. As these devices require compact and efficient batteries, the demand for advanced battery separators is on the rise. The consumer electronics market is expected to grow at a CAGR of 5% from 2023 to 2028, which could translate into increased demand for polyolefin battery separators. These films are essential for ensuring safety and performance in lithium-ion batteries, which are widely used in consumer electronics. Consequently, the growth in this sector is likely to drive the Polyolefin Battery Separator Films Market forward, as manufacturers seek to enhance battery performance and safety.

Increasing Adoption of Renewable Energy Storage

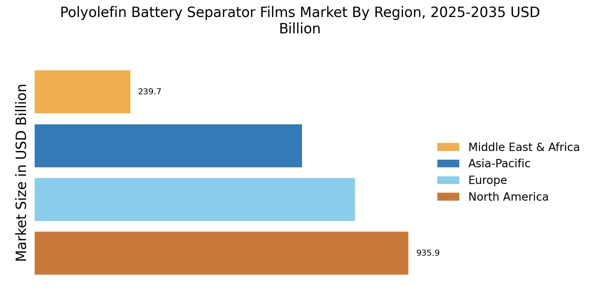

The transition towards renewable energy sources has led to a heightened demand for efficient energy storage solutions. Polyolefin Battery Separator Films Market plays a crucial role in enhancing the performance of batteries used in renewable energy systems. As energy storage becomes essential for balancing supply and demand, the need for high-quality battery separators is likely to grow. The market for energy storage systems is projected to reach USD 200 billion by 2026, indicating a robust growth trajectory. This trend suggests that the Polyolefin Battery Separator Films Market will benefit from the increasing investments in renewable energy projects, as these films are integral to the efficiency and longevity of energy storage solutions.

Technological Innovations in Battery Manufacturing

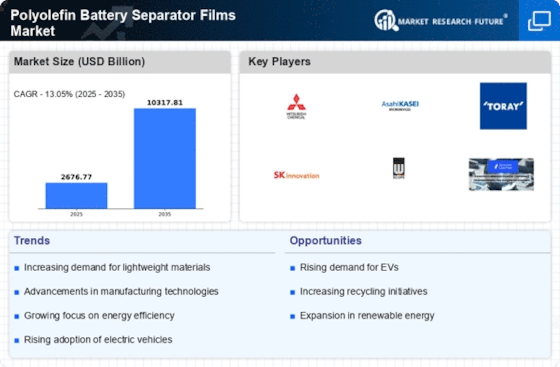

Advancements in battery technology are reshaping the landscape of the Polyolefin Battery Separator Films Market. Innovations such as solid-state batteries and enhanced lithium-ion technologies require high-performance separators to ensure optimal functionality. The Polyolefin Battery Separator Films Market is anticipated to reach USD 120 billion by 2025, with a substantial portion attributed to the demand for advanced separators. These innovations not only improve battery efficiency but also enhance safety, which is paramount in applications ranging from electric vehicles to consumer electronics. As manufacturers continue to invest in research and development, the Polyolefin Battery Separator Films Market is poised to benefit from these technological advancements, leading to improved product offerings and market expansion.

Growing Focus on Energy Efficiency and Sustainability

The increasing emphasis on energy efficiency and sustainable practices is influencing the Polyolefin Battery Separator Films Market. As industries and consumers alike prioritize sustainability, the demand for eco-friendly battery solutions is rising. Polyolefin battery separators are often favored for their recyclability and lower environmental impact compared to traditional materials. The market for sustainable battery technologies is expected to grow significantly, with projections indicating a potential increase of 15% annually through 2027. This trend suggests that manufacturers in the Polyolefin Battery Separator Films Market will need to adapt to changing consumer preferences and regulatory requirements, positioning themselves as leaders in sustainable battery solutions.

Regulatory Support for Electric Vehicle Infrastructure

Government initiatives aimed at promoting electric vehicles (EVs) are creating a favorable environment for the Polyolefin Battery Separator Films Market. Various countries are implementing policies to support EV adoption, including tax incentives and infrastructure development. The EV market is projected to grow at a CAGR of 22% through 2030, which suggests a substantial increase in demand for batteries and, consequently, battery separators. Polyolefin battery separators are essential for the performance and safety of EV batteries, making them a critical component in this rapidly expanding market. As regulatory frameworks continue to evolve, the Polyolefin Battery Separator Films Market is likely to experience significant growth driven by the increasing production of EVs.