Polyolefin Battery Separator Films Size

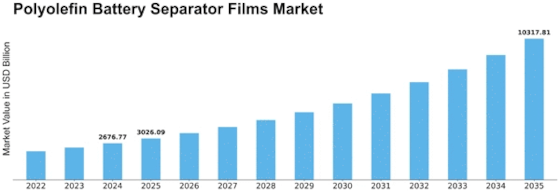

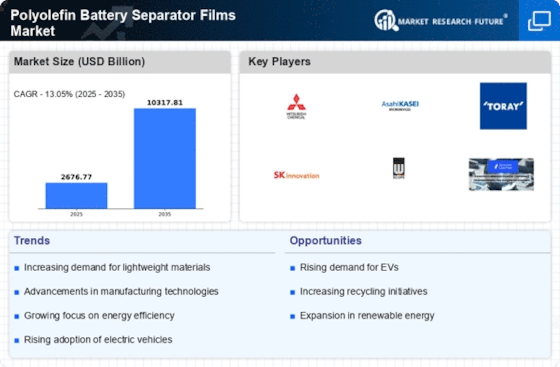

Polyolefin Battery Separator Films Market Growth Projections and Opportunities

This is influenced by several market factors that impact the dynamics of the Polyolefin Battery Separator Films market. One of them is the global increase in demand for electric vehicles (EVs). The automobile industry is shifting towards green and sustainable transportation solutions, thereby increasing demand for lithium-ion battery parts known as polyolefin battery separator films. In 2021, it was $3.98 billion in the Polyolefin Battery Separator Films Market size. On this note, the polyolefin battery separator films industry is expected to exceed USD 10.40 billion with a CAGR of 12.67% while heading to 2030. Another significant factor in this market has been technological advances in batteries. Advances are being made in lithium-ion batteries through ongoing research and development efforts into energy storage systems that have led to improvements in performance and efficiency. These developments have been beneficial to polyolefin battery separator films because manufacturers are seeking better materials that can enhance the overall safety and performance of batteries. Moreover, consumer electronics play a crucial role in influencing the Polyolefin Battery Separator Films market today. The need for compact, lightweight batteries with longer life cycles has increased due to the widespread use of smartphones, laptops, tablets, and other portable electronic devices. The demand for safer and high-performing batteries is thus driving up the production of polyolefin battery separator films, which constitute an integral part of any battery manufacturing process targeting consumer electronics like smartphones. Polyethylene Battery Separator Films are likely to expand significantly due to a growing number of mobile phone users. However, fluctuations in raw material prices used for making Polyethylene Battery Separator Films are among several challenges affecting these films' dynamics or behavior over time. Because polyethylene and polypropylene prices fluctuate, it implies that changes in their costs will greatly affect total production cost, hence impacting the price levels of these products, such as polyolefin battery separator films. Apart from pricing strategy politics such as cost-plus pricing, value-based pricing, and market skimming, other factors affect the Polyolefin Battery Separator Films market. These norms are established to promote safety regulations and environmental sustainability in batteries, which have resulted in companies seeking to produce polyolefin battery separator films that meet performance requirements. Besides being required to deliver on their functional attributes, these products should be compliant with regulatory standards put forth by authorities keen on ensuring clean and safer technologies.

Leave a Comment