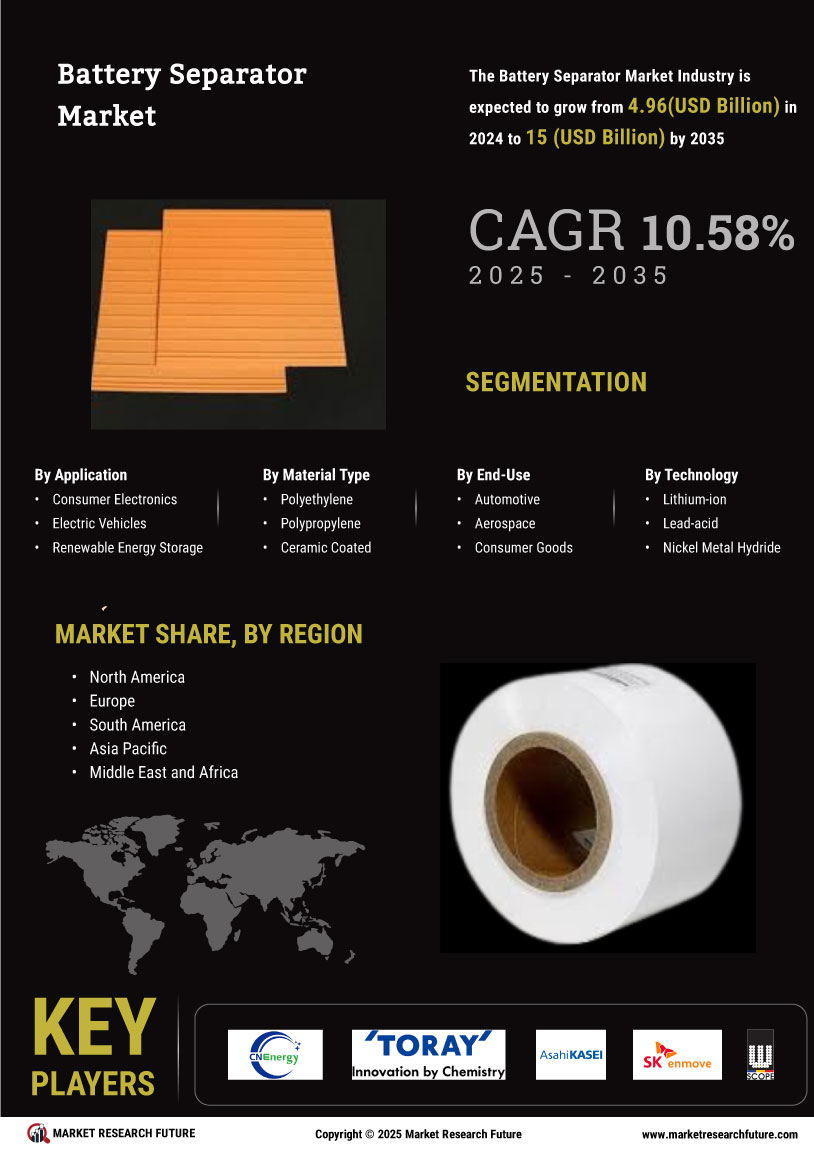

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle infrastructure is a pivotal driver for the Battery Separator Market. As governments and private sectors invest heavily in charging stations and related technologies, the demand for electric vehicles is expected to rise significantly. This surge in electric vehicle adoption necessitates high-performance batteries, which in turn require advanced battery separators. The market for electric vehicles is projected to grow at a rate of around 20% annually, creating a substantial demand for battery separators that can enhance battery efficiency and safety. Consequently, the Battery Separator Market is likely to benefit from this expansion, as manufacturers strive to meet the increasing requirements of electric vehicle batteries.

Growing Consumer Awareness of Battery Performance

Consumer awareness regarding battery performance and longevity is increasingly influencing the Battery Separator Market. As consumers become more informed about the benefits of high-quality battery separators, they are more likely to demand products that enhance battery life and efficiency. This shift in consumer behavior is prompting manufacturers to focus on producing separators that not only meet performance expectations but also offer superior safety features. The market is witnessing a trend where consumers prioritize products that provide better thermal management and reduced risk of failure. This growing awareness is likely to contribute to a steady increase in demand for advanced battery separators, potentially leading to a market growth rate of around 12% in the near future.

Increasing Regulatory Standards for Battery Safety

The Battery Separator Market is also shaped by increasing regulatory standards aimed at enhancing battery safety. Governments worldwide are implementing stricter regulations concerning battery manufacturing and performance, particularly in the context of electric vehicles and energy storage systems. These regulations often mandate the use of high-quality battery separators that can withstand extreme conditions and prevent failures. As a result, manufacturers are compelled to innovate and improve their products to comply with these standards. The emphasis on safety is expected to drive the demand for advanced battery separators, potentially leading to a market growth rate of around 10% in the coming years. This trend underscores the importance of regulatory compliance in the Battery Separator Market.

Rising Adoption of Renewable Energy Storage Solutions

The Battery Separator Market is significantly influenced by the rising adoption of renewable energy storage solutions. As the world shifts towards sustainable energy sources, the need for efficient energy storage systems becomes paramount. Battery separators play a critical role in enhancing the efficiency and longevity of energy storage systems, particularly in applications such as solar and wind energy. The increasing deployment of these systems is expected to drive the demand for high-quality battery separators. Market analysts suggest that the energy storage sector could witness a growth rate of over 15% in the coming years, further propelling the Battery Separator Market. This trend indicates a robust future for battery separators as they become integral components in the transition to renewable energy.

Technological Innovations in Battery Separator Market

The Battery Separator Market is experiencing a surge in technological innovations, particularly in the development of advanced materials. Innovations such as ceramic-coated separators and polymer-based membranes are enhancing the performance and safety of batteries. These advancements are crucial as they improve thermal stability and reduce the risk of short circuits. The market for battery separators is projected to grow at a compound annual growth rate of approximately 8% over the next few years, driven by these technological enhancements. Manufacturers are increasingly investing in research and development to create separators that not only meet the demands of high-performance batteries but also comply with stringent safety regulations. This focus on innovation is likely to shape the future landscape of the Battery Separator Market.