Government Policies and Regulations

Government policies and regulations aimed at promoting electric vehicle adoption are significantly influencing the Electric Vehicle Battery Separator Market. Many countries are implementing stringent emissions regulations and offering incentives for EV purchases, which in turn drives the demand for efficient battery systems. For instance, various regions have set ambitious targets for EV sales, with some aiming for 100% electric vehicle sales by 2035. This regulatory environment creates a favorable landscape for the Electric Vehicle Battery Separator Market, as manufacturers align their products with these evolving standards to ensure compliance and capitalize on market opportunities.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Battery Separator Market. As more individuals and businesses transition to EVs, the demand for efficient and safe battery systems rises. In 2025, the number of electric vehicles on the road is projected to exceed 30 million units, significantly boosting the need for high-performance battery separators. These components are crucial for enhancing battery efficiency and safety, thereby supporting the overall growth of the EV market. The Electric Vehicle Battery Separator Market is expected to benefit from this trend, as manufacturers strive to meet the growing requirements for advanced battery technologies.

Sustainability and Recycling Initiatives

Sustainability initiatives and recycling efforts are becoming increasingly important in the Electric Vehicle Battery Separator Market. As the focus on reducing environmental impact intensifies, manufacturers are exploring ways to produce separators using sustainable materials and processes. Additionally, the recycling of battery components, including separators, is gaining traction as a means to minimize waste and recover valuable materials. This trend is likely to drive innovation in separator technology, as companies seek to develop eco-friendly solutions that align with global sustainability goals. The Electric Vehicle Battery Separator Market stands to benefit from these initiatives, as they enhance the appeal of EVs to environmentally conscious consumers.

Focus on Energy Efficiency and Performance

The emphasis on energy efficiency and performance in electric vehicles is a critical driver for the Electric Vehicle Battery Separator Market. As consumers become more environmentally conscious, the demand for batteries that offer longer ranges and faster charging times is increasing. Battery separators play a vital role in enhancing the overall performance of EV batteries by improving energy density and thermal stability. The market is expected to witness a surge in demand for advanced separators that can meet these performance criteria, thereby supporting the growth of the Electric Vehicle Battery Separator Market as manufacturers innovate to meet consumer expectations.

Technological Innovations in Battery Design

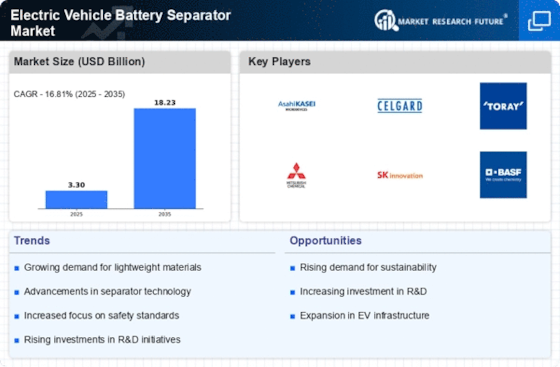

Technological advancements in battery design are propelling the Electric Vehicle Battery Separator Market forward. Innovations such as solid-state batteries and improved lithium-ion technologies necessitate the development of specialized separators that can withstand higher temperatures and voltages. The market for battery separators is projected to grow at a compound annual growth rate of approximately 15% through 2027, driven by these innovations. As manufacturers invest in research and development, the demand for high-quality separators that enhance battery performance and longevity is likely to increase, further stimulating the Electric Vehicle Battery Separator Market.