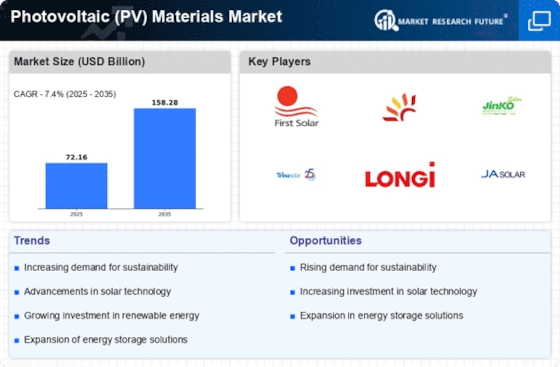

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Photovoltaic (PV) Materials market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Photovoltaic (PV) Materials industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the photovoltaic materials industry to benefit clients and increase the market sector. In recent years, the Photovoltaic (PV) Materials industry has offered some of the most significant advantages to medicine. Major players in the photovoltaic (PV) Materials market, including Wacker Chemie AG (Germany), I. du Pont de Nemours and Company (US), Honeywell International Inc. (US), Coveme SpA (Italy), Mitsubishi Materials Corporation (Japan), Targray (Canada), Hangzhou Foster Applied Materials Co. Ltd (China), Ferrotec Corporation (US), JinkoSolar Holding Co.Ltd (China), SunPower Corporation (US), Baoding Lightway Green Energy Technology Ltd (China), Shine Earth (Fujian) New Energy Co. Ltd (China), Power Solar Systems Ltd (India), Wuxi Suntech Power Co. Ltd (China), Acciona Energía SA (Spain), and others, are attempting to increase market demand by investing in research and development operations.Wacker Chemie AG, headquartered in Germany, is a leading player in the photovoltaic (PV) materials market. The business specialises in the creation of cutting-edge materials used in the production of solar cells and modules. The creation of high-quality solar cells requires a variety of PV materials, including silicones, polymers, and high-purity chemicals, all of which are provided by Wacker Chemie. Wacker Chemie consistently works to improve the effectiveness, efficiency, and durability of PV materials with a strong emphasis on research and development.The company can produce cutting-edge materials that adhere to the exacting standards of the PV industry because to its knowledge in silicon chemistry and cutting-edge manufacturing capabilities. PV materials from Wacker Chemie are widely used by solar module producers worldwide, fostering the expansion of the solar energy industry. As it seeks to offer clean and renewable energy solutions, the company's dedication to sustainability and environmental responsibility is consistent with the objectives of the photovoltaic sector.Honeywell International Inc., a multinational conglomerate based in the United States. To meet the rising need for renewable energy, the company provides a wide range of PV materials and solutions. Advanced encapsulants, backsheets, adhesives, and other speciality materials from Honeywell's portfolio of PV materials improve the efficiency and dependability of solar cells and modules. With its proficiency in materials science and engineering, Honeywell offers creative solutions aimed at enhancing the effectiveness, resilience, and financial viability of PV systems.PV module manufacturers all around the world use the company's products to improve the power production, long-term reliability, and environmental robustness of solar installations. Honeywell's PV materials selections demonstrate its dedication to sustainability and renewable energy. Instigating the shift to renewable energy sources, Honeywell plays a critical role by facilitating the development of high-quality solar modules.Dow Chemical, a chemical conglomerate based in the United States, will offer a photovoltaic (PV) product line in 2023, including six silicone-based sealants and adhesives for PV module assembly.DOWSIL is a new product line designed to provide durability and performance for frame sealing, rail and junction box bonding, potting, and constructing integrated photovoltaic installation materials.One of the most important events on the renewables calendar, All-Energy Australia, will conclude for another year in 2023, following a likely record-breaking turnout. The official numbers are not yet in, but there were 15,000 registrations, and word is that the number of attendance will easily exceed last year's event, which drew 8,500 people.