Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Concentrated Photovoltaic Market (CPV) Market. Many countries are implementing favorable regulations and financial incentives to promote renewable energy sources, including CPV systems. For instance, feed-in tariffs and tax credits are being offered to encourage investments in solar technologies. In 2025, several nations have set ambitious renewable energy targets, which include significant contributions from CPV systems. This regulatory support not only enhances the financial viability of CPV projects but also stimulates market growth by attracting private sector investments. The alignment of government objectives with environmental sustainability goals indicates a robust framework for the CPV market, potentially leading to increased deployment and innovation in the sector.

Technological Innovations in CPV Systems

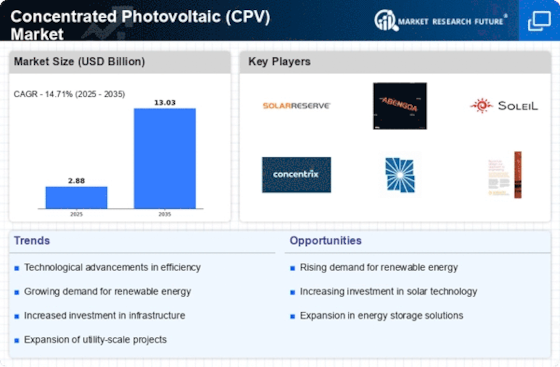

The Concentrated Photovoltaic Market (CPV) Market is experiencing a surge in technological innovations that enhance efficiency and reduce costs. Recent advancements in optics and tracking systems have led to improved energy conversion rates, with some systems achieving efficiencies exceeding 40%. This is particularly relevant as the demand for high-performance solar solutions grows. Furthermore, the integration of artificial intelligence in monitoring and maintenance processes is streamlining operations, thereby reducing downtime and operational costs. As these technologies mature, they are likely to attract more investments, fostering a competitive landscape that could further drive down prices and increase adoption rates. The ongoing research and development efforts in CPV technology suggest a promising future for the industry, potentially leading to wider applications in various geographical regions.

Growing Interest from Private Sector Investors

The Concentrated Photovoltaic Market (CPV) Market is witnessing a growing interest from private sector investors, which is crucial for its expansion. As the renewable energy sector matures, institutional and private investors are increasingly recognizing the potential returns associated with CPV technologies. In 2025, venture capital and private equity investments in renewable energy projects, including CPV, are expected to rise significantly. This influx of capital is likely to accelerate research and development efforts, leading to further innovations and cost reductions in CPV systems. Additionally, partnerships between technology developers and financial institutions are becoming more common, facilitating the deployment of CPV projects. The increasing confidence of investors in the long-term viability of CPV solutions indicates a robust future for the industry.

Rising Energy Costs and Demand for Alternatives

The rising costs of traditional energy sources are propelling the Concentrated Photovoltaic Market (CPV) Market into the spotlight. As fossil fuel prices fluctuate and environmental concerns mount, there is a growing urgency to seek alternative energy solutions. CPV systems, with their ability to generate electricity at lower costs per watt, present a viable option for both utility-scale and distributed generation applications. In 2025, the cost of electricity generated from CPV systems is projected to be competitive with conventional energy sources, making them an attractive choice for energy providers. This shift in energy economics is likely to drive further investments in CPV technology, as stakeholders seek to capitalize on the potential for long-term savings and sustainability.

Environmental Concerns and Sustainability Initiatives

The increasing awareness of environmental issues is significantly influencing the Concentrated Photovoltaic Market (CPV) Market. As climate change becomes a pressing global challenge, there is a heightened focus on sustainable energy solutions. CPV systems, which utilize less land and water compared to traditional solar technologies, are gaining traction as a more environmentally friendly option. In 2025, many corporations and governments are committing to sustainability initiatives that prioritize renewable energy sources, including CPV. This trend is likely to drive demand for CPV installations, as organizations seek to reduce their carbon footprints and meet regulatory requirements. The alignment of corporate social responsibility with energy procurement strategies suggests a promising outlook for the CPV market.

![Concentrated Photovoltaic [CPV] Market Regional Image Concentrated Photovoltaic [CPV] Market Regional Image](https://www.marketresearchfuture.com/uploads/reports/5946/concentrated-photovoltaic-market_reg_chart.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/abengoa-solar-es_keyplayer.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/brightsource-energy-us_keyplayer.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/concentrix-solar-de_keyplayer.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/hcpv-us_keyplayer.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/solarreserve-us_keyplayer.webp)

![Concentrated Photovoltaic [CPV] Market key player Concentrated Photovoltaic [CPV] Market key player](https://www.marketresearchfuture.com/uploads/reports/5946/soleil-fr_keyplayer.webp)