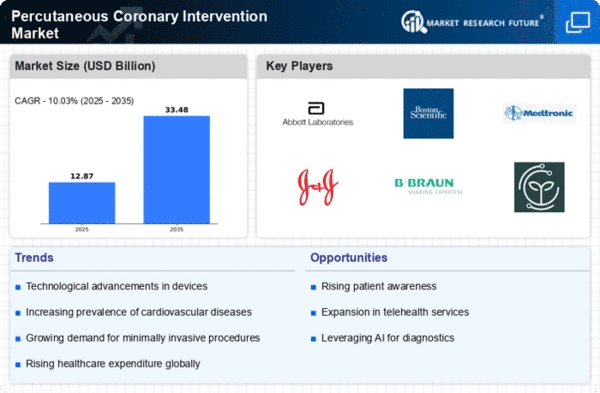

Market Growth Projections

The Global Percutaneous Coronary Intervention Market Industry is on a trajectory of substantial growth, with projections indicating a market size of 11.7 USD Billion in 2024 and an anticipated increase to 33.5 USD Billion by 2035. This growth reflects a compound annual growth rate of 10.03% from 2025 to 2035, driven by factors such as rising cardiovascular disease prevalence, technological advancements, and increased healthcare expenditure. These projections highlight the dynamic nature of the PCI market and its critical role in addressing global cardiovascular health challenges.

Growing Geriatric Population

The demographic shift towards an aging population is a crucial factor propelling the Global Percutaneous Coronary Intervention Market Industry. As individuals age, the risk of developing cardiovascular diseases escalates, necessitating more frequent interventions. By 2030, it is anticipated that the number of people aged 60 and older will surpass 1.4 billion globally, creating a substantial demand for PCI procedures. This demographic trend underscores the need for healthcare systems to adapt and expand their cardiovascular care capabilities, thereby driving market growth in the coming years.

Increased Healthcare Expenditure

Rising healthcare expenditure across various regions is a significant driver of the Global Percutaneous Coronary Intervention Market Industry. Governments and private sectors are investing more in healthcare infrastructure, particularly in cardiovascular care. This trend is evident in many countries where healthcare budgets are being allocated to advanced medical technologies and procedures. As a result, the market is poised for growth, with a projected compound annual growth rate of 10.03% from 2025 to 2035, reflecting the increasing prioritization of cardiovascular health in national health agendas.

Enhanced Awareness and Screening Programs

The growing awareness of cardiovascular health and the implementation of screening programs are pivotal in shaping the Global Percutaneous Coronary Intervention Market Industry. Public health initiatives aimed at educating populations about heart disease risk factors have led to earlier detection and treatment of cardiovascular conditions. This proactive approach not only improves patient outcomes but also drives demand for PCI procedures. As awareness continues to rise, the market is likely to experience sustained growth, further emphasizing the importance of preventive care in cardiovascular health.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally serves as a primary driver for the Global Percutaneous Coronary Intervention Market Industry. With an estimated 17.9 million deaths attributed to cardiovascular conditions each year, the demand for effective treatment options is surging. Percutaneous coronary interventions, which include angioplasty and stenting, are becoming essential in managing these diseases. As healthcare systems adapt to this growing burden, the market is projected to reach 11.7 USD Billion in 2024, reflecting the urgent need for innovative solutions in cardiovascular care.

Technological Advancements in PCI Procedures

Technological innovations in percutaneous coronary interventions are significantly influencing the Global Percutaneous Coronary Intervention Market Industry. Advancements such as drug-eluting stents, bioresorbable stents, and improved imaging techniques enhance procedural outcomes and patient safety. These innovations not only improve the efficacy of interventions but also reduce recovery times, leading to increased patient throughput in healthcare facilities. As a result, the market is expected to expand, with projections indicating a growth to 33.5 USD Billion by 2035, driven by the continuous evolution of PCI technologies.