Aging Population

The global demographic shift towards an aging population is a crucial driver of the Global Cardiovascular Drugs Market Industry. Older adults are at a higher risk for cardiovascular diseases, leading to increased demand for effective treatment options. By 2035, the market is expected to grow significantly, reaching 359.5 USD Billion, largely due to the rising number of elderly individuals requiring cardiovascular care. This demographic trend compels healthcare providers to focus on age-related cardiovascular issues, thereby fostering the development of specialized drugs tailored to this population's unique needs.

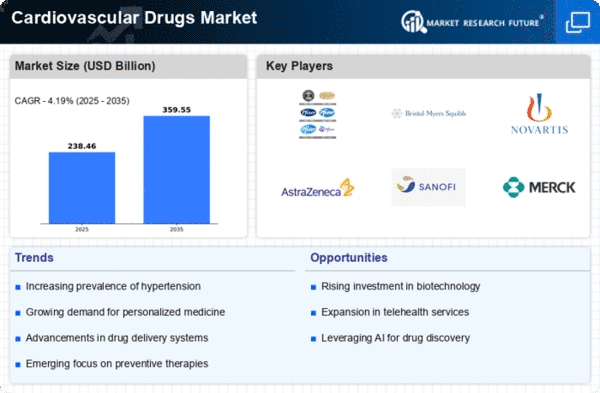

Market Trends and Projections

The Global Cardiovascular Drugs Market Industry is characterized by various trends and projections that highlight its growth trajectory. The market is expected to reach a value of 228.9 USD Billion in 2024, with a projected CAGR of 4.19% from 2025 to 2035, ultimately reaching 359.5 USD Billion by 2035. These figures reflect the increasing demand for cardiovascular medications driven by the rising prevalence of cardiovascular diseases and advancements in drug development. The market's evolution is influenced by factors such as demographic shifts, government initiatives, and growing awareness, indicating a robust future for cardiovascular drug therapies.

Growing Awareness and Education

Increasing awareness and education regarding cardiovascular health significantly impact the Global Cardiovascular Drugs Market Industry. Public health campaigns and educational programs are empowering individuals to recognize risk factors and seek timely medical intervention. This heightened awareness contributes to early diagnosis and treatment, thereby driving demand for cardiovascular drugs. As more people become informed about the importance of managing cardiovascular health, the market is poised for growth, with projections indicating a substantial increase in value over the coming years. This trend underscores the critical role of education in shaping health behaviors and outcomes.

Advancements in Drug Development

Technological advancements in drug development significantly influence the Global Cardiovascular Drugs Market Industry. Innovations such as personalized medicine and biotechnology are enhancing the efficacy and safety profiles of cardiovascular drugs. For instance, the introduction of novel anticoagulants and lipid-lowering agents has transformed treatment protocols. These advancements not only improve patient outcomes but also stimulate market growth, with projections indicating a market value of 359.5 USD Billion by 2035. As research continues to evolve, the industry may witness the emergence of groundbreaking therapies that address unmet medical needs.

Government Initiatives and Funding

Government initiatives aimed at combating cardiovascular diseases play a pivotal role in shaping the Global Cardiovascular Drugs Market Industry. Various countries are implementing national health programs that prioritize cardiovascular health, leading to increased funding for research and development. For instance, public health campaigns and subsidies for cardiovascular drugs enhance accessibility and affordability for patients. These initiatives not only promote awareness but also stimulate market growth, as evidenced by the projected CAGR of 4.19% from 2025 to 2035. Such support is vital for fostering innovation and ensuring that effective treatments reach those in need.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally drives the Global Cardiovascular Drugs Market Industry. According to health statistics, cardiovascular diseases remain the leading cause of mortality worldwide, accounting for approximately 31% of all deaths. This alarming trend necessitates the development and distribution of effective cardiovascular drugs, which are projected to reach a market value of 228.9 USD Billion in 2024. As healthcare systems adapt to this growing burden, investments in innovative therapies and preventive measures are likely to expand, further propelling the market's growth.