Market Analysis

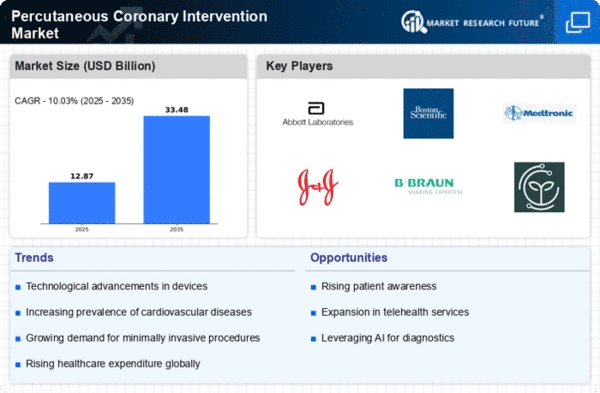

In-depth Analysis of Percutaneous Coronary Intervention Market Industry Landscape

Percutaneous coronary intervention (PCI) has emerged as a prevalent treatment for coronary artery disease on a global scale, with an annual performance of over two million procedures. Despite its widespread adoption, PCI is not without its constraints and limitations, necessitating ongoing research and innovation to enhance both its outcomes and safety. Several concerns associated with PCI include restenosis, which refers to the re-narrowing of the treated artery, stent thrombosis characterized by clot formation within the stent, bleeding complications, radiation exposure, and considerations related to cost-effectiveness. To address these challenges, continuous efforts are directed towards refining PCI techniques and introducing innovations that promise improved patient outcomes and prolonged efficacy.

Among the recent advancements in PCI techniques, bioresorbable vascular scaffolds (BVS) have garnered attention. These scaffolds gradually dissolve after the artery heals, presenting a promising solution to the issue of restenosis. Additionally, the integration of cutting-edge imaging technologies such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) has played a pivotal role in reinforcing precise decision-making and treatment planning during PCI procedures.

The evolution of PCI extends beyond these technical innovations, embracing the integration of robotics and telemedicine. These technologies are instrumental in making PCI treatments more accessible, especially for patients residing in rural areas. The integration of robotics enhances procedural precision and expands the reach of PCI expertise, while telemedicine facilitates remote consultations and interventions.

Over the past few decades, PCI has undergone significant transformations, witnessing the introduction of novel devices, procedures, and strategies that contribute to its enhanced efficacy and safety. The trajectory of PCI research remains dynamic, driven by the overarching goal of further improving patient outcomes and extending the accessibility of PCI procedures to a global patient population.

In conclusion, while PCI has established itself as a cornerstone in the treatment of coronary artery disease, the field continues to evolve. Ongoing research endeavors strive to overcome existing limitations, introducing innovations that not only address current challenges but also aim to make PCI procedures more universally accessible, ensuring that patients worldwide can benefit from the advancements in this crucial medical intervention.

Leave a Comment