Percutaneous Coronary Intervention Market

製品タイプ別(冠状動脈ステント、バルーンカテーテル、冠動脈ガイドワイヤ、ガイディングカテーテル、ガイディングシース、診断用カテーテル、クロッシングカテーテル、膨張装置、ガイダンスシステム、末梢血栓除去システム、塞栓保護システム、付属品)、血管アクセス(橈骨および大腿)別、エンドユーザー別の経皮的冠動脈インターベンション市場調査レポート情報(病院と診療所、外来手術センターなど)、および地域別 (北米、ヨーロッパ、アジア太平洋、その他の世界 - 2034 年までの予測)

世界の経皮的冠動脈インターベンション市場概要

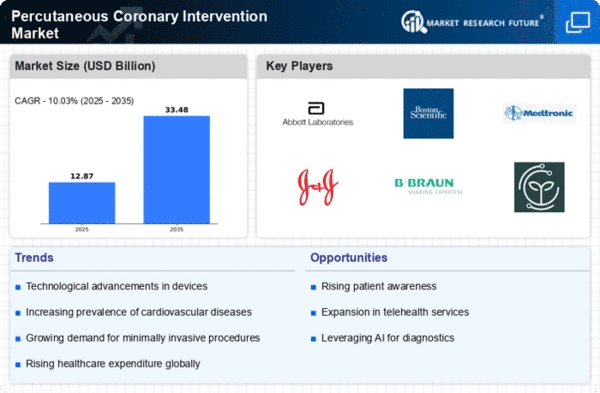

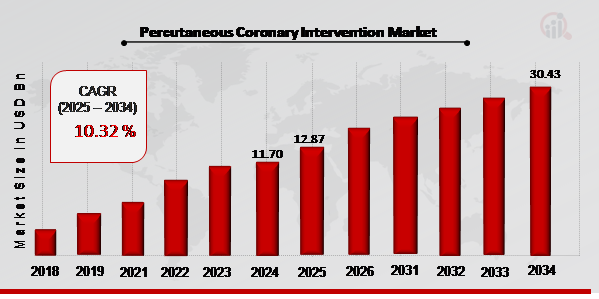

pMRFRの分析によると、経皮的冠動脈インターベンション市場規模は2024年に117億米ドルと推定されています。経皮的冠動脈インターベンション市場産業は、2025年の128億7000万米ドルから2034年までに304億3000万米ドルに成長し、予測期間(2025~2034年)中のCAGR(年平均成長率)は約10.03%と予想されています。「経皮的冠動脈インターベンション市場は、技術の進歩、心血管疾患の罹患率の増加、高齢化の進展により、堅調な成長が見込まれています。低侵襲手術と革新的なステント技術に重点を置くことで、市場は持続的な拡大を遂げ、患者の転帰を改善し、医療の進化に貢献すると見込まれます。

市場の成長が見込まれる理由は、心臓病の有病率の上昇と低侵襲手術への選好の高まりにあります。

出典: 二次調査、一次調査、MRFR データベース、アナリストレビュー

経皮的冠動脈インターベンションの動向 ul- 心臓病の有病率の上昇が市場の成長を促進

p過去 30 年間、世界中で心血管疾患による死亡者数と障害者数は継続的に増加しています。心臓病や脳卒中を含むこの疾患は、2019年の世界全体の死亡原因の3分の1を占めました。例えば、世界保健機関(WHO)は2019年に約1,790万人が心血管疾患で死亡したと推定しており、これは世界の死亡者全体の32%を占めています。心臓発作と脳卒中はこれらの死亡原因の85%を占めています。不健康な食事、運動不足、喫煙、そして問題のあるアルコール摂取は、心臓病と脳卒中の最も主要な行動的危険因子です。行動的危険因子により、血圧上昇、血糖値上昇、血中脂質上昇、そして過体重または肥満を経験する可能性があります。これらの「中間危険因子」はプライマリケアの現場で評価され、心臓発作、脳卒中、心不全などのリスク上昇を示唆しています。心臓病のために手術を受ける人も増加しています。したがって、心臓病の罹患率が上昇しているため、経皮的冠動脈形成術の市場は世界中でプラスのペースで成長するでしょう。経皮的冠動脈形成術セグメントの洞察 h3経皮的冠動脈形成術製品タイプの洞察

p経皮的冠動脈形成術市場の製品タイプに基づく区分には、冠動脈ステント、バルーンカテーテル、冠動脈ガイドワイヤー、ガイディングカテーテル、ガイディングシース、診断カテーテル、クロッシングカテーテル、インフレーションデバイス、ガイダンスシステム、末梢血栓除去システム、塞栓保護システム、および付属品が含まれます。 2022年には、冠動脈ステントセグメントが市場の大部分を占めました。さらに、医師の需要を満たす最新世代の薬剤溶出カテーテルステントの発売が、この製品タイプセグメントの成長を後押ししています。経皮的冠動脈インターベンション(PCI)血管アクセスに関する洞察

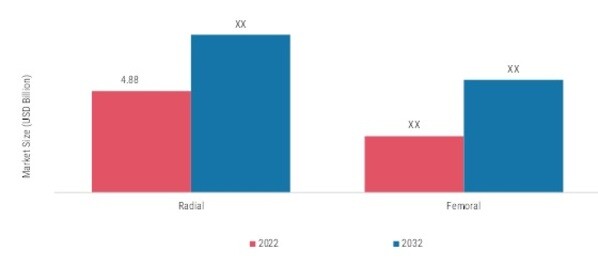

p経皮的冠動脈インターベンション(PCI)市場は、血管アクセスに基づいて橈骨動脈と大腿動脈に区分されています。2022年には、橈骨動脈セグメントが市場を席巻しました。橈骨PCIは、様々な冠動脈疾患の治療に使用できる安全かつ効果的な治療法です。大腿動脈PCIに比べて多くの利点があるため、多くの患者にとってPCIよりも好ましいアプローチとなっています。さらに、ラジアル PCI は、処置中の脳卒中のリスクの低減や入院期間の短縮などの利点により、ますます人気が高まっています。図 2: 経皮的冠動脈インターベンション市場、血管アクセス別 strong、2023 年および2032年(10億米ドル)

出典:二次調査、一次調査、MRFRデータベースおよびアナリストレビュー

経皮的冠動脈インターベンションエンドユーザーの洞察

pエンドユーザーに基づいて経皮的冠動脈インターベンション市場のセグメンテーションには、病院と診療所、外来手術センターなどが含まれます。 2022年には、クリニックセグメントが市場を支配しました。これは、血管形成術の増加、糖尿病や肥満患者の発症率の上昇が冠動脈疾患につながる可能性があるなどの要因によるものです。経皮的冠動脈インターベンション strong地域別インサイト

p地域別に、本調査では市場を北米、ヨーロッパ、アジア太平洋、その他の地域に分類しています。北米の経皮的冠動脈インターベンション市場は、2022年に最大の市場シェアを占めました。北米はさらに米国とカナダに区分されます。北米は、低侵襲手術の需要増加、心血管疾患の有病率上昇、そして不健康な生活習慣が予測期間中の地域市場の成長を牽引したため、最大の市場シェアを維持しました。例えば、米国では、心臓病は男性、女性、そしてほとんどの人種・民族の人々にとって主要な死因となっています。米国では、心血管疾患により33秒ごとに1人の命が奪われています。2021年には、米国で約69万5000人が心臓病で亡くなり、これは死亡者の5人に1人を占めています。さらに、調査対象となる主要国は、米国、カナダ、ドイツ、フランス、英国、イタリア、スペイン、中国、日本、インド、オーストラリア、韓国、ブラジルです。

図3:経皮的冠動脈インターベンション市場(地域別)2023年および2024年2032年(10億米ドル)

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

ヨーロッパの経皮的冠動脈介入市場は、不健康な生活習慣、高齢者人口の増加、広範な研究開発活動により、2番目に大きな市場シェアを占めました。さらに、ドイツの経皮的冠動脈介入市場は最大の市場シェアを占めるとされており、フランスの経皮的冠動脈介入市場はヨーロッパ地域で最も急速に成長する市場になると予測されています。

アジア太平洋地域の経皮的冠動脈介入市場は、所得水準の上昇、心血管疾患の有病率の増加、医療インフラの改善により、2023年から2032年にかけて最も急速に成長すると予想されています。さらに、中国の経皮的冠動脈介入市場は最大の市場シェアを占めており、インドの経皮的冠動脈介入市場はアジア太平洋地域で最も急速に成長する市場になると予測されています。

経皮的冠動脈介入の主要市場プレーヤーと競合の洞察

経皮的冠動脈介入市場は、多くの世界的、地域的、および地元のプレーヤーの存在によって特徴付けられます。心臓疾患の罹患率の上昇と低侵襲手術への嗜好の高まりは、予測期間中の経皮的冠動脈インターベンション市場の成長をさらに促進すると予想されます。しかしながら、心臓カテーテル検査中の感染や合併症のリスクは、経皮的冠動脈インターベンション市場の成長を阻害する可能性があります。主要企業は、政府機関から機器の規制承認を取得し、契約や協定を締結することで、リーチを拡大し、運用コストを削減する戦略を採用しています。例えば、2022年4月には、ボストン・サイエンティフィック社(米国)が経皮的冠動脈インターベンション(PCI)用のKinetixガイドワイヤーを発売しました。ガイドワイヤーは、薬剤溶出ステントなどのインターベンションデバイスを外科医が挿入するために使用する、非常に細い柔軟なワイヤーです。

ボストン・サイエンティフィック・コーポレーションは、様々なインターベンション医療分野で使用される医療機器の開発、製造、販売を手掛ける、定評のある医療機器メーカーです。同社は医療専門家と協力し、治療成績の向上、コスト削減、効率性向上につながる重要なイノベーションを幅広く取り揃えています。製品ポートフォリオは、インターベンション心臓学、内視鏡検査、神経調節、末梢インターベンション、リズムマネジメント、泌尿器科および骨盤内ケアの分野に分かれています。ボストン・サイエンティフィック・コーポレーションの製造施設は、マレーシア、米国、アイルランドに所在しています。同社は世界130カ国で製品を販売しています。これに加え、日本、オランダ、フランス、ポーランド、インド、中国、トルコ、南アフリカ、シンガポールなどにも拠点を有しています。

さらに、ボストン・サイエンティフィック社は2022年4月、経皮的冠動脈インターベンション(PCI)用のKinetixガイドワイヤーを発売しました。ガイドワイヤーは、薬剤溶出ステントなどのインターベンションデバイスを留置するために外科医が使用する、非常に小型で柔軟なワイヤーです。

経皮的冠動脈インターベンション市場の主要企業には以下が含まれます。

- ボストン・サイエンティフィック・コーポレーション(米国)

- アボット(米国)

- マイクロポート・サイエンティフィック・コーポレーション(中国)

- テルモ株式会社(日本)

- メドトロニック(アイルランド)

- クック(米国)

- APTメディカル(中国)

- メリット・メディカル・システム(米国)

- ブラウンSE(ドイツ)

- カーディナル・ヘルス(米国)

- メリルライフサイエンス(米国)

- PLS Minimally Invasive International Medical Co Ltd (中国)

- Lepu Medical Technology Co., Ltd (中国)

経皮的冠動脈インターベンション(PCI)業界の動向

- 2023年1月、MicroPort Scientific Corporation (中国) はペルーで「MicroPort Coronary Balloon Catheters」の販売承認を取得しました。この製品承認により、同社はペルーでの事業を拡大し、サポートを提供します。

- 2022年8月、Medtronic (アイルランド) は Onyx Frontier 薬剤溶出ステント (DES) システムを発売しました。 Onyx Frontier DESは、Resolute Onyx薬剤溶出ステントの急性期におけるパフォーマンスと臨床データに基づいた独自のデリバリーメカニズムを提供します。

- 2022年3月、MicroPort Scientific Corporation(中国)は、自社製品「Hyperflex」について、独立行政法人医薬品医療機器総合機構(PMDA)より販売承認を取得しました。同社は日本での製品販売を拡大し、収益成長を加速させることができます。

- 冠状動脈ステント

- バルーンカテーテル

- PCTA バルーン カテーテル

- 滑り止め要素とスコアリングバルーンカテーテル

- オーバー・ザ・ワイヤーバルーン拡張カテーテル

- 固定ワイヤーバルーンカテーテル

- 薬剤コーティングバルーンカテーテル

- その他

- 冠動脈ガイドワイヤー

- ガイディングカテーテル

- ガイディングシース

- 診断用カテーテル

- クロッシングカテーテル

- インフレーションデバイス

- ガイダンスシステム

- 末梢血栓除去システム

- 塞栓保護システム

- 付属品

経皮的冠動脈インターベンション(PCI)血管アクセスの展望 ul - 橈骨動脈

- 大腿動脈

h3

経皮的冠動脈インターベンション(PCI)エンドユーザー展望 ul - 病院およびクリニック

- 外来手術センター

- その他

- 北米

- 米国

- カナダ

- ヨーロッパ

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他ヨーロッパ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋地域

- 世界のその他の地域

- 中東

- アフリカ

- ラテンアメリカ

FAQs

What is the projected growth of the Percutaneous Coronary Intervention market?

The Percutaneous Coronary Intervention market is the expected increase in total market value of 33.48 USD billion over a defined forecast period 2025–2035. It is driven by factors such as demand trends, technological advances, regulatory changes, and geographic expansion.

What is the size of the Percutaneous Coronary Intervention market?

Percutaneous Coronary Intervention market size was valued at approximately 11.7 billion USD in 2024. This figure will reach 33.48 billion USD covering all regions (America, Europe, Asia, MEA and ROW), focusing its segments / services / distribution channels till 2035.

What is the CAGR of the Percutaneous Coronary Intervention market?

Percutaneous Coronary Intervention market is expected to grow at a CAGR of 10.03% between 2025 and 2035.

How much will the Percutaneous Coronary Intervention market be worth by 2035?

Percutaneous Coronary Intervention market is expected to be worth of 33.48 billion USD, reflecting growth driven by usage, technology and global demands by the end of 2035.

How will the Percutaneous Coronary Intervention market perform over the next 10 years?

Over the next 10 years the Percutaneous Coronary Intervention market is expected to shift from usd billion 11.7 to 33.48 billion USD, led by adoption of advanced tech, demographic trends, regulatory approvals, with potential headwinds from 2025 to 2035.

How much is the percutaneous coronary intervention market?

The Percutaneous Coronary Intervention Market is anticipated to reach 20.53 Billion during the forecast period of 2024-2035.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”