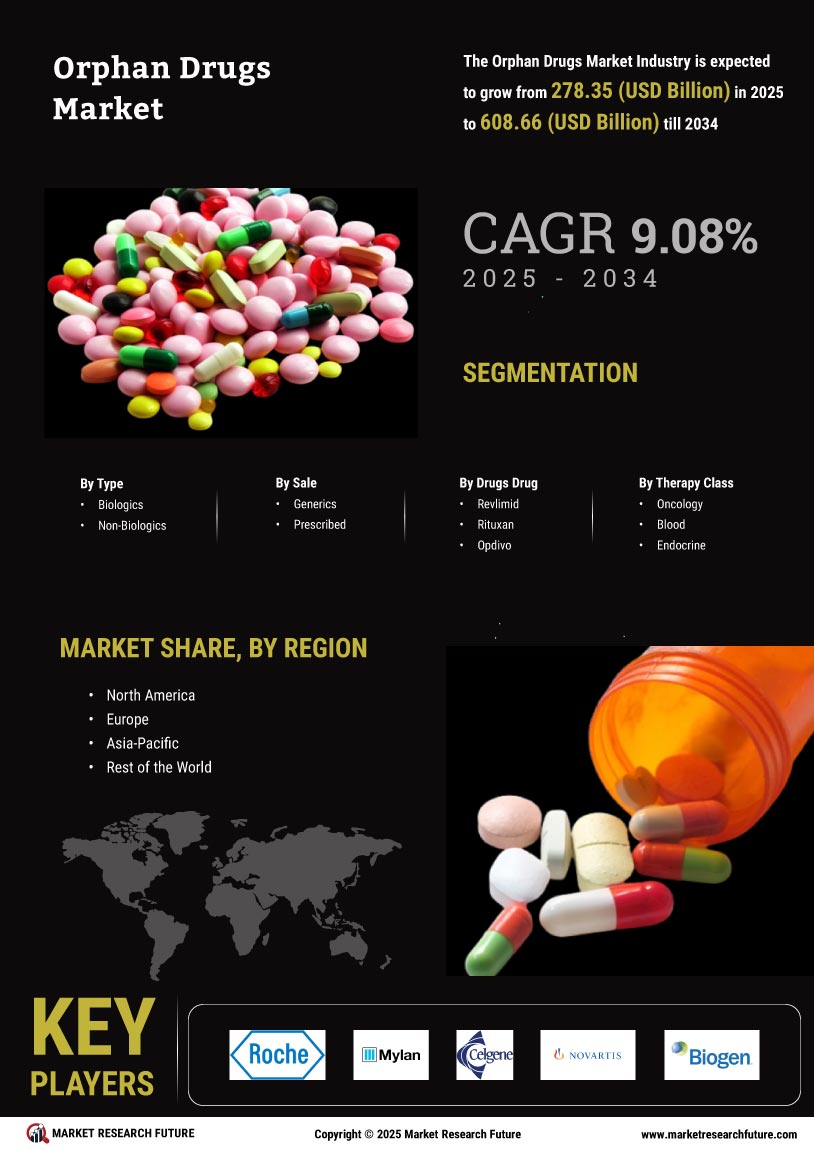

Market Growth Projections

The Global Orphan Drugs Market Industry is poised for substantial growth, with projections indicating a market value of 195.3 USD Billion in 2024 and an anticipated increase to 400 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.74% from 2025 to 2035. Such figures reflect the increasing focus on rare diseases and the corresponding demand for effective treatments. The market's expansion is likely to be driven by various factors, including advancements in biotechnology, regulatory support, and rising patient advocacy.

Advancements in Biotechnology

Technological innovations in biotechnology are significantly influencing the Global Orphan Drugs Market Industry. The emergence of novel therapeutic modalities, such as gene therapy and monoclonal antibodies, has expanded treatment options for rare diseases. These advancements enable the development of targeted therapies that can address the underlying causes of conditions previously deemed untreatable. As a result, the market is expected to experience robust growth, with a projected CAGR of 6.74% from 2025 to 2035. This growth trajectory indicates a strong commitment to research and development in the orphan drug sector.

Favorable Regulatory Environment

A supportive regulatory framework is fostering growth within the Global Orphan Drugs Market Industry. Governments worldwide are implementing policies that incentivize the development of orphan drugs, such as extended market exclusivity and tax credits. For example, the Orphan Drug Act in the United States provides significant benefits to companies developing treatments for rare diseases. This regulatory support encourages pharmaceutical companies to invest in research and development, ultimately leading to an increase in the number of approved orphan drugs. As the market evolves, it is anticipated that the Global Orphan Drugs Market will continue to expand, potentially reaching 400 USD Billion by 2035.

Rising Prevalence of Rare Diseases

The increasing incidence of rare diseases is a primary driver of the Global Orphan Drugs Market Industry. As awareness grows, more patients are diagnosed, leading to a heightened demand for specialized treatments. For instance, it is estimated that approximately 7,000 rare diseases affect around 30 million people in the United States alone. This growing patient population necessitates the development of orphan drugs, which are specifically designed to treat these conditions. Consequently, the Global Orphan Drugs Market is projected to reach 195.3 USD Billion in 2024, reflecting the urgent need for effective therapies.

Growing Patient Advocacy and Awareness

The role of patient advocacy groups in raising awareness about rare diseases is increasingly impacting the Global Orphan Drugs Market Industry. These organizations are instrumental in educating the public and policymakers about the challenges faced by patients with rare conditions. Their efforts have led to increased visibility and urgency for the development of orphan drugs. As more individuals become informed about available treatments, the demand for orphan drugs is likely to rise. This heightened awareness is expected to contribute to the overall growth of the market, aligning with the projected expansion of the industry in the coming years.

Increased Investment in Rare Disease Research

Investment in research and development for rare diseases is a crucial driver of the Global Orphan Drugs Market Industry. Pharmaceutical companies and biotech firms are allocating substantial resources to discover and develop new therapies. This trend is evident in the growing number of clinical trials targeting rare diseases, which has surged in recent years. The influx of funding from both public and private sectors is likely to accelerate the pace of innovation, resulting in a broader array of treatment options. This commitment to research is expected to sustain market growth, with projections indicating a significant rise in market value over the next decade.