Regulatory Support for Organic Farming

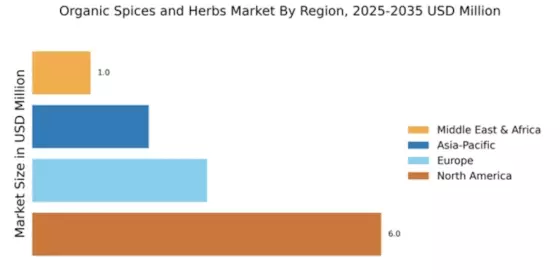

Regulatory frameworks that support organic farming practices are emerging as a crucial driver in the Organic Spices Herbs Market. Governments in various regions are implementing policies that promote organic agriculture, providing incentives for farmers to transition from conventional to organic methods. This regulatory support not only enhances the availability of organic spices and herbs but also assures consumers of the quality and authenticity of these products. Market data indicates that regions with robust organic certification processes are witnessing a higher growth rate in organic product sales. As these regulations continue to evolve, they are likely to bolster consumer confidence and expand the Organic Spices Herbs Market.

Consumer Demand for Natural Ingredients

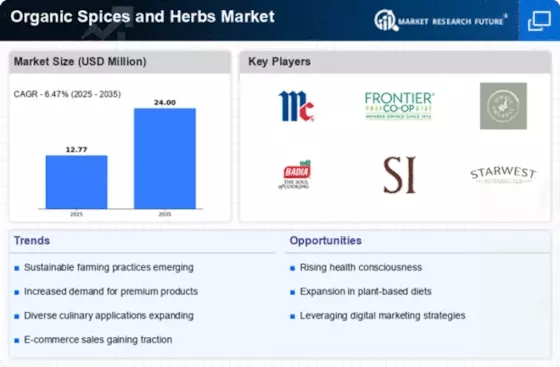

The increasing consumer preference for natural and organic products is a pivotal driver in the Organic Spices Herbs Market. As consumers become more health-conscious, they are gravitating towards products that are free from synthetic additives and chemicals. This trend is reflected in market data, which indicates that the organic food sector has been experiencing a compound annual growth rate of approximately 10% over the past few years. The demand for organic spices and herbs is particularly pronounced among millennials and Generation Z, who prioritize transparency in sourcing and production. This shift in consumer behavior is likely to propel the Organic Spices Herbs Market further, as brands adapt their offerings to meet these evolving preferences.

Culinary Exploration and Global Flavors

The growing interest in culinary exploration and the incorporation of The Organic Spices Herbs Industry. Consumers are increasingly seeking diverse and exotic flavors, which has led to a surge in the demand for organic spices and herbs from various regions. Market analysis suggests that the popularity of cooking shows and social media platforms has further fueled this trend, as individuals are inspired to experiment with new recipes and ingredients. This cultural shift towards embracing international cuisines is expected to enhance the market landscape, as consumers actively seek out organic options to elevate their culinary experiences.

Sustainability Initiatives in Agriculture

Sustainability initiatives within the agricultural sector are increasingly shaping the Organic Spices Herbs Market. As environmental concerns gain prominence, consumers are more inclined to support brands that prioritize sustainable farming practices. This trend is reflected in market statistics, which show that a significant portion of consumers is willing to pay a premium for sustainably sourced organic products. The emphasis on reducing carbon footprints and promoting biodiversity is driving farmers to adopt organic methods, thereby enhancing the supply of organic spices and herbs. This alignment with sustainability goals is expected to create a favorable environment for growth within the Organic Spices Herbs Market.

Technological Advancements in Agriculture

Technological advancements in agricultural practices are playing a transformative role in the Organic Spices Herbs Market. Innovations such as precision farming, biotechnology, and advanced irrigation techniques are enabling farmers to enhance yield and quality while minimizing environmental impact. These technologies facilitate the efficient cultivation of organic spices and herbs, making them more accessible to consumers. Industry expert's suggest that the integration of technology in organic farming is likely to lead to increased productivity and reduced costs, thereby fostering growth in the Organic Spices Herbs Market. As these advancements continue to evolve, they may redefine the landscape of organic agriculture.