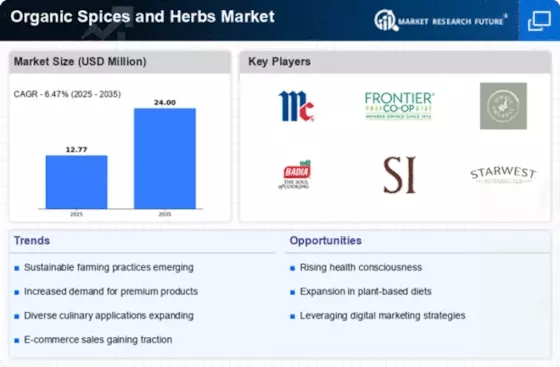

Market Analysis

In-depth Analysis of Organic Spices Herbs Market Industry Landscape

Ensuring Safe Food: Regulations and the Rise of Organic Choices

Food safety regulations have come a long way, with a primary goal of safeguarding consumers from potential health risks linked to foods grown using synthetic methods. Governments globally are revamping their laws to make them more contemporary and efficient. They are moving towards outcome-based regulations, emphasizing results and transparency. This shift is significantly increasing the demand for organic foods and spices worldwide.

Growing Desire for Organic Food and Drinks

The desire for foods produced organically is rapidly increasing, particularly in developed regions like Europe, the United States, Japan, and Australia. This surge in demand is also impacting the preference for organic spices. Spices play a crucial role in our meals and beverages, and consumers are opting for organic spices over conventional ones as part of their commitment to healthy eating. Many companies producing convenient foods are incorporating organic spices into their products. This not only enhances the nutritional value but also differentiates their products from others in the market. The rising consumer preference for healthy eating and organic choices is prompting more stores to include organic food in their offerings.

Shifting Regulations Towards Safety and Transparency

Modern food safety regulations are evolving to prioritize consumer well-being, especially regarding foods grown synthetically. Governments globally are revising and modernizing their legislation to enhance food safety. There is a notable shift towards outcome-based regulations that focus on achieving specific results and being transparent about the process. This evolution in regulations is a key driver behind the increasing demand for organic foods and spices globally.

Impact on Organic Spice Market

The surge in demand for organically produced foods in developed countries is directly influencing the demand for organic spices. Spices, known for enhancing flavor in our meals and beverages, are now subject to a growing preference for organic varieties. Consumers, seeking healthier dietary choices, are opting for organic spices, leading to a significant market shift. The incorporation of organic spices by food manufacturing companies reflects the changing consumer preferences and contributes to product differentiation in a competitive market.

Retailers Responding to Consumer Preferences

As consumers increasingly prioritize health and choose organic options, retailers are adjusting their offerings to meet these preferences. The rising demand for organic food and spices is prompting more stores to include organic products in their inventory. This shift in consumer behavior is not only reshaping the food industry but also influencing retailers to align with changing dietary preferences.

Leave a Comment