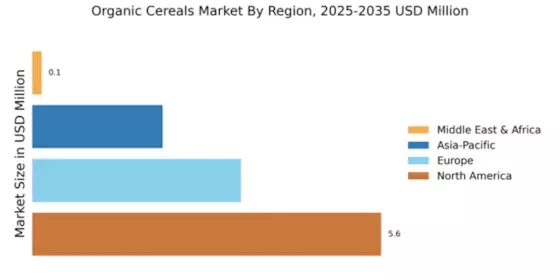

North America : Market Leader in Organic Cereals

North America continues to lead the organic cereals market, holding a significant share of 5.62 in 2024. The growth is driven by increasing consumer awareness regarding health benefits, coupled with a rising demand for organic products. Regulatory support, including subsidies for organic farming, has further catalyzed this growth. The trend towards healthier eating habits is expected to sustain demand, with projections indicating continued expansion in the coming years.

The competitive landscape in North America is robust, featuring key players such as General Mills, Kellogg's, and Quaker Oats. These companies are investing in innovative product development and marketing strategies to capture the growing health-conscious consumer base. The U.S. remains the largest market, with Canada also showing promising growth. The presence of established brands and a strong distribution network enhances market accessibility, solidifying North America's position as a leader in organic cereals.

Europe : Emerging Market for Organic Products

Europe's organic cereals market is on the rise, with a market size of 3.36 in 2024. The growth is fueled by increasing consumer preference for organic foods, driven by health consciousness and environmental concerns. Regulatory frameworks, such as the EU Organic Regulation, support organic farming practices, enhancing market growth. The region is witnessing a shift towards sustainable agriculture, which is expected to further boost demand for organic cereals in the coming years.

Leading countries in this market include Germany, France, and the UK, where consumer demand for organic products is particularly strong. The competitive landscape features prominent players like Nature's Path and Kellogg's, who are adapting their offerings to meet local preferences. The presence of a well-established retail network, including health food stores and online platforms, facilitates access to organic cereals, making Europe a key player in this sector.

Asia-Pacific : Rapidly Growing Organic Sector

The Asia-Pacific region is witnessing a burgeoning organic cereals market, with a size of 2.1 in 2024. This growth is driven by rising disposable incomes, urbanization, and a growing awareness of health and wellness among consumers. Regulatory initiatives promoting organic farming practices are also contributing to market expansion. The increasing availability of organic products in retail outlets is expected to further stimulate demand in this region.

Countries like Australia, Japan, and China are leading the charge in the organic cereals market. The competitive landscape is evolving, with both local and international players, including Bob's Red Mill and Annie's, vying for market share. The region's diverse consumer preferences are prompting companies to innovate and tailor their products, ensuring a dynamic and competitive market environment.

Middle East and Africa : Niche Market with Growth Potential

The Middle East and Africa represent a nascent market for organic cereals, with a size of 0.15 in 2024. The growth potential is significant, driven by increasing health awareness and a shift towards organic food consumption. Regulatory support for organic farming is gradually improving, which is expected to enhance market conditions. The region's diverse agricultural landscape offers opportunities for local organic production, which can cater to the growing demand for healthier food options.

Countries like South Africa and the UAE are beginning to embrace organic cereals, although the market remains relatively small. The competitive landscape is characterized by emerging local brands and a few international players. As consumer awareness grows and distribution channels expand, the organic cereals market in this region is poised for gradual growth, presenting opportunities for investment and development.