Organic Cereals Size

Organic Cereals Market Growth Projections and Opportunities

The organic cereals market is influenced by a myriad of factors that collectively shape its dynamics and growth trajectory. One of the pivotal market factors is the increasing consumer inclination towards healthier and more sustainable food choices. As awareness about the benefits of organic products continues to rise, consumers are actively seeking cereals that are free from synthetic pesticides, genetically modified organisms (GMOs), and artificial additives. This growing demand for organic cereals is driven by a broader societal shift towards healthier lifestyles and a heightened awareness of the environmental impact of conventional farming practices.

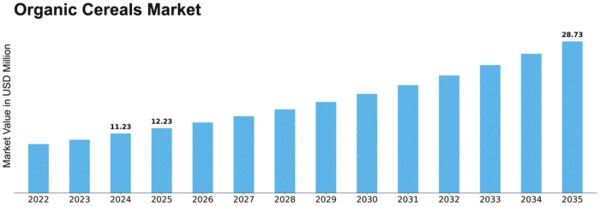

Moreover, regulatory support and certification standards play a crucial role in defining the landscape of the organic cereals market. Governments and regulatory bodies worldwide have implemented stringent standards to ensure the authenticity and quality of organic products. The presence of credible certification organizations, such as the USDA Organic and the European Organic Certification, instills confidence among consumers and facilitates market growth. Manufacturers and producers that adhere to these standards gain a competitive edge in the market, as consumers are more likely to trust and choose certified organic cereals. The global organic cereals market is projected to experience a compound annual growth rate (CAGR) of 5.32% from 2020 to 2027, with an estimated market value reaching USD 36,100 Million by the close of 2027. Various cereals, including wheat, barley, oats, maize, and sorghum, contribute to this market. Renowned for their rich vitamin content, cereals are particularly abundant in B vitamins such as thiamine, folate, and niacin. These nutrients play crucial roles in supporting the proper functioning of the brain, nervous system, heart, eyesight, and hair. With a substantial fiber content, cereals are also recognized for their digestive benefits, making them a preferred choice among health-conscious consumers.

Cereals hold staple status in numerous regions globally, contributing to the escalating demand for these grains. The surge in the popularity of organic food further fuels the growth of the global organic cereals market. Moreover, the expanding vegan population is expected to act as a significant driver for the market's growth. Economic factors also contribute significantly to the dynamics of the organic cereals market. The rising disposable income in many regions has allowed consumers to allocate more of their budget towards premium and organic food products. While organic cereals may have a higher price point compared to conventional ones, consumers are increasingly willing to invest in their health and well-being, driving the overall market growth. Additionally, the availability of organic cereals across various retail channels, including supermarkets, specialty stores, and online platforms, provides consumers with convenient access, further fueling market expansion.

Technological advancements in agriculture and food production have a direct impact on the organic cereals market. Innovations in organic farming practices, such as precision farming techniques and sustainable agricultural technologies, contribute to increased yields and improved efficiency in organic cereal production. These advancements not only benefit producers by enhancing their productivity but also contribute to the overall supply chain sustainability, meeting the growing demand for organic cereals without compromising on environmental stewardship.

Consumer preferences and tastes also influence the product offerings within the organic cereals market. Manufacturers are responding to the diversity of consumer demands by introducing a wide range of flavors, textures, and ingredient combinations. This customization aligns with the varying preferences of consumers, making organic cereals a versatile choice for different demographics and age groups. The market is witnessing the emergence of innovative formulations, such as gluten-free options and cereals enriched with superfoods, to cater to specific dietary needs and preferences.

Furthermore, global trends, such as the focus on plant-based diets and sustainability, have a ripple effect on the organic cereals market. As more consumers adopt plant-based lifestyles and prioritize environmentally friendly products, organic cereals, which are often associated with sustainable and ethical farming practices, gain traction. The alignment of organic cereals with these broader lifestyle trends positions the market for sustained growth, reflecting the evolving consumer consciousness in the food and beverage sector.

Leave a Comment