Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices is reshaping the landscape of the Optical Encryption Market. With billions of devices interconnected, the potential for data breaches increases exponentially. Optical encryption offers a viable solution to secure the vast amounts of data generated by IoT devices. In 2025, the number of connected IoT devices is expected to surpass 30 billion, creating a pressing need for effective encryption methods. As organizations seek to protect sensitive information transmitted between devices, the demand for optical encryption technologies is likely to rise. This trend underscores the importance of optical encryption in ensuring the integrity and confidentiality of data within the expanding IoT ecosystem.

Adoption of Cloud Computing

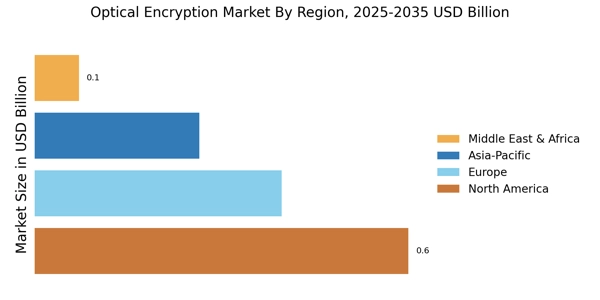

The rise of cloud computing has catalyzed the growth of the Optical Encryption Market. As businesses migrate to cloud-based platforms, the need for secure data transmission becomes increasingly critical. Optical encryption provides a unique advantage by enabling secure communication channels that protect data in transit. In 2025, the cloud computing market is projected to reach a valuation of over 800 billion dollars, further driving the demand for optical encryption solutions. Organizations are seeking to ensure that their data remains confidential and secure while leveraging the benefits of cloud technologies. This trend indicates a robust future for the Optical Encryption Market as it aligns with the growing reliance on cloud services.

Increasing Cybersecurity Threats

The Optical Encryption Market is experiencing a surge in demand due to the escalating threats posed by cybercriminals. As organizations increasingly rely on digital infrastructure, the need for robust security measures becomes paramount. In 2025, it is estimated that cybercrime will cost businesses trillions of dollars annually, prompting a shift towards advanced encryption technologies. Optical encryption, with its ability to secure data transmission through light-based methods, offers a compelling solution. This technology not only enhances data security but also ensures compliance with stringent data protection regulations. Consequently, the Optical Encryption Market is likely to witness significant growth as enterprises prioritize safeguarding sensitive information against evolving cyber threats.

Growing Awareness of Data Privacy

The Optical Encryption Market is benefiting from a heightened awareness of data privacy among consumers and businesses alike. As data breaches and privacy violations become more prevalent, organizations are compelled to adopt stringent security measures. In 2025, it is anticipated that data privacy regulations will become even more rigorous, prompting companies to invest in advanced encryption solutions. Optical encryption, with its ability to provide high levels of security, is increasingly viewed as a necessary component of data protection strategies. This growing emphasis on privacy is likely to drive the Optical Encryption Market forward, as organizations seek to build trust with their customers by safeguarding their personal information.

Technological Advancements in Encryption

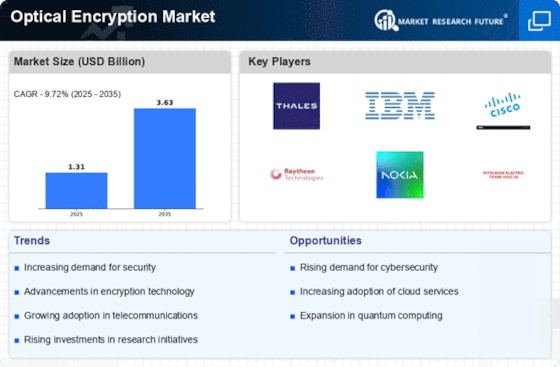

The Optical Encryption Market is poised for growth due to continuous technological advancements in encryption methods. Innovations in optical encryption technologies are enhancing the efficiency and effectiveness of data protection. In 2025, advancements such as quantum encryption and improved optical fiber technologies are expected to revolutionize the market. These developments not only increase the security of data transmission but also reduce latency and improve overall performance. As organizations seek to stay ahead of potential threats, the demand for cutting-edge optical encryption solutions is likely to rise. This trend indicates a promising future for the Optical Encryption Market as it adapts to the evolving technological landscape.