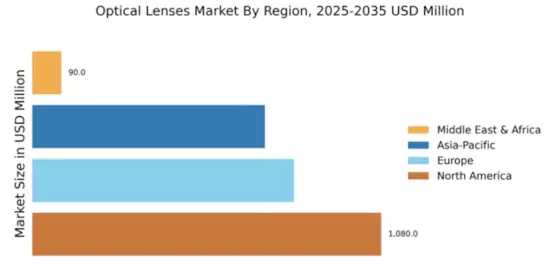

North America : Market Leader in Optical Lenses

North America continues to lead the optical lenses market, holding a significant share of 1080.0 million in 2024. The growth is driven by increasing demand for corrective lenses, advancements in lens technology, and a rising aging population. Regulatory support for vision care and health insurance coverage for optical products further catalyze market expansion. The region's focus on innovation and quality assurance also plays a crucial role in maintaining its market leadership. The competitive landscape in North America is characterized by the presence of major players such as EssilorLuxottica and Bausch + Lomb. These companies are investing heavily in R&D to develop advanced lens solutions, including digital lenses and blue light filtering options. The U.S. market, in particular, is witnessing a surge in demand for personalized lenses, which is reshaping the competitive dynamics. As a result, North America is expected to maintain its dominance in the optical lenses market through 2025.

Europe : Emerging Trends in Vision Care

Europe's optical lenses market is projected to reach 810.0 million by 2025, driven by increasing awareness of eye health and the growing prevalence of vision disorders. The region benefits from stringent regulations that ensure product quality and safety, fostering consumer trust. Additionally, the rise of e-commerce platforms for eyewear is reshaping distribution channels, making optical products more accessible to consumers across Europe. Leading countries such as Germany, France, and Italy are at the forefront of this market, with key players like Zeiss and Hoya driving innovation. The competitive landscape is marked by collaborations and mergers aimed at enhancing product offerings. The European market is also witnessing a shift towards sustainable practices, with companies focusing on eco-friendly materials and production methods. This trend is expected to further boost market growth in the coming years.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific optical lenses market is anticipated to grow significantly, reaching 720.0 million by 2025. This growth is fueled by rising disposable incomes, increasing urbanization, and a growing awareness of eye health. The region's young population is also contributing to the demand for fashionable eyewear, while the aging demographic is driving the need for corrective lenses. Regulatory frameworks are evolving to support the optical industry, enhancing product standards and consumer protection. Countries like Japan, China, and India are leading the market, with key players such as Nikon and Hoya expanding their presence. The competitive landscape is characterized by a mix of local and international brands, with companies focusing on innovative designs and technology integration. The Asia-Pacific region is becoming a hub for optical lens manufacturing, attracting investments and fostering growth in the sector.

Middle East and Africa : Untapped Potential in Vision Care

The Middle East and Africa (MEA) optical lenses market, valued at 90.0 million, presents significant growth opportunities. The region is witnessing an increase in awareness regarding eye health, driven by rising urbanization and lifestyle changes. Government initiatives aimed at improving healthcare access are also contributing to market growth. However, challenges such as economic disparities and limited access to advanced optical products remain. Countries like South Africa and the UAE are leading the market, with a growing number of local and international players entering the space. The competitive landscape is evolving, with companies focusing on affordable and quality optical solutions. As the region continues to develop, the demand for optical lenses is expected to rise, driven by both corrective and fashionable eyewear trends.