Research Methodology on Data Encryption Market

Introduction

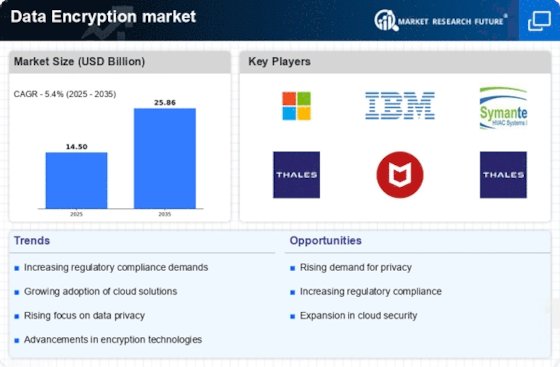

Data encryption is an important security measure that is used to protect data from unauthorized access. With data increasingly moving online, there has been an increased need to ensure that data is kept secure and protected from malicious actors. As such, data encryption is becoming increasingly important, and the use of the technology has grown extensively over the past decade. This research aims to analyze the data encryption market and explore the major drivers and trends behind the growth of this industry.

Research Methodology

1.1 Introduction

The purpose of this research is to analyze the global data encryption market and discuss the major drivers and trends behind the growth of this industry. The research methodology is constructed to provide a systematic process of data collection, data analysis, and hypothesis testing in order to reach reliable and valid conclusions.

1.2 Research Design

In order to conduct this analysis, a combination of qualitative and quantitative research methods is used. A qualitative approach is used to explore the market trends and drivers that might be impacting the global data encryption market. Qualitative data is collected using primary and secondary sources. This includes a survey of experts in the field of data encryption, interviews with key stakeholders in the industry, and a review of relevant literature.

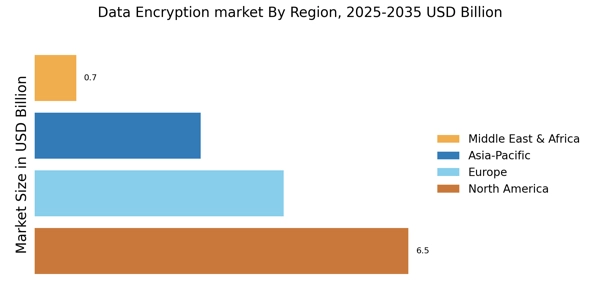

Additionally, a quantitative approach is used to collect data and analyze the data encryption market. Quantitative data is gathered from reliable sources such as published reports, articles, and statistics. Different statistical techniques are utilized in order to analyze the data collected and draw meaningful insights.

1.3 Sampling Design

A purposive sampling method is used to survey experts in the field of data encryption. The sample size is kept relatively small (n=20) in order to ensure that sufficient detail and perspective are gathered. The research team also employs a snowball sampling method, whereby each respondent is asked to refer another expert who could provide further insight.

1.4 Data Collection Methods

The data collection process involves two phases. The first phase includes a desk review of relevant literature on the subject matter and exploring the technology, its applications, and the major drivers impacting the market. The second phase involves collecting primary data. This includes online surveys and interviews with experts in the data encryption market. All responses were collected, coded, and analyzed.

1.5 Data Analysis and Interpretation

The collected data is analyzed using both quantitative and qualitative methods. Quantitative analysis is done using descriptive statistics and graphical methods. This includes pie charts, bar graphs, and scatter plots. Additionally, content analysis is used to interpret and analyze the qualitative data gathered from the interviews.