Adoption of Cloud Services

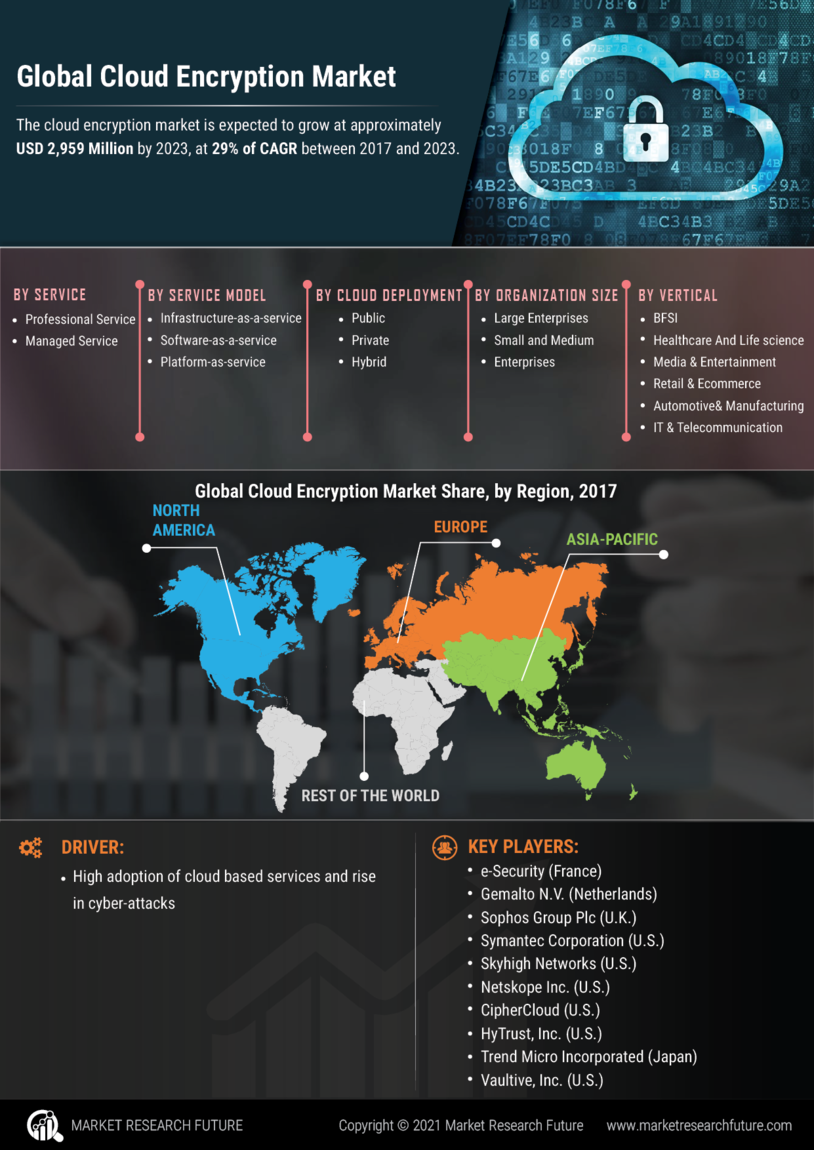

The rapid adoption of cloud services is a key driver of the Cloud Encryption Market. As businesses increasingly migrate their operations to the cloud, the need for effective encryption solutions to protect sensitive data becomes more pronounced. The cloud services market has seen exponential growth, with estimates suggesting that it will reach a valuation of over 800 billion dollars by 2025. This growth is accompanied by a heightened awareness of data security, leading organizations to seek encryption solutions that can safeguard their information in cloud environments. The integration of encryption technologies into cloud services not only enhances security but also fosters customer confidence. Consequently, the Cloud Encryption Market is poised for substantial growth as organizations prioritize data protection in their cloud strategies.

Increasing Cybersecurity Threats

The Cloud Encryption Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyberattacks. Organizations are recognizing the necessity of robust encryption solutions to safeguard sensitive data stored in the cloud. According to recent statistics, nearly 60% of businesses have reported experiencing a data breach in the past year, underscoring the urgency for effective encryption strategies. As cyber threats evolve, the need for advanced encryption technologies becomes paramount, driving growth in the Cloud Encryption Market. Companies are investing in encryption solutions not only to protect their data but also to maintain customer trust and comply with regulatory requirements. This trend indicates a strong correlation between the rise in cyber threats and the expansion of the Cloud Encryption Market.

Growing Awareness of Data Privacy

The Cloud Encryption Market is witnessing growth driven by the increasing awareness of data privacy among consumers and organizations alike. As data breaches and privacy violations become more prevalent, stakeholders are demanding greater transparency and security in how their data is handled. This heightened awareness is prompting organizations to implement encryption solutions as a fundamental aspect of their data protection strategies. Surveys indicate that over 70% of consumers are concerned about their data privacy, influencing businesses to prioritize encryption in their cloud services. The trend towards data privacy is likely to continue shaping the Cloud Encryption Market, as organizations recognize that robust encryption not only protects sensitive information but also enhances their reputation and customer trust.

Regulatory Compliance Requirements

The Cloud Encryption Market is significantly influenced by the stringent regulatory compliance requirements imposed on organizations across various sectors. Regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) mandate that organizations implement robust data protection measures, including encryption. Failure to comply with these regulations can result in severe penalties, prompting businesses to adopt encryption solutions to ensure compliance. The market for cloud encryption is projected to grow as organizations prioritize compliance and data protection. In fact, a recent report indicates that compliance-related investments in encryption technologies are expected to increase by over 25% in the coming years. This trend highlights the critical role of regulatory frameworks in shaping the Cloud Encryption Market.

Emergence of Advanced Encryption Technologies

The Cloud Encryption Market is being propelled by the emergence of advanced encryption technologies that offer enhanced security features. Innovations such as homomorphic encryption and quantum encryption are gaining traction, providing organizations with new ways to protect their data in the cloud. These technologies allow for data processing without exposing sensitive information, addressing concerns about data privacy and security. As organizations seek to leverage these advanced solutions, the demand for cloud encryption is expected to rise. Furthermore, the increasing complexity of cyber threats necessitates the adoption of cutting-edge encryption technologies. The Cloud Encryption Market is likely to benefit from ongoing research and development efforts aimed at creating more sophisticated encryption methods that can effectively counter emerging threats.