Cost Efficiency and Operational Agility

Cost efficiency remains a pivotal driver in the Cloud Computing Banking Market. By migrating to cloud-based solutions, banks can significantly reduce their operational costs associated with maintaining on-premises infrastructure. Reports indicate that financial institutions can save up to 30% on IT expenditures by leveraging cloud services. Furthermore, cloud computing enhances operational agility, allowing banks to quickly scale their services in response to market demands. This flexibility is particularly crucial in a rapidly evolving financial landscape, where customer expectations are continuously changing. As banks seek to optimize their resources and improve service delivery, the adoption of cloud solutions is likely to accelerate, reinforcing the industry's shift towards more agile operational models.

Regulatory Compliance and Risk Management

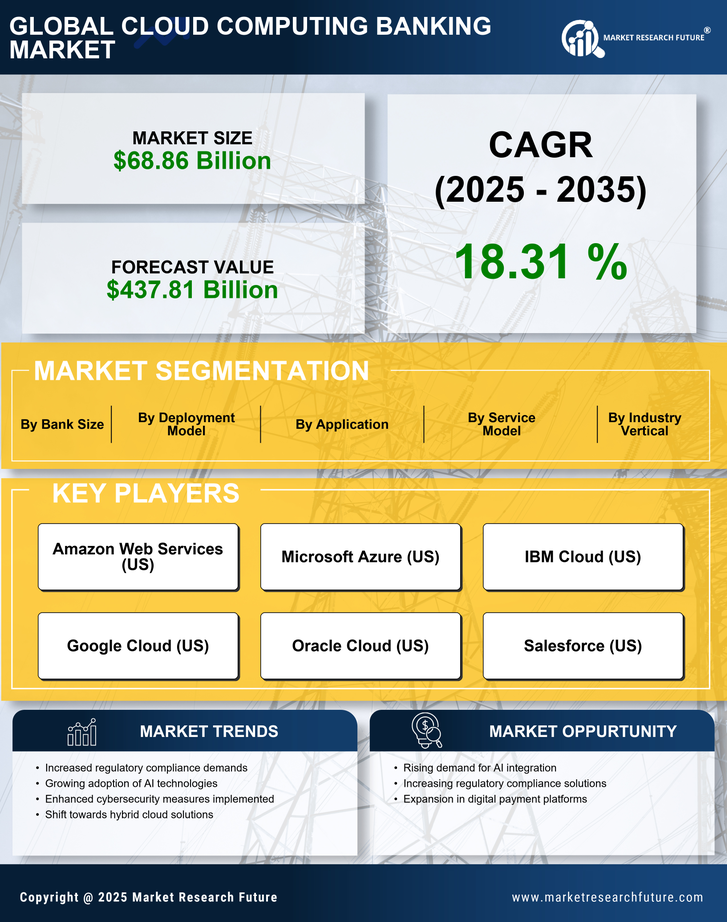

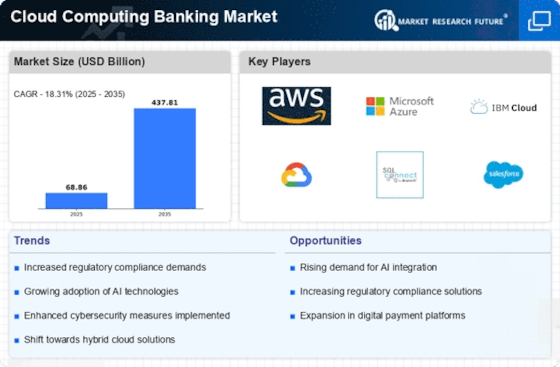

The Cloud Computing Banking Market is increasingly influenced by the need for regulatory compliance and effective risk management. Financial institutions are under constant scrutiny to adhere to stringent regulations, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). As a result, banks are adopting cloud solutions that facilitate compliance through automated reporting and data management. The market for cloud compliance solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. This trend indicates that cloud computing is not merely a technological shift but a strategic necessity for banks aiming to mitigate risks and enhance their compliance frameworks.

Scalability and Flexibility in Service Delivery

Scalability and flexibility are critical drivers in the Cloud Computing Banking Market. As financial institutions face fluctuating demands for their services, the ability to scale operations quickly is paramount. Cloud solutions offer banks the flexibility to adjust their resources in real-time, accommodating spikes in customer activity without compromising service quality. This capability is particularly beneficial during peak periods, such as holiday seasons or promotional events, where transaction volumes can surge dramatically. Industry expert's indicate that banks utilizing cloud infrastructure can achieve a 40% improvement in service delivery times. This enhanced scalability not only improves operational efficiency but also positions banks to respond proactively to market changes, thereby maintaining a competitive edge in the dynamic banking landscape.

Collaboration and Innovation through Cloud Ecosystems

Collaboration and innovation are becoming essential components of the Cloud Computing Banking Market. Financial institutions are increasingly forming partnerships with fintech companies and technology providers to create cloud ecosystems that foster innovation. These collaborations enable banks to access cutting-edge technologies and services that enhance their offerings. For instance, cloud-based platforms facilitate the integration of third-party applications, allowing banks to expand their service portfolios without significant investments in infrastructure. This collaborative approach is expected to drive innovation in product development and service delivery, with market analysts predicting a surge in the number of cloud-based banking solutions in the next few years. As banks embrace this trend, the potential for new revenue streams and improved customer experiences becomes increasingly apparent.

Enhanced Customer Experience through Digital Transformation

The Cloud Computing Banking Market is witnessing a transformation driven by the need to enhance customer experience. Banks are increasingly leveraging cloud technologies to deliver personalized services and improve customer engagement. By utilizing data analytics and customer relationship management (CRM) tools hosted in the cloud, financial institutions can gain insights into customer behavior and preferences. This capability allows for the development of tailored products and services, which can lead to increased customer satisfaction and loyalty. Market data suggests that banks investing in digital transformation initiatives, including cloud adoption, are likely to see a 20% increase in customer retention rates. This trend underscores the importance of cloud computing in shaping the future of customer interactions within the banking sector.