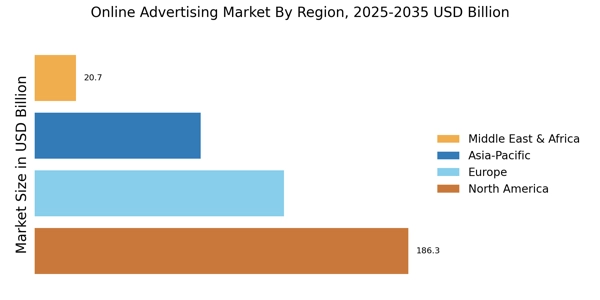

North America : Digital Advertising Leader

North America remains the largest market for online advertising, accounting for approximately 45% of the global share. The region's growth is driven by high internet penetration, advanced technology infrastructure, and a strong focus on data-driven marketing strategies. Regulatory frameworks, such as the California Consumer Privacy Act, are shaping advertising practices, ensuring consumer protection while fostering innovation.

The United States is the leading country in this region, with major players like Google, Meta, and Amazon dominating the landscape. The competitive environment is characterized by continuous innovation and investment in advertising technologies. Canada also plays a significant role, contributing to the market with its growing digital ad spend and increasing adoption of programmatic advertising.

Europe : Evolving Digital Landscape

Europe is the second-largest market for online advertising, holding around 30% of the global market share. The region's growth is fueled by increasing digital media consumption and the rise of e-commerce. Regulatory initiatives, such as the General Data Protection Regulation (GDPR), are pivotal in shaping advertising strategies, ensuring data privacy while promoting transparency in digital marketing practices.

Leading countries in Europe include the United Kingdom, Germany, and France, each contributing significantly to the online advertising landscape. The competitive environment is marked by a mix of local and global players, with companies like Google and Meta facing competition from regional firms. The emphasis on localized content and compliance with stringent regulations is driving innovation and adaptation in advertising strategies across the continent.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the online advertising market, accounting for approximately 20% of the global share. The region's expansion is driven by increasing smartphone penetration, a burgeoning middle class, and the rise of social media platforms. Countries like China and India are at the forefront, with significant investments in digital infrastructure and advertising technologies, creating a dynamic market environment.

China, led by giants like Alibaba and Baidu, is the largest market in the region, while India follows closely with its growing digital user base. The competitive landscape is characterized by a mix of established players and emerging startups, all vying for market share. The focus on mobile advertising and localized content is reshaping strategies, making the Asia-Pacific region a hotbed for innovation in online advertising.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is an emerging player in the online advertising market, holding about 5% of the global share. The growth is driven by increasing internet access, mobile penetration, and a young, tech-savvy population. Countries like South Africa and the UAE are leading the charge, with significant investments in digital marketing and advertising technologies, creating new opportunities for advertisers.

The competitive landscape is evolving, with both local and international players entering the market. The presence of key players like Google and Facebook is complemented by regional firms that are adapting to local preferences. The focus on mobile advertising and social media engagement is crucial, as brands seek to connect with consumers in innovative ways, making this region ripe for growth in the online advertising sector.